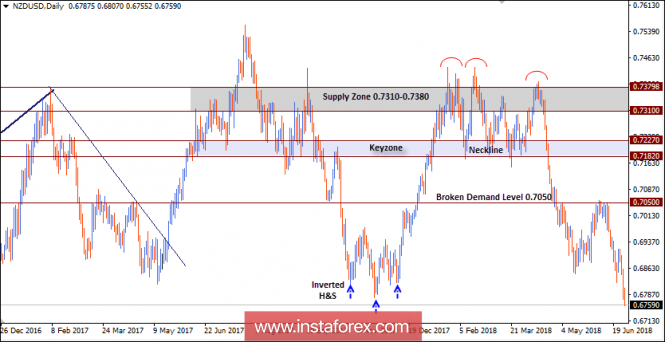

The NZD/USD pair had been trapped between the price levels of 0.7170 and 0.7350 until the bearish breakdown of 0.7200 occurred on April 23.

Breakdown of 0.7220-0.7170 (neckline zone) was needed to confirm the depicted reversal pattern. Bearish target levels around 0.7050 and 0.7000 have been achieved already.

The price level of 0.7050 was considered a key-level for the NZD/USD bears That's why the bearish persistence below 0.7050 allowed further bearish decline to occur towards the price levels around 0.6800.

As anticipated, the recent bullish pullback towards the price level of 0.7050 (Broken Demand-Level) offered a good opportunity for sellers to have a valid SELL entry. It's already running in profits. S/L should be lowered to 0.6875 to secure some profits.

Currently, the price zone of 0.6820-0.6780 is being challenged by the NZD/USD bears. This price zone should be considered as an initial target level for current sellers.

Bearish breakdown of the price zone 0.6820-0.6780 will probably allow further bearish decline towards 0.6700-0.6670 if the current bearish momentum is maintained on a daily basis.

The material has been provided by InstaForex Company - www.instaforex.com