Donald Trump brought the entire German business into a state of light panic, which was reflected in the form of an unreasonable weakening of the single European currency, which also pulled the pound. The fact is that the President of the United States signed the Pentagon budget for next year, which includes measures to counteract the construction of Nord Stream 2. It is no secret to anyone that Germany, or rather German business, will receive a tremendous advantage in the form of a significant reduction in energy costs, as soon as the gas pipeline is fully operational. In addition, Germany itself will receive an excellent instrument of influence on other European countries, since they will now receive gas through it. Due to this, the actions of the United States are perceived by German business as extremely hostile and potentially causing serious economic damage. In this regard, the general weakening of the single European currency is not surprising. Thus, investors are worried and see rising risks.

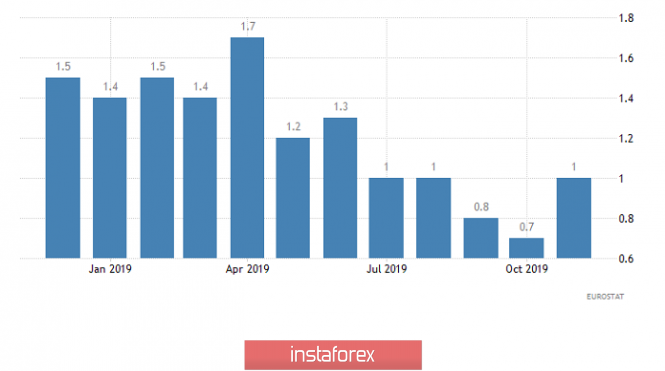

At the same time, there were in fact no real economic reasons for weakening the single European currency. And Nord Stream 2 itself will be completed. The only question is what sanctions will be imposed on those or other companies participating in the implementation of this project. Meanwhile, inflation in Europe accelerated from 0.7% to 1.0%, which is nothing but rejoice, because there were fears that inflation would be slightly less noticeable until the last moment. Indeed, the pace of decline in producer prices in Germany accelerated from -0.6% to -0.7%. In addition, the volume of construction in Europe increased by 0.3%, while the decline of the previous month was revised from -0.7% to -0.3%. Therefore, the single European currency really had an occasion for optimism.

Inflation (Europe):

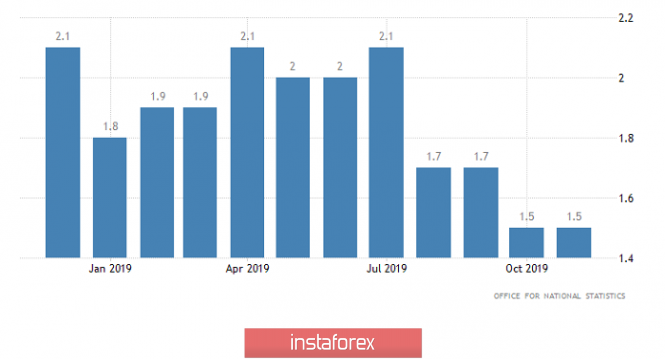

Honestly, the pound had also no reason to weaken, as inflation remained stable, and did not fall from 1.5% to 1.4%. However, Boris Johnson's brilliant idea of a legislative ban on extending the transition period, which will begin on February 1, continues to put pressure on the pound. This should last about a year. During this time, the UK and the European Union must sign all the necessary documents governing their interaction, but already in a situation where the United Kingdom is not a resident of a pan-European hostel. However, investors fear that this time will not be enough to agree on the most pressing issues, on which there is still no understanding. We are talking about the border between Ireland and Northern Ireland, as well as trade and customs duties with all sorts of quotas and technical regulations.

Inflation (UK):

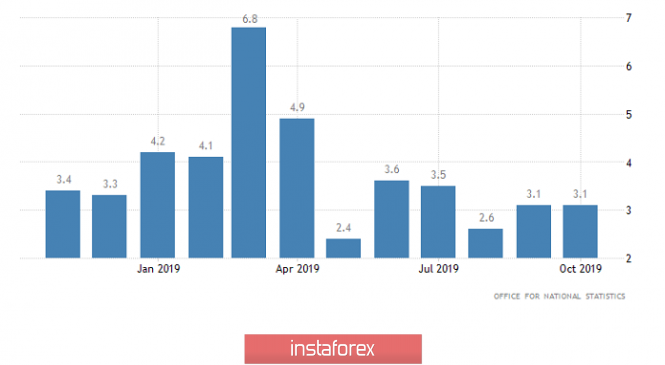

Today, Britain will be in focus again, but not because of a meeting of the Bank of England board. The fact is that Mark Carney has long explained to everyone that there should be no changes in the interest rate policy of the regulator before Brexit. In the light of Boris Johnson's latest initiatives, these words can be interpreted as saying that nothing will change before the end of the transition period. Morally, investors are ready for this, and it is clear that no reaction to the next inaction of the Bank of England will follow. Despite this, retail trade is of interest. The growth rate of which should slow down from 3.1% to 2.1%. Such a significant decline in consumer activity is not even offset by the constancy of inflation, so the pound will obviously be under pressure.

Retail Sales (UK):

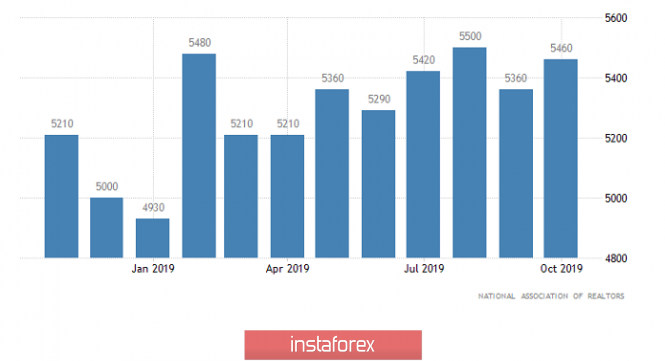

At the same time, the dollar itself will have reasons for joy and not bad. In particular, even if the number of repeated applications for unemployment benefits should increase by 18 thousand, the number of initial applications for unemployment benefits can be reduced by 33 thousand, that is, in general, the number of applications for unemployment benefits can be reduced by 15 thousand In addition, home sales should increase by 0.8% in the secondary market. Thus, in general, expectations are quite optimistic according to American statistics.

Secondary Home Sales (United States):

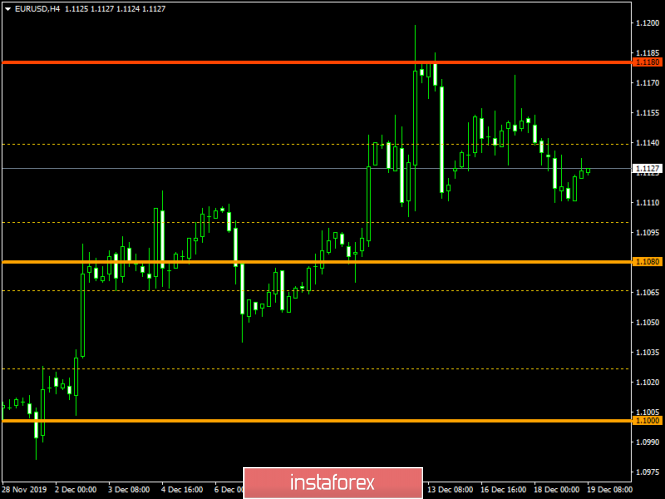

The euro/dollar currency pair found a variable support in the form of a local minimum on December 13, where it formed a stagnation with a subsequent rollback. Thus, it is likely to assume a chatter variable within the values of 1.1110/1.1135, where the work will be arranged according to the "breakdown of borders" method.

The pound/dollar currency pair maintains downward interest, but the past day was reflected in a characteristic stagnation. Thus, it is likely to assume a temporary chatter, where the psychological level of 1.3000 will play a key role in case of breakdown.