Today, the pound paired with the dollar slowed down, but still remains under pressure, despite the very tolerable data on the growth of British inflation. In turn, traders of the pair are clearly nervous in anticipation of tomorrow, and in the framework of which, the December meeting of the Bank of England will be held.

Recently, currency strategists increasingly admit the probability of a proactive easing of monetary policy at the beginning of next year. The decline in key economic indicators amid weak inflationary growth only reinforce concerns about this. In addition, the pound came under pressure from political factors: traders did not have time to celebrate the victory of the conservatives, as Johnson presented them with an unpleasant surprise - he expressed his intention to legislatively limit the transition period. At the same time, the market began to trade in the face of uncertainty, above all - regarding the prospects for future negotiations between London and Brussels. Thus, it is already obvious that these negotiations will be difficult, especially considering the rather tough line of behavior of the current British prime minister.

Now, let's go back to the Bank of England. Let me remind you that the Briton collapsed throughout the market following the November meeting, although the regulator left all the parameters of monetary policy unchanged. The fact is that two members of the Committee - Saunders and Haskell - unexpectedly voted to reduce the interest rate, thereby violating the expected balance of power (0-2-7 instead of the predicted 0-0-9). For the first time in three years, that is, since August 2016, Central Bank officials, albeit not in the majority, have voted in favor of easing monetary policy. Moreover, representatives of the "dovish wing" said that the regulator needs to introduce additional incentives as soon as possible, as recent releases indicate a weakening of the British labor market amid increasing risks from the global trade conflict. It can be noted that Saunders is not the first to vote contrary to the opinion of most colleagues. A little over a year ago, he, along with Ian McCafferty (who is no longer a member of the Committee), voted to raise the rate, while the remaining 7 members of the Committee voted to maintain the status quo. Now, the opposite situation has developed: the "disgraced" official insists on easing monetary policy, pointing to a slowdown in Britain's GDP growth, the labor market, as well as weak inflation.

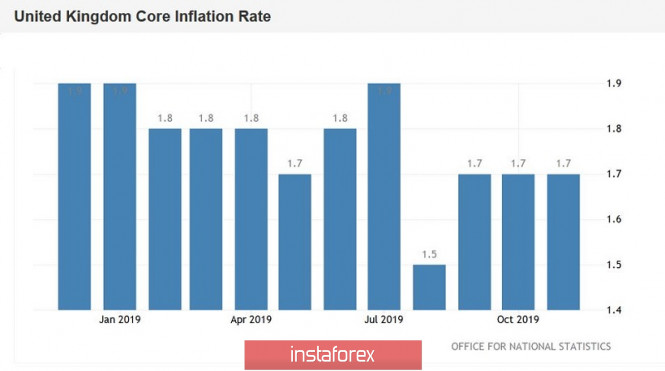

Recent releases really leave much to be desired. The UK economy for the last study period (October) remained at zero level (on a monthly basis), while the key indicator increased by only 0.7% in annual terms - this is the weakest growth rate in the last 7 years. Moreover, data on the labor market also turned out to be very contradictory: unemployment remained at the same level (3.8% with a forecast of growth of up to 3.9%), and the number of applications for unemployment benefits increased significantly - to almost 29 thousand (with a forecast of 20 thousand). Disappointing salaries. On the other hand, the average earnings level (including premiums) grew to only 3.2% - this is the weakest growth dynamics since April this year. However, without taking into account premiums, this indicator came out better than expected, being at around 3.5%. But inflation on a monthly basis scrambled out of the negative area, and remained at around 1.5% (with a forecast of decline to 1.4%) in annual terms. Core inflation reached the forecast level (1.7%), and the retail price index showed unexpected growth - both in monthly and annual terms.

So what to expect from the December meeting of the Central Bank? Last month, the Bank of England summarized the outcome of the meeting in two ways - on the one hand, the English regulator made it clear that if global economic growth does not stabilize, Brexit uncertainty will continue, and key economic indicators will continue downward trend , then the Central Bank may have to "intervene." But then the regulator hastened to declare the probability of an alternative scenario. If these risks do not materialize, then the issue of a gradual increase in the rate will be on the agenda again.

Now, what has changed since the November meeting? The probability of a "tough" Brexit was reduced to zero, but at the same time, uncertainty about the prospects for the transition period increased. Key macroeconomic indicators show a slowdown. Many of the components of which came out in the green zone today even inflation, which still demonstrates weakness - especially if you recall the rate at which the corresponding indicators increased at least a year ago. As for the prospects for a trade war, there is also only a temporary "thaw" here. Obviously, the main battles of the negotiation process will unfold after the New Year holidays, so this topic has faded into the background. In this regard, the parties were able to avoid the escalation of the trade conflict on December 15, significantly defusing the overall situation. But in general, the problem is still far from being resolved.

All this suggests that the British Central Bank may take either a very cautious or frankly "dovish" position tomorrow. As a result, the pound has a chance to return to the range of 29-28 figures if the number of people who voted for the rate cut is more than two (general forecast 0-2-7) or Mark Carney will talk about the advisability of easing monetary policy in the foreseeable future. Moreover, the pound may show short-term growth in the region of the 31st figure, if the regulator takes a wait-and-see position, allowing the British economy to "freeze itself" after the approval of the Brexit deal. In the second scenario, the attention of the traders of GBP/USD will quickly switch to political factors, since Boris Johnson plans to submit a bill on Brexit to the House of Commons at the end of this week (namely December 20).

The material has been provided by InstaForex Company - www.instaforex.com