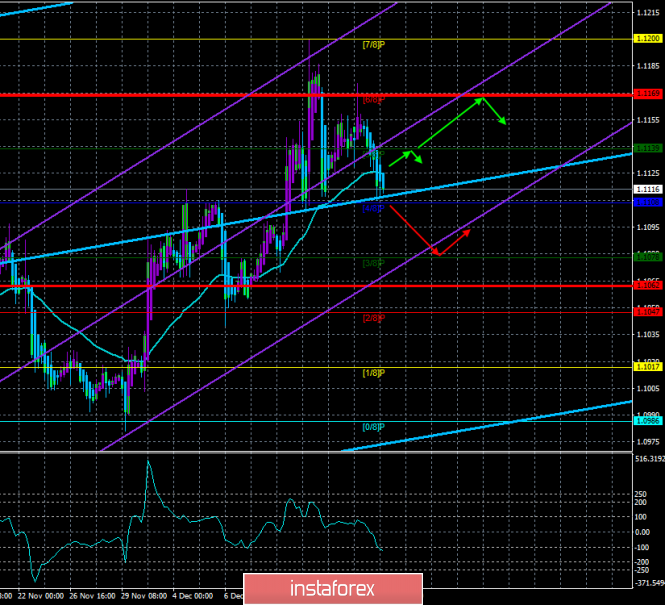

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - sideways.

CCI: -128.6496

On Thursday, December 19, the EUR/USD currency pair starts by breaking the moving average line. Thus, two trading systems ("Ichimoku" and "linear regression channels") have signals to change the trend to a downward one. As you can see, the euro/dollar pair did not manage to overcome the Murray level of "6/8" - 1.1169, from which the rebound was performed twice, and before that, from October 21 to November 4, another 3 times. Thus, this level (or the area around this level) is a strong resistance zone, which the bulls could not overcome. If the fundamental background spoke in favor of the European currency, then it would be possible to count on overcoming the specified resistance area, but the fundamental background leaves much to be desired for the euro currency. The short-term fundamental background will be extremely weak today. In the European Union, no important macroeconomic publication is scheduled for Thursday, in the States - only data on applications for unemployment benefits will be published, which are unlikely to cause at least some reaction among traders. All the attention of traders, thus, will be shifted towards the meeting of the Bank of England and the vote of the House of Representatives of the US Congress for the impeachment of Donald Trump.

The topic of the meeting of the British Regulator will be discussed in detail in the article on GBP/USD. And in this article, we will look at the topic with the vote of the US Congress. The latest information says the following. Last week, the Congressional Judiciary Committee approved two articles under which Trump could be impeached. The US President is accused of abuse of office and obstruction of the US Congress. Today, the House of Representatives began the next meeting, at which the vote will take place. The session of Congress began with a speech by Speaker Nancy Pelosi, who said: "It is a fact that President Trump is a constant threat to our national security, the integrity of our elections and the foundations of our democracy." The Speaker of Congress considers it a reliable fact that Donald Trump violated the US Constitution. According to Pelosi, Donald Trump simply left no other options but to start the impeachment procedure to Congress. However, several representatives of the Republican Party have already spoken out. For example, Debbie Lesko, representing Arizona, called the process "the most cheating she's ever seen." "No Democrat has ever given evidence that the President committed crimes that could cause impeachment," the Republican said. Indiana Republican Jackie Walorski said that "this is a shameful impeachment that is being done at the expense of Americans who want the country to move forward." And Republican Steve Scalise said that unlike the impeachment proceedings that began against Richard Nixon and Bill Clinton, the process against Trump began "without a crime." Paradoxically, Donald Trump's political ratings have risen over the past few months. Now, 43% of Americans support the activities of the US President, and 52% do not support him. But even with the rise in political popularity, 43% is not enough to seriously expect to win the 2020 presidential election.

The end of the Congressional vote can be predicted with a 90% probability. By and large, this whole topic leaves only one important question: will it affect the opinion of voters in November 2020? After all, there is no denying that Trump's official accusations of treason can make some fans of the odious president change their minds. Anyway, this topic is interesting, although it does not yet have much impact on the movement of the euro/dollar currency pair. Given the general fundamental background and the technical picture, we expect the US currency to continue strengthening. Both channels of linear regression are still directed upwards, so US dollar purchases are recommended in small lots.

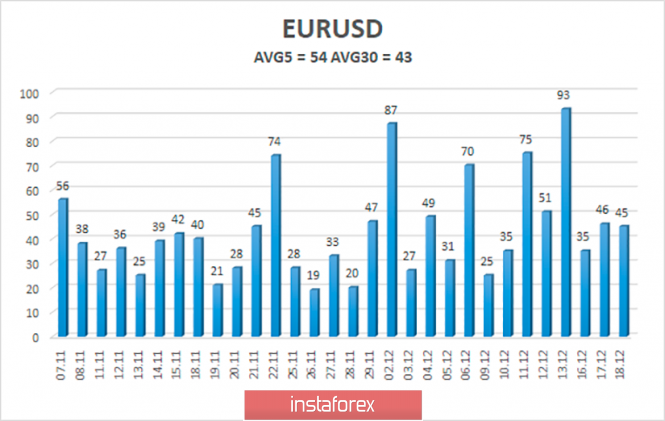

The average volatility of the euro/dollar currency pair has decreased due to the last three trading days and is now about 54 points per day, which is the average. The average volatility for the last 30 days remains unchanged - 43 points. Thus, the channel in which the pair can move on December 19 is limited to the levels of 1.1062 and 1.1169. We still believe the upward trend is complete. Tomorrow's fundamental background will be almost zero, so the volatility may be about 30-40 points.

Nearest support levels:

S1 - 1.1108

S2 - 1.1078

S3 - 1.1078

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.1200

Trading recommendations:

The euro/dollar pair continues to move down, the upward trend is canceled. Thus, it is now recommended to consider the sale of the euro currency with the targets of 1.1108 and 1.1078, which can be opened in small lots. The overall fundamental background is not on the side of the euro, so the pair's fall is more preferable. It is recommended to buy the euro again not earlier than the return of quotes to the area above the moving average with a target of 1.1169.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com