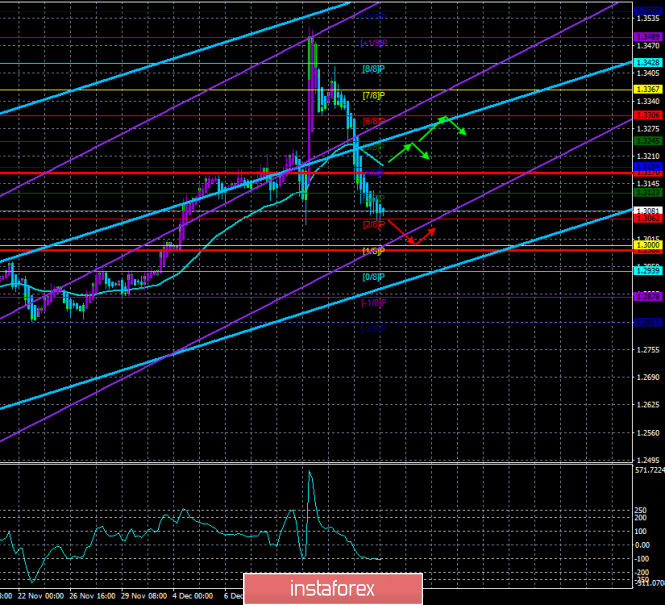

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -98.8376

The British pound continues a completely recoilless downward movement, although yesterday the movement slowed and weakened slightly. However, there is still no upward correction, the pair has fixed below the moving average line, so the trend has already changed to a downward one. This is also signaled by the Ichimoku indicator trading system. At the moment, the quotes of the pound/dollar pair rested on the Murray level of "2/8" - 1.3062. Approximately the same level is the line Senkou Span B of the Ichimoku indicator. Therefore, overcoming this level by bears will allow the British currency to continue falling, which is fully justified from fundamental analysis. Indeed, what can the British pound rely on, which continuously (almost) grew for two months while the British macroeconomic statistics failed from time to time, and the British Central Bank at the last meeting made an impressive step towards easing monetary policy (two of the nine members of the Monetary Committee voted to reduce the key rate)?

Although the Bank of England is preparing to reduce the key rate, we believe that this will happen a little later. Surprises are certainly possible. For example, if the Bank of England will lower its key interest rate tomorrow, the pound might collapse down. However, do not forget that on the horizon now, instead of elections to parliament, are looming Brexit, "transition period" and complex negotiations between Boris Johnson and the group from the EU, led by Michel Barnier. Johnson, who is completely unafraid of a "hard" Brexit, will continue to put pressure on the EU. Like, if the Europeans are not going to conclude a "quick agreement", which will suit the UK, then London can get out of the jurisdiction of Brussels and without any agreements. That was Johnson's mindset from the start. It was against it that the Laborites, the Scottish nationalists and virtually every other political force in the UK fought. However, the elections showed that the population is eager to leave the EU quickly and are ready to follow Boris Johnson and his decisions. Thus, the Bank of England, most likely, will not rush to lower the key rate, realizing that in the future the Prime Minister can receive several "unpleasant surprises", and he will not be able to stop his activities with the help of the opposition or through the Supreme Court. Thus, the regulator is likely to leave such a step as a rate cut as a last resort. It is expected that members of the monetary committee Michael Saunders and Jonathan Haskell will continue to vote in favor of lowering the rate, but it is unlikely that someone else will support them now. Thus, with the maximum "dovish" mood of the Committee, the balance of votes will turn out to be 0-3-6. However, in the future, we believe that such a step by the British regulator as a reduction in the key rate is almost inevitable.

In addition to the meeting of the Bank of England, traders tomorrow will see the publication of data on retail sales in the UK for November. Experts' forecasts suggest that the growth will be about 2.1% in annual terms and 0.3% - every month. Thus, the slowdown in retail sales is expected to continue, which can be interpreted as another deterioration in the economic situation in Albion. Thus, potentially, the pound tomorrow may continue to be under pressure from market participants, like all factors, at first glance, speak against it. If we add another technical factor, which implies a strong fall in the British currency, at least as part of the correction against the two-month growth, the fall of the pound tomorrow becomes almost inevitable.

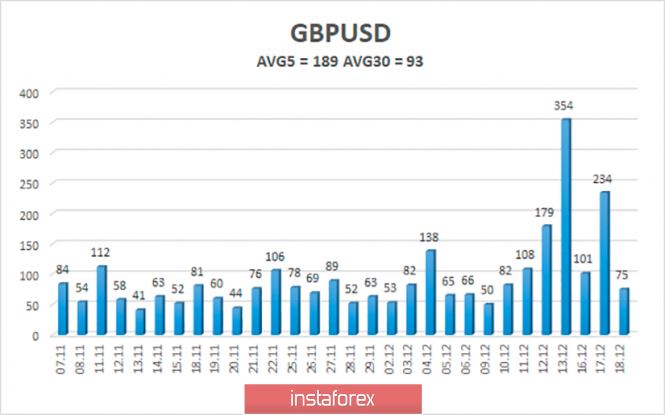

The average volatility of the pound/dollar pair over the past 5 days is 189 points, but even for the pound, it is unnatural to pass more than 200 points per day. Therefore, 3 of the last 5 trading days can be considered abnormal in terms of volatility. Thus, we took the indicators of average volatility for 30 days and according to them, the working volatility channel on December 19 is limited to the levels of 1.2988 and 1.3170. The meeting of the Bank of England is a very important event, but the regulator is not likely to make any particularly important decisions. This means that volatility is unlikely to be more than 100-120 points.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The GBP/USD pair continues its downward movement. Thus, traders are advised to remain in the sales of the British currency with the nearest targets of 1.3062 and 1.3000 until the Heiken Ashi indicator turns upwards, which signals the beginning of a correction. It is recommended to return to the purchases of the pound/dollar pair not earlier than the reverse consolidation above the moving average line with the targets of 1.3245 and 1.3306.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com