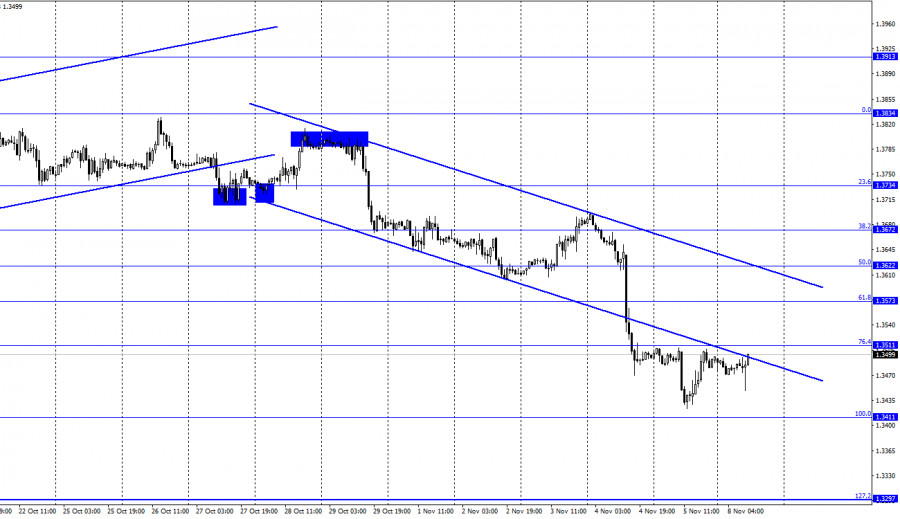

GBP/USD – 1H.

Hi, dear traders! On Friday, according to the 1-hour chart, the GBP/USD pair approached the 100.0% retracement level (1.3411). Afterwards, it bounced back towards the 76.4% Fibonacci level of 1.3511. The price failed to reach any of these levels and reversed near them. The quote is currently traded below the downward channel that indicates a bearish trend. If the price consolidates above the retracement level of 76.4%, further upward movement is expected towards 1.3573 and 1.3622. In case of a bounce from the 1.3511 level, the downward trend could resume. On Friday, the dollar missed the chance to grow against the pound even further. The unemployment report and Nonfarm payrolls beat market expectations but failed to boost the greenback.

Although the dollar went up in the first half of the day, it reversed afterwards. By the end of last week, the sterling nearly reached its previous low. Now, it's ready for a new uptrend. Both lows and the important level near them are seen on the H4 chart. Fundamentals are unlikely to provide support to the dollar after they became a reason for a drop in the pound in the previous week. After the Fed's and BoE's meetings, there are hardly any significant events this week, except for the US inflation report set for release on Wednesday. The CPI is expected to rise, and it is hard to predict a possible market reaction to it. The long-awaited QE tapering has already begun.

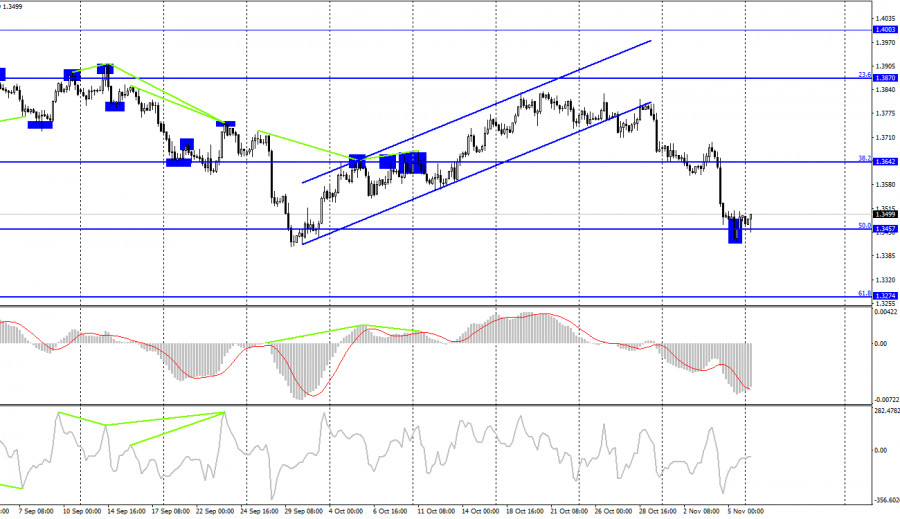

GBP/USD – 4H.

According to the 4-hour chart, the sterling has fallen to the retracement level of 50.0% (1.3457). If the price bounces off this level, an upward reversal towards the 38.2% Fibonacci level of 1.3642 could be possible. If the quote consolidates below 50.0%, it could lead to a further downward movement towards the next retracement level of 61.8% (1.3274). Today, the indicators show no sign of emerging divergences.

US/UK economic calendar:

US - Speech by Jerome Powell, chairman of the Federal Reserve (15-30 UTC)

UK - Speech by Andrew Bailey, governor of the Bank of England (17-00 UTC)

It is unlikely that Monday's speeches would significantly influence the market.

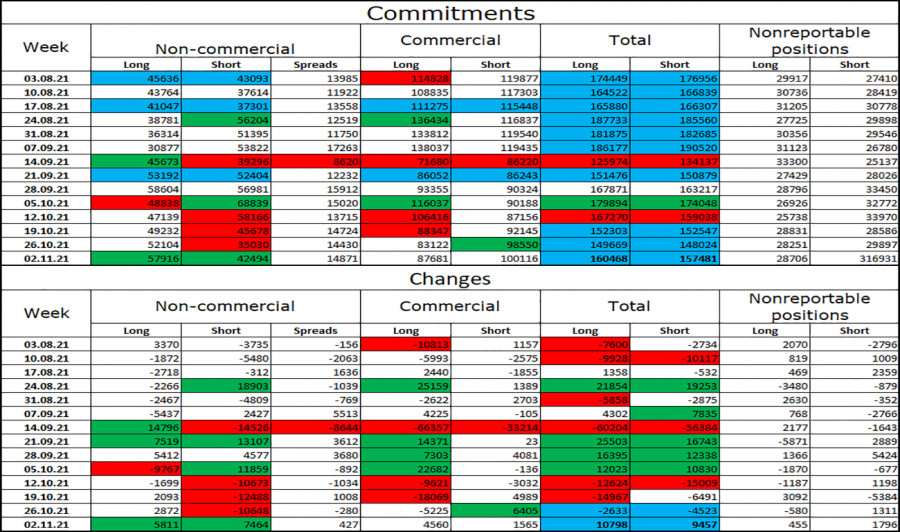

COT (Commitments of traders) report:

The latest COT report as of November 2 for GBP/USD indicates the bullish sentiment among major players decreased slightly. Traders opened 5,811 Long positions and closed 7,464 Short positions. The number of Long positions among major players is still exceeding the number of Short positions by 17,000, but the gap between them is narrowing. Over the past few weeks, market players were uncertain whether to buy or sell the pair. So, the number of Long and Short positions is the same for all categories of traders (160,000 vs 157,000). After several weeks of active buying, traders may shift to active selling.

Outlook for GBP/USD:

Long positions could be opened if the price bounces off the 50.0% level (1.3457) on the 4-hour chart, with targets at 1.3511 and 1.3573. Short positions could be opened if the pair closes below 1.3457 at the 4-hour chart, with targets at 1.3411 and 1.3297.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com