MG Network

something big isHappening!

In the mean time you can connect with us with via:

- 981-981-9811

- Empire Damansara, Jln PJU 8/8A, Damansara Perdana

- info@moneygrows.net

Copyright ©

Money Grows Network | Theme By Gooyaabi Templates

Money Grows Network

Archive

- ► 2021 (6029)

- ► 2020 (6116)

-

▼

2019

(9411)

-

▼

February

(1083)

-

▼

Feb 28

(54)

- Fundamental Analysis of EUR/CHF for February 28, 2019

- EURUSD: Results of the meeting of leaders of the U...

- Pound buyers trapped

- GBP / USD: the reassessment of the prospects for t...

- Brexit and the Fed: EU leaders are not against a B...

- GBP / USD. February 28. The trading system. "Regre...

- Intraday technical levels and trading recommendati...

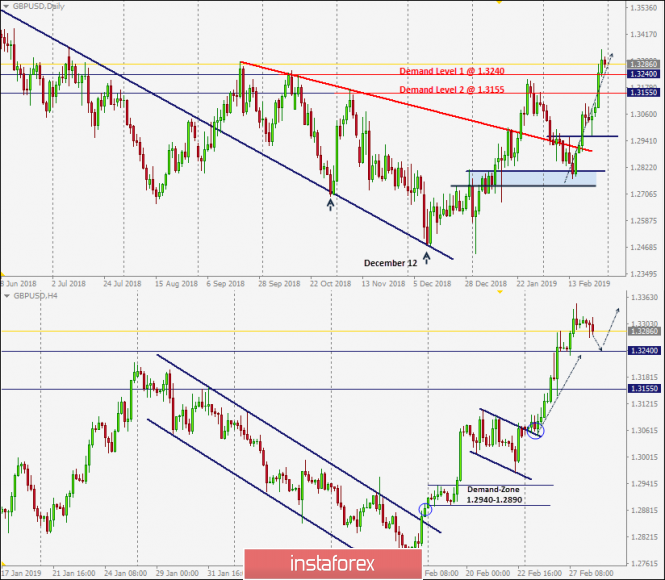

- February 28, 2019 : GBP/USD is retracing towards i...

- EUR / USD. February 28. The trading system. "Regre...

- Analysis of the divergence of EUR / USD for Februa...

- Analysis of the divergence of GBP / USD for Februa...

- GBP / USD plan for the American session on Februar...

- EUR / USD plan for the US session on February 28. ...

- Gold rally continues due to geopolitical tensions

- GBP / USD: next stop at 1.3520?

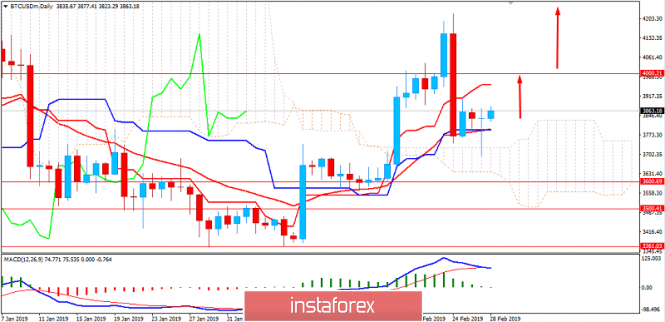

- BITCOIN Analysis for February 28, 2019

- Control zones of USD/CAD pair on 02.28.19

- Bitcoin analysis for February 28, 2019

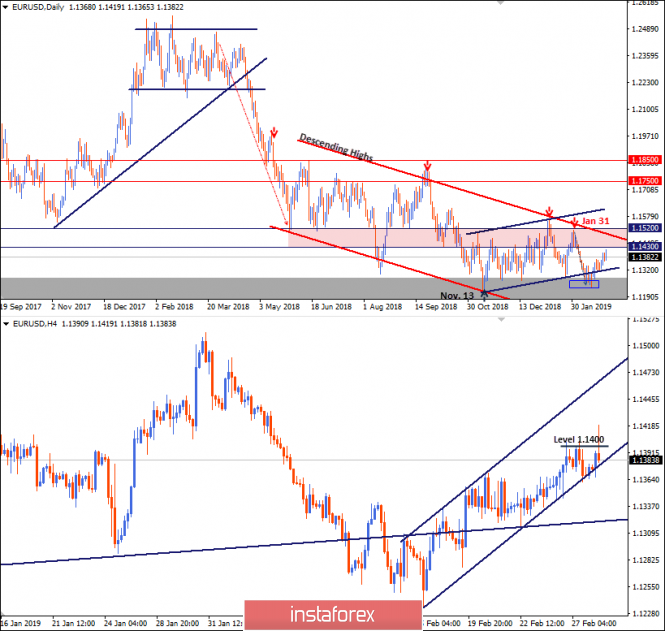

- EUR/USD analysis for February 28, 2019

- Trading recommendations for the EURUSD currency pa...

- Analysis of Gold for February 28, 2019

- Data on US GDP can harm the dollar. Forex Market F...

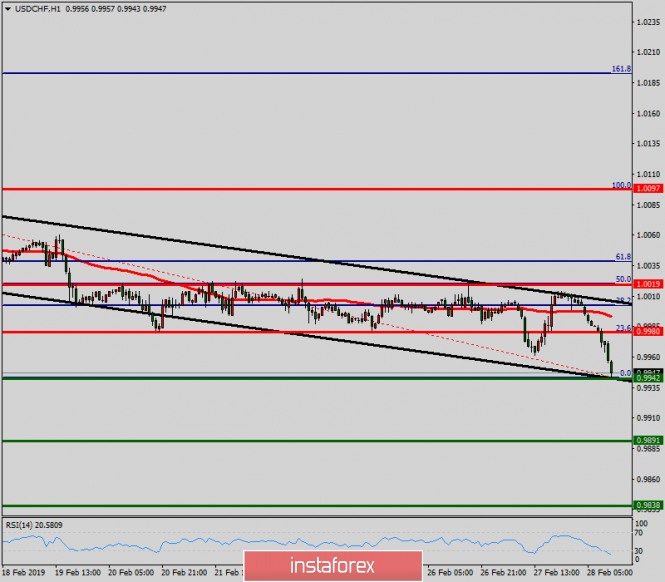

- Technical analysis of USD/CHF for February 28, 2019

- Forecast for GBP / USD pair on February 28, 2019

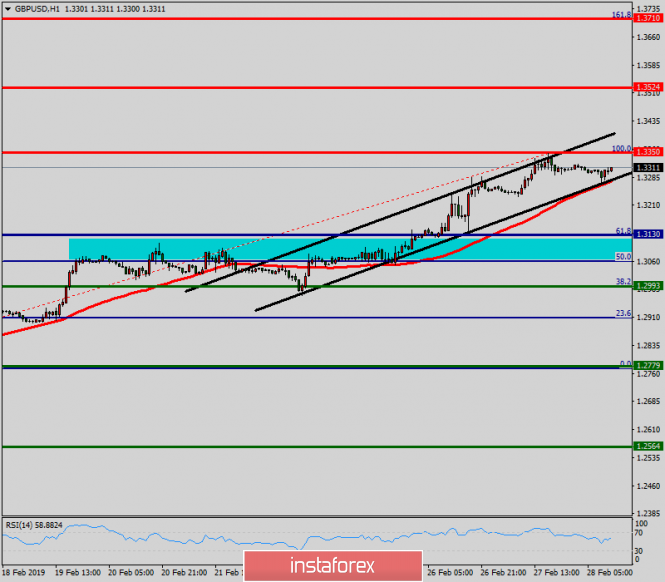

- Technical analysis of GBP/USD for February 28, 2019

- Wave analysis of EUR / USD for February 28. The ne...

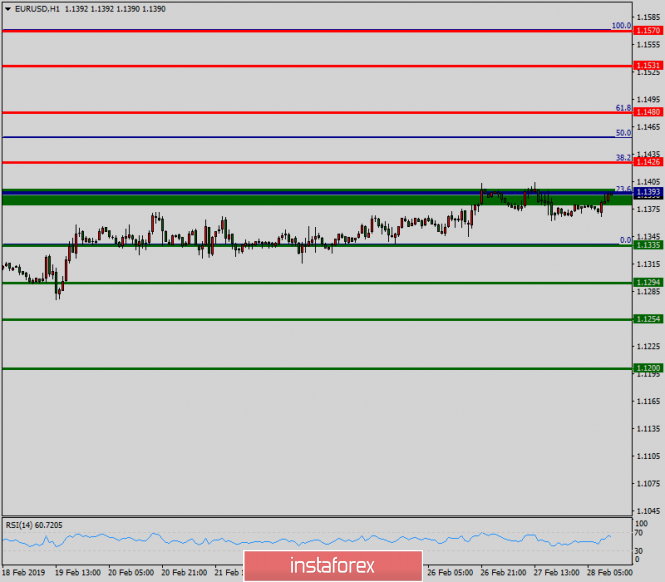

- Technical analysis of EUR/USD for February 28, 2019

- Indicator analysis. Daily review for February 28, ...

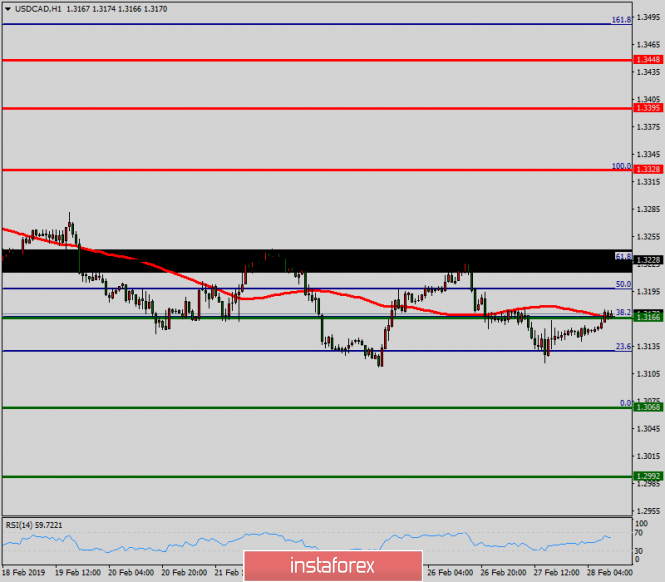

- Technical analysis of USD/CAD for February 28, 2019

- Fundamental Analysis of EUR/GBP for February 28, 2019

- Wave analysis of GBP / USD for February 28. Pound ...

- Indicator analysis. Daily review for February 28, ...

- Trading recommendations for the GBPUSD currency pa...

- Burning forecast 02/28/2019

- GBP/USD: plan for the European session on February...

- Fundamental Analysis of USD/CHF for February 28, 2019

- EUR/USD: plan for the European session on February...

- EUR/USD technical analysis for 28/02/2019

- GBP/USD technical analysis for 28/02/2019

- Bitcoin Elliott Wave analysis for 28/02/2019

- Ethereum Elliott Wave analysis for 28/02/2019

- Elliott wave analysis of GBP/JPY for February 28, ...

- Trading plan for EUR/USD for February 28, 2019

- Elliott wave analysis of EUR/JPY for February 28, ...

- Control zones NZDUSD 02.28.19

- Control zones GBPUSD 02/28/19

- Forecast for AUD/USD on February 28, 2019

- Technical analysis: Intraday Level For EUR/USD, Fe...

- Technical analysis: Intraday level for USD/JPY, Fe...

- The Fed sat on the side of the road. Where's the d...

- GBP/USD. February 27. Results of the day. Emmanuel...

- EUR/USD. February 27. Results of the day. The US n...

- USD/CAD: Canadian inflation weakness and fear of n...

- EUR/USD. A divide in the camp of the Federal Reser...

-

▼

Feb 28

(54)

-

▼

February

(1083)

- ► 2018 (8656)

- ► 2017 (7162)

- ► 2016 (7614)

- ► 2015 (7602)

Powered by Blogger.

Welcome To Money Grows Network

Tags

2006 - 2019 © www.moneygrows.net

Investments in financial products are subject to market risk. Some financial products, such as currency exchange, are highly speculative and any investment should only be done with risk capital. Prices rise and fall and past performance is no assurance of future performance. This website is an information site only.

Popular

-

4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction -...

-

4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction -...

-

Analysis of previous deals: 30M chart of the GBP/USD pair The GBP/USD pair also resumed a not too strong upward movement on Friday. An up...

-

GBP/USD 5M The GBP/USD pair moved much more "softly" in comparison with the jerky movements of the euro/dollar pair on Friday. T...

-

EUR/USD 5M The EUR/USD pair did not trade in the best way during the last trading day of the week. Of course, the report on inflation in t...

Expert In