USD/CHF has been quite corrective and volatile after the daily close below 0.9980 area recently. Despite downbeat economic reports from the US, it managed to sustain the bullish momentum in the pair against CHF.

Recently US Core Durable Goods Orders report was published with an increase to 0.1% from the previous value of 0.0% but failed to meet the expected value of 0.4%, Durable Goods Orders decreased significantly to -4.4% from the previous value of 0.7% which was expected to be at -2.2%, and Unemployment Claims increased to 224k from the previous figure of 221k which was expected to decrease to 215k. Today, amid Thanksgiving day observation, USD was quite silent throughout the day with not much liquidity in the pair.

On the other hand, this week Switzerland's Trade Balance report was published with an increase to 3.75B from the previous figure of 2.23B which was expected to increase to 2.89B. The positive report helped CHF to gain momentum, but the impulsive sustainability is currently fading away.

In the meanwhile, USD has been weaker due to downbeat economic reports published recently, whereas the positive data from Switzerland could not provide a greater impact as expected. This indicates that investors are currently looking forward to the rate hike at the December pollicy meeting. Such expectations are certainly bullish to USD. On the other hand, CHF may struggle to retain momentum.

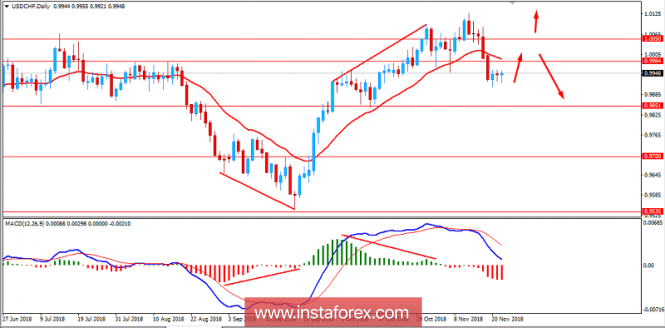

Now let us look at the technical view. The price has been quite corrective with recent price action after breaking below 0.9980 area which is expected to retrace towards 0.9980-1.0050 area before pushing further lower in the coming days. If the price manages to break above 1.0050 area, further bullish momentum is expected in this pair with a target towards 1.0100 or further in the future. As the price remains above 0.9850 area, the bullish bias is expected to continue.

SUPPORT: 0.9700, 0.9850

RESISTANCE: 0.9980, 1.0050

BIAS: BULLISH

MOMENTUM: VOLATILE