The euro ignored data on improving sentiment in German business circles in December this year, as weak inflation, which fell in November in the eurozone, confirms the need for new measures to stimulate the economy by the European Central Bank once again. It has already been repeatedly noted that the European regulator can go on a reduction in the deposit rate already in the early spring of next year, and reports coming out at the end of this year only confirms this forecast.

According to Ifo, the German business sentiment index rose to 96.3 points in December 2019 from 95.1 points in November, while economists predicted the index rose to 95.5 points. The current conditions index reached 98.8 points, while the expectations index rose to 93.8 points. Economists had expected the index of conditions to rise to 98 points, and the index of expectations to 93.0. Ifo noted that the German economy could enter the new year more confidently, but problems remain in the manufacturing sector, even though companies' expectations regarding prospects have become less pessimistic. It is important to note that the service sector continues to stay away from the manufacturing sector, in every possible way ignoring its problems, fueled mainly by domestic demand.

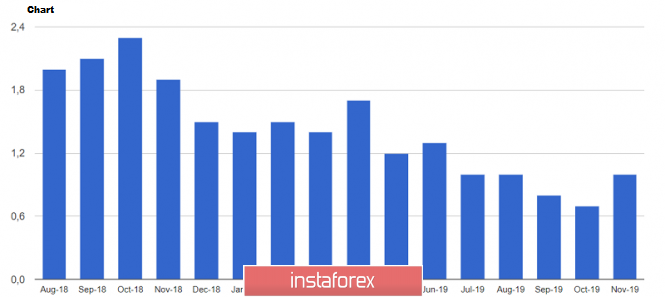

As for inflation in the eurozone, it is not as pleasing as we would like. According to the report, CPI in the eurozone in November this year declined by 0.3% compared with October, fully coinciding with the forecasts of economists. Lower inflation is direct evidence of the sluggish economic growth of the eurozone throughout the year. Inflation grew by only 1.0% compared to the same period of 2018, which clearly does not reach the target value of the European Central Bank of about 2.0%. As for core inflation excluding volatile categories, the reduction was even greater, which is around 0.5% compared with October, which indicates an increase in the overall indicator, which was achieved due to energy sources. Core inflation rose by 1.3% compared to last year.

As for the technical picture of the EUR/USD pair, it remained unchanged. At the moment, the bears will strive to push the trading instrument below the support of 1.1110, which will lead to the lows of 1.1070 and 1.1040. With an upward correction, problems for euro buyers may begin in the resistance area of 1.1165. Due to this, larger players will prefer protection level 1.1200, which is a kind of psychological level. Now, its breakthrough will lead to the continuation of the upward trend of the European currency.

GBP/USD

The pound stopped falling, despite the ONS report stating that inflation in the UK was at a 3-year low in November this year.

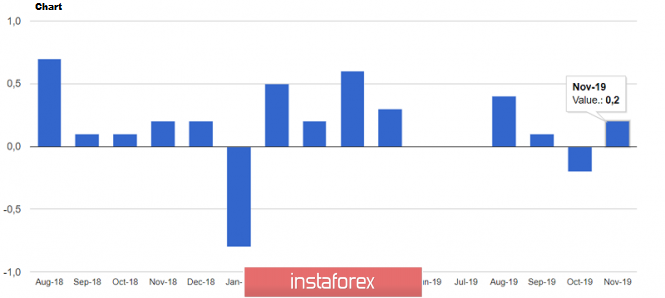

According to data, UK consumer prices rose 0.2% in November this year after a 0.2% decline in October this year. Moreover, prices rose by 1.5% compared to November last year, which fully coincided with the forecasts of economists. The report indicated that the increase was mainly due to the price of chocolate and tickets. In turn, price reductions were observed for tobacco products. The basic consumer price index, which does not take into account volatile categories, grew by 1.7% in November compared to the same period of the previous year.

The data, on the one hand, allow the Bank of England to adhere to the current level of interest rates, since inflation has not reached the 2% mark for four consecutive months. Thus, if the English regulator decides to raise rates, then there will also be no problems with this, since a seriously one-time increase is unlikely to slow down the current price increase. In addition, lower rates do not threaten a strong price increase.

Meanwhile, housing prices in the UK rose in October 2019, but the pace has seriously slowed down. According to the National Bureau of Statistics, the average housing price increased by 0.7%, to 233,000 pounds in October of this year, compared with the same period last year.

As for the technical picture of the GBP/USD pair, it has not changed in any way compared to the morning forecast. The breakdown of support 1.3075 will hit the stop orders of buyers, however, it is hardly worth counting on maintaining a powerful downward momentum. Apparently, the bulls are beginning to gradually return to the market, although more acceptable levels for purchases are visible in the areas of 1.3013 and 1.2952. At the same time, if there is any upward correction of the pound, it will be limited to the area of the 32nd figure.

The material has been provided by InstaForex Company - www.instaforex.com