The most important conclusion is that the US regulator will not rush to raise rates. The Fed still considers high inflation to be a temporary phenomenon and the labor market has not fully recovered. For USD, this situation becomes a deterrent. This does not mean that the dollar will be under pressure or fall. New circumstances that emerged last week may keep the US currency from more actively rising against its counterparts.

The dollar index is showing a downward correction. On Monday, market players will pay attention to Jerome Powell's speech at an online economic conference. Today, among other things, there are speeches by President and Chief Executive Officer of the New York Fed John Williams, and Vice-Chair of the Fed Richard Clarida.

Any unexpected comments about the outlook for monetary policy could cause a little turbulence in the financial markets. If the officials do not address the topic of monetary policy at all, there may be no reaction at all.

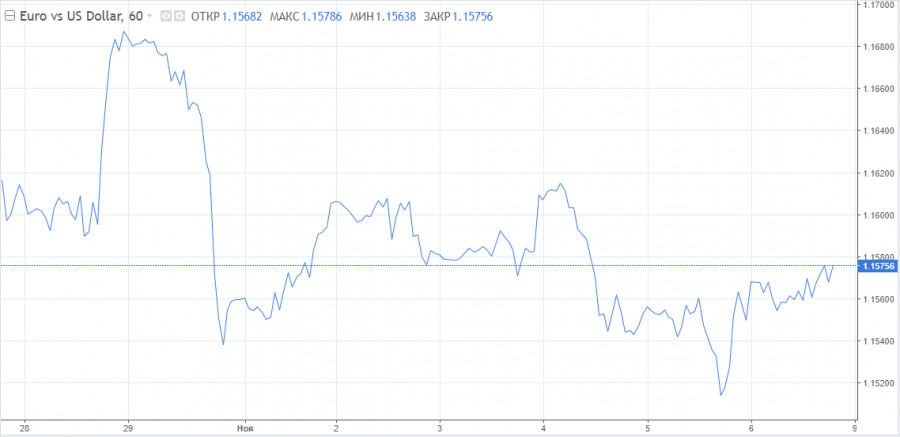

EUR/USD

The EUR/USD pair is showing signs of recovery, but they will be hindered mainly due to the lack of positive fundamental data for the euro. The ECB reminds the markets that it sees no reason to start policy normalization. Today, the ECB economist once again noted the temporary nature of inflation in the country, which does not require a rate hike.

The divergence of the ECB and Fed policies became evident after the latter decided to start tapering its QE program. In the short term, the fundamental data is completely on the side of the dollar. This means that the current euro recovery attempts may be restrained by technical levels.

The pair is trading below 1.1600 and the situation seems to be under the bear's control trading the euro. If bulls manage to fix the price above 1.1575, it may pave the way to reach 1.1610 and 1.1670.

It is important to assess the situation realistically and remember that the current upward movement is purely corrective. At any moment we should be ready to close long positions and return to opening short positions. If the EUR/USD pair fixes below 1.1500 the next targets for the bears are located at 1.1300 and 1.1000.

The initial resistance is located at 1.1575, and the second resistance is at 1.1600. If the session closes above 1.1600, buyers may be attracted and there will be an opportunity for growth to the static resistance at 1.1650.

Support is located at 1.1530, 1.1500, and 1.1440.

GBP/USD

As for the GBP/USD pair, it may become hard to recover the losses after last week's Bank of England meeting, which caused the pound to fall. In an interview with Bloomberg Andrew Bailey, governor of the Bank of England reiterated that the regulator would not manage the financial markets with interest rates. Traders may also be concerned about the pound because of renewed tensions related to Brexit.

There have been rumors that the UK may use Article 16. Ireland's Minister for Foreign Affairs, commenting on these rumors, said that the UK wants to deliberately derail the deal because of the Northern Ireland Protocol. According to the Minister, the EU could suspend the entire Brexit deal if the UK does decide to invoke Article 16.

The GBP/USD pair began the new week with a decline, but amid the downward correction of the dollar, the pound managed to break through 1.3500. The question is whether the buyers will be able to fix higher. If not, the outlook for the pound may remain negative in the short term. Notably, the closing of the session above 1.3500 may not be enough for a trend reversal. Investors need new fundamental factors.

The Bank of England's refusal to raise rates is a major bearish factor. However, markets did not fully believe the regulator's dovish message. The CME Group's BoEWatch Tool now indicates that markets estimate the probability of a 20bp rate hike in December at nearly 70%.

Resistance is located at 1.3500, 1.3570, and 1.3630. Support is located at 1.3400, 1.3360, and 1.3300.

The material has been provided by InstaForex Company - www.instaforex.com