Currently, the world economy is undergoing a global shift that is comparable to the abandonment of the Bretton Woods monetary system. For months, central banks have been convincing financial markets that they are "doves" and will tolerate high inflation in favour of GDP recovery after the recession. However, in October, investors said that banks would change their minds under the threat of rising consumer prices and would regulate monetary policy.

For decades, the precious metal was a major alternative to fiat money. Investors were attracted by the fact that, unlike dollars, pounds, and other currencies, gold cannot be multiplied by turning on the printing press. It is a naturally limited asset that has its own value. As a result, in 2020, the XAUUSD quotes exceeded 2,000. The reason was probably the weakness of fiat money. About $23 trillion was injected into the global financial system as part of quantitative easing programs. It is not surprising that demand for precious metals has grown rapidly.

In mid-autumn, it was time to quit QE and raise interest rates. However, inflation is not going down. The same is happening in other countries, suggesting a global shift. Monetary policy normalisation is bullish for fiat currencies. It is also a bad sign for gold. The fact that the Fed was one of the first to announce its change of mind back in June led to a strengthening of the US dollar and simultaneously broke the uptrend of the XAUUSD.

Gold and US dollar trends

Many thought that a prolonged period of high inflation could bring prices back above $2000 per ounce, but this was not the case. If by the time the QE programme is curtailed in mid-2022 the Personal Consumption Expenditure Index continues to rise by 4% or more, the Fed will definitely raise rates. Moreover, thanks to the improved epidemiological situation, the US labour market is ready to recover much sooner than is currently expected.

The short-term dynamics of the XAUUSD will depend on the FOMC meeting and the US non-farm payrolls. If Jerome Powell and his colleagues do not boost the US dollar, the labour market will surely do so. In such a scenario, gold should be sold either on the upside after the announcement of the results of the Fed meeting or on a breakout of important supports.

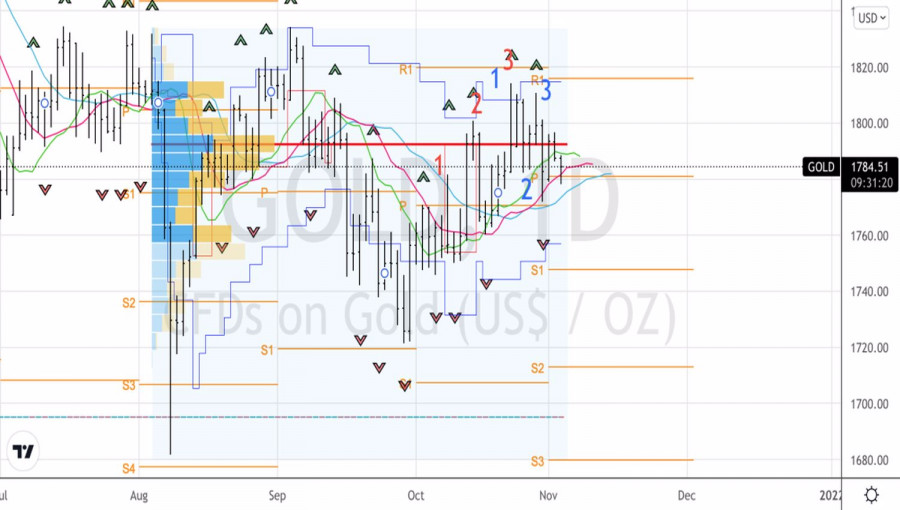

Technically, the combination of the Three Indians and 1-2-3 patterns is a bad sign for the precious metal. A successful bearish assault on support at $1775 per ounce is a reason to sell it. A rebound from the fair value of $1795 could be a reason to go short. The pivot levels at $1750 and $1735 per ounce are targets.

Gold, daily chart