MG Network

something big isHappening!

In the mean time you can connect with us with via:

- 981-981-9811

- Empire Damansara, Jln PJU 8/8A, Damansara Perdana

- info@moneygrows.net

Copyright ©

Money Grows Network | Theme By Gooyaabi Templates

Money Grows Network

Archive

- ► 2021 (6029)

- ► 2020 (6116)

- ► 2019 (9411)

- ► 2018 (8656)

-

▼

2017

(7162)

-

▼

April

(587)

-

▼

Apr 18

(26)

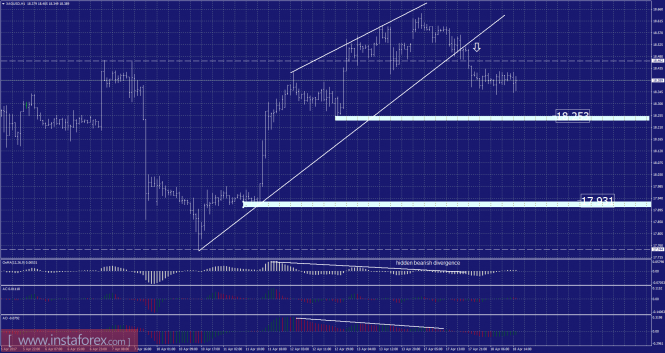

- Analysis of Silver for April 18, 2017

- Daily analysis of major pairs for April 18, 2017

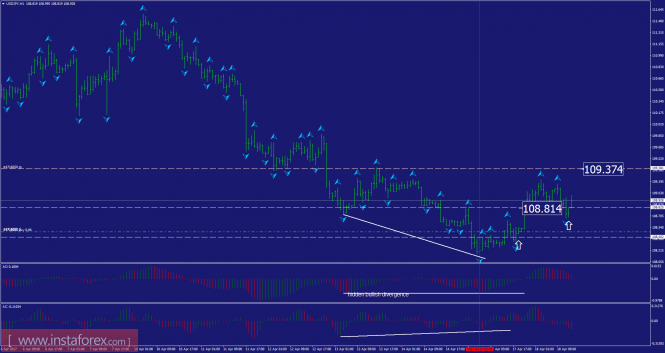

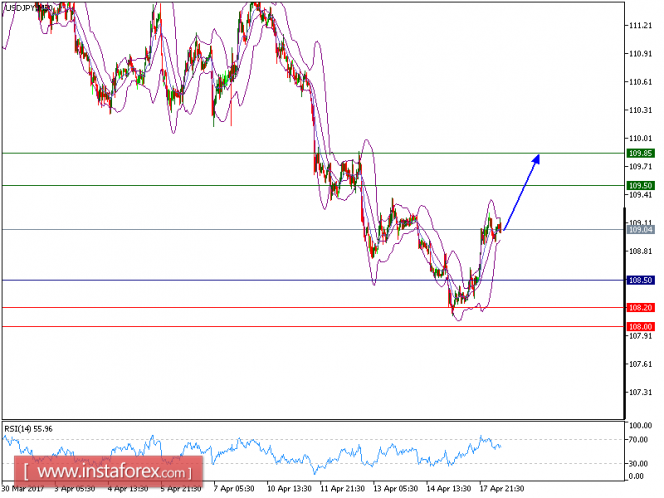

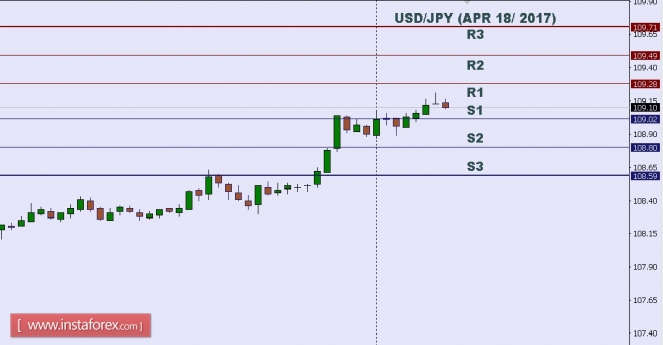

- USD/JPY analysis for April 18, 2017

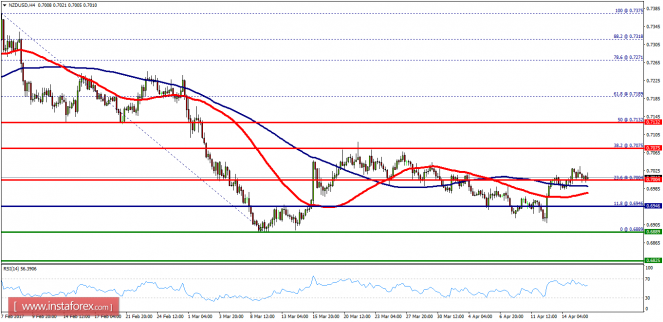

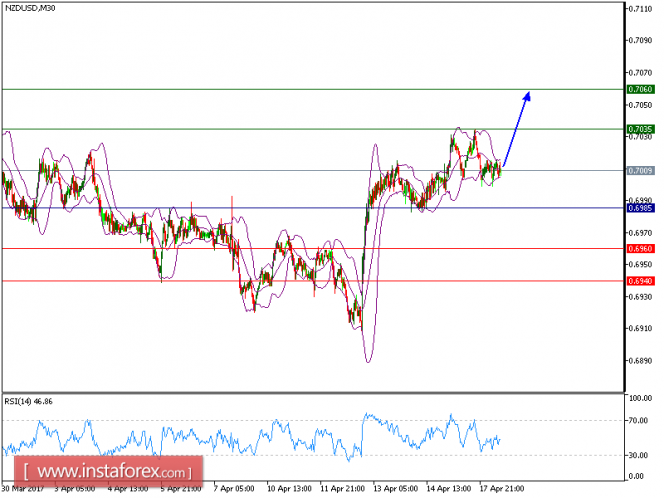

- Technical analysis of NZD/USD for April 18, 2017

- Trading plan for 18/04/2017

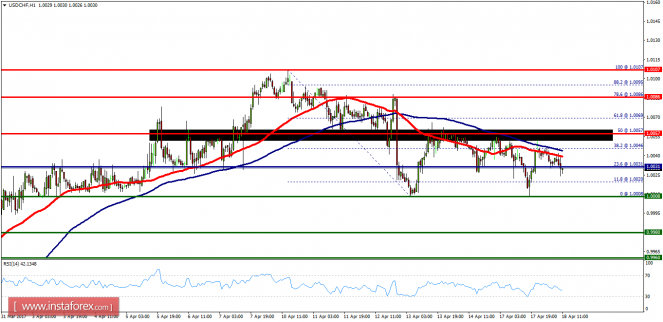

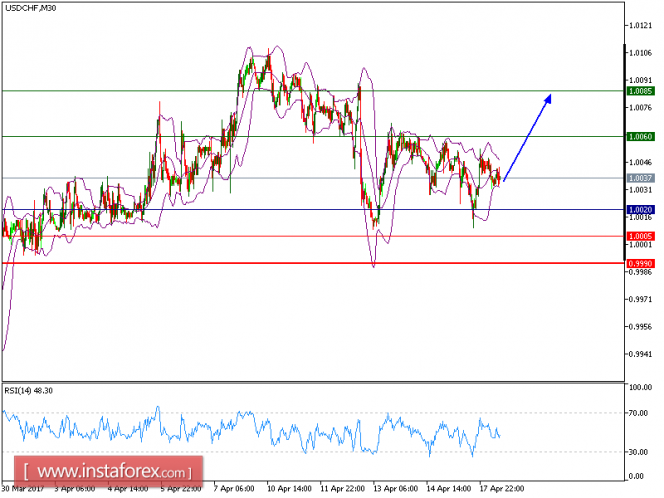

- Technical analysis of USD/CHF for April 18, 2017

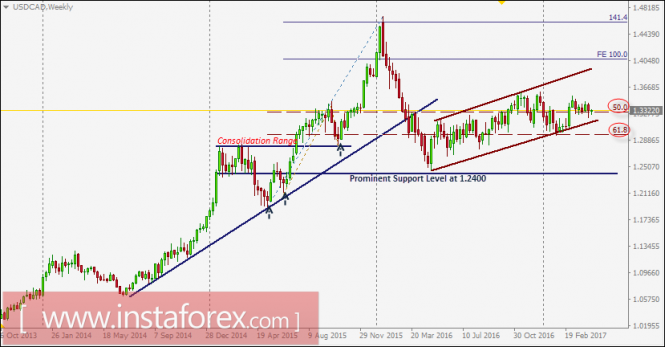

- Technical analysis of USD/CAD for April 18, 2017

- Global macro overview for 18/04/2017

- Global macro overview for 18/04/2017

- Technical analysis of USD/JPY for April 18, 2017

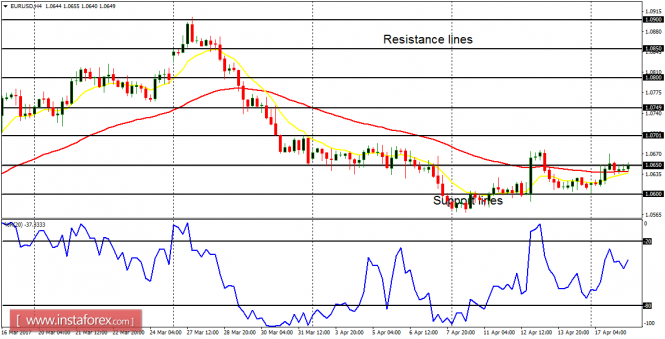

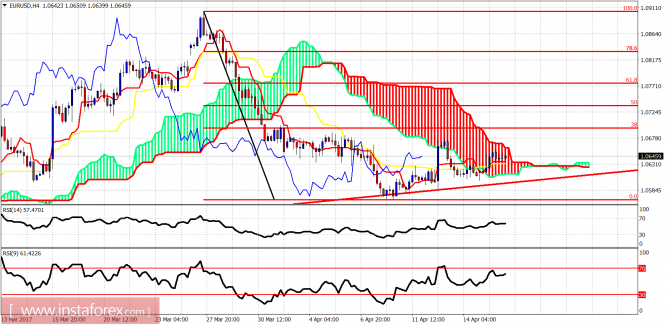

- Technical analysis of EUR/USD for April 18, 2017

- Technical analysis of USD/CHF for April 18, 2017

- Technical analysis of NZD/USD for April 18, 2017

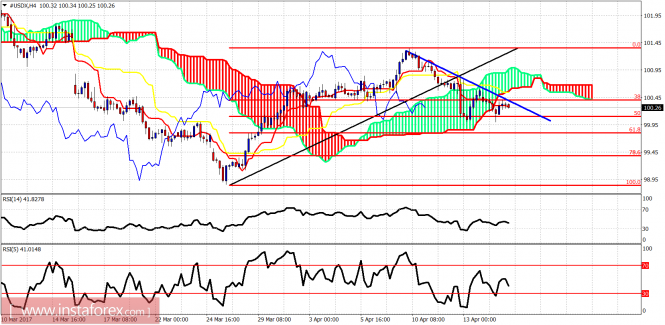

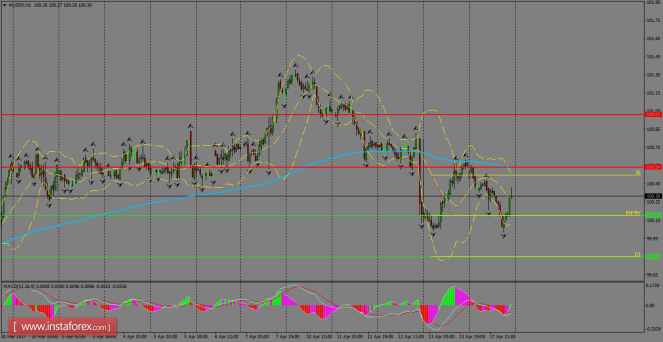

- Ichimoku indicator analysis of USDX for April 18, ...

- Technical analysis of GBP/JPY for April 18, 2017

- Ichimoku indicator analysis of gold for April 18, ...

- USD/JPY analysis for April 17, 2017

- NZD/USD Intraday technical levels and trading reco...

- USD/CAD intraday technical levels and trading reco...

- Daily analysis of USDX for April 18, 2017

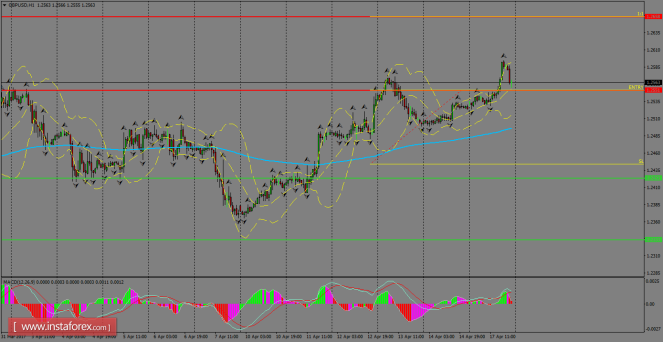

- Daily analysis of GBP/USD for April 18, 2017

- Elliott wave analysis of EUR/NZD for April 18, 2017

- Elliott wave analysis of EUR/JPY for April 18, 2017

- Technical analysis of EUR/USD for Apr 18, 2017

- Technical analysis of USD/JPY for Apr 18, 2017

- Daily Video Technical Analysis | NZD/USD | 17th Ap...

-

▼

Apr 18

(26)

-

▼

April

(587)

- ► 2016 (7614)

- ► 2015 (7602)

Powered by Blogger.

Welcome To Money Grows Network

Tags

2006 - 2019 © www.moneygrows.net

Investments in financial products are subject to market risk. Some financial products, such as currency exchange, are highly speculative and any investment should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only.

Popular

-

GBP/USD 5M The GBP/USD pair moved much more "softly" in comparison with the jerky movements of the euro/dollar pair on Friday. T...

-

EUR/USD 5M The EUR/USD pair did not trade in the best way during the last trading day of the week. Of course, the report on inflation in t...

-

4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction -...

-

4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction -...

-

Analysis of previous deals: 30M chart of the GBP/USD pair The GBP/USD pair also resumed a not too strong upward movement on Friday. An up...

Expert In