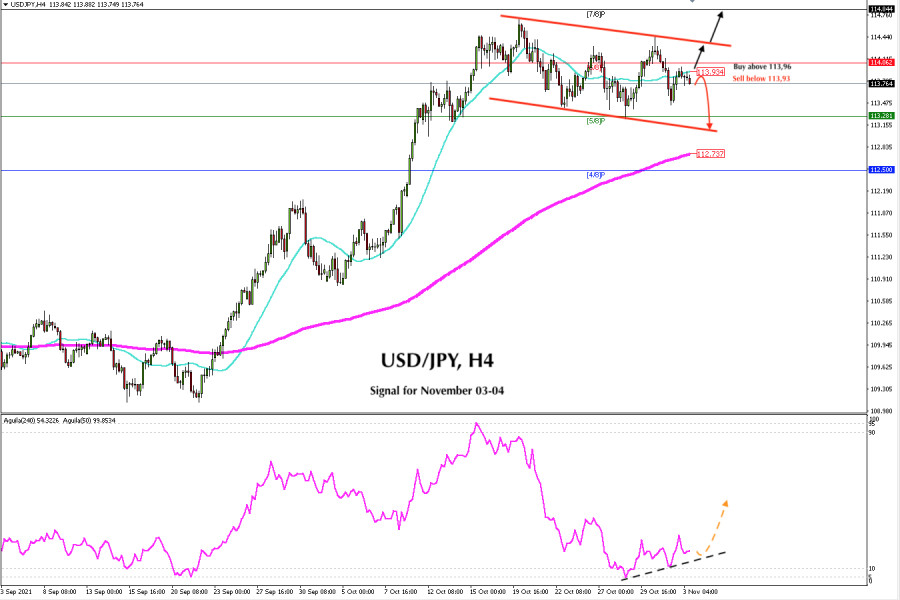

In the early American session, the USD / JPY pair is trading below the SMA of 21. The pair is likely to fall to the support of 113.28. However, the eagle indicator is showing a bullish signal. If the price returns to 113.96, it will be a good opportunity to buy with targets at 114.30. The pair could break the bearish channel with targets at 7/8 of murray around 114.84.

The US dollar index continues to show its strength at the beginning of the US session. It is rising, having bounced off the 21 SMA. In addition, the ADP pollster showed optimistic employment data that surpassed expectations. The US private sector created 571,000 jobs, much better than the consensus for a 400,000 increase.

Undoubtedly, the Fed will be willing to reduce its bond purchase program. This decision that will be announced in the next few hours that could trigger strong volatility in the currency market. The protagonist will be the US dollar, and in turn USD / JPY may trade higher. On the chart, it could rise to the resistance of 7/8 murray at 114.84.

On the other hand, if investors do not show much interest after the Fed announcement, the stock market could have a strong fall and investors will be willing to take safe haven in USD / JPY and we could see the yen advance towards the support level of 113.28 (5/8).

Our trading plan is to buy USD / JPY in the next few hours only if it consolidates above 113.93. The targets could be set at 114.30 and 114.84. On the other hand, if the pair falls below moving average of 21 after the Fed's announcement, we will be able to sell with a target at 113.28. If the pair remains under downward pressure, it could fall to 112.73 that is where the EMA of 200 is located.

Market sentiment shows that there are 68.85% of traders who are buying the USD / JPY pair which is a positive sign. The pair is likely to fall again as long as it remains below 114.84, with targets at 4/8 of a murray around 112.50.

Support and Resistance Levels for November 03 - 04, 2021

Resistance (3) 114.52

Resistance (2) 114.22

Resistance (1) 113.88

----------------------------

Support (1) 113.54

Support (2) 113.46

Support (3) 113.16

***********************************************************

A trading tip for USD/JPY for November 03 - 04, 2021

Buy above 113.96 (SMA 21) with take profit at 114.30 (top of bearish channel) and 114.84 (7/8), stop loss below 113.60.

The material has been provided by InstaForex Company - www.instaforex.com