USD/CAD has been quite corrective and volatile recently after breaking above the 1.3120 resistance area with a daily close. USD has been dominating CAD since the recent rate hike By the US Fed from 1.75% to 2.00%. Meanwhile, CAD is expected to regain footing.

On the back of lingering trade jitters between the US and Cadana because of looming tariffs on steel and aluminum imports, the pair is likely to trade with higher volatility in the nearest days. Canada's GDP report is due tomorrow. According to flash estimates, Q1 GDP is expected to decrease to 0.0% from the previous value of 0.3%. So, CAD is currently trying to regain footing. Though Bank of Canada's Governor Poloz did not speak about upcoming rate hike in July, his comments injected indecision in the market momentum.

On the USD side, today final GDP report is going to be published which is expected to be unchanged at 2.2%, Unemployment Claims is expected to increase to 220k from the previous figure of 218k, Final GDP Price Index is also expected to be unchanged at 1.9%, and Natural Gas Storage report is expected to show a decrease to 73B from the previous figure of 91B. Moreover, today FOMC Member Bostic is going to speak. His was quite optimistic in his last speech. However, in the context of the looming trade war, his speech is sure to make an impact on the USD gains today.

Ahead of the upcoming macroeconomic reports and events from the US and Canada, the market is expected to be quite volatile and corrective in the short run. USD already has an upper hand over CAD. If Canada's reports come better than expected, CAD may gain some momentum in the short term.

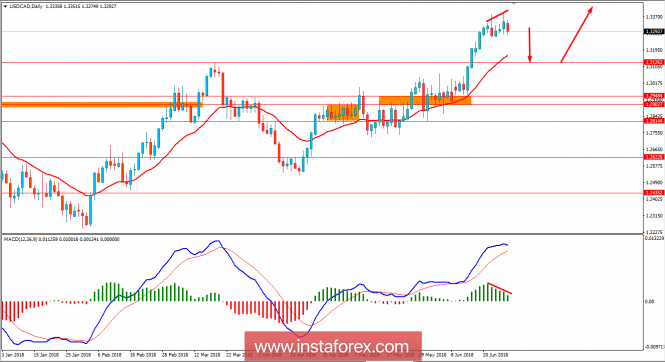

Now let us look at the technical view. The price has recently developed Continuous Bearish Divergence which is expected to push the price lower towards 1.3120 area in the coming days before the price climbs higher with a target towards 1.40 in the future. The bearish momentum is likely to be short-lived. As the price remains above 1.3120 area with a daily close, the bullish bias is expected to continue further.