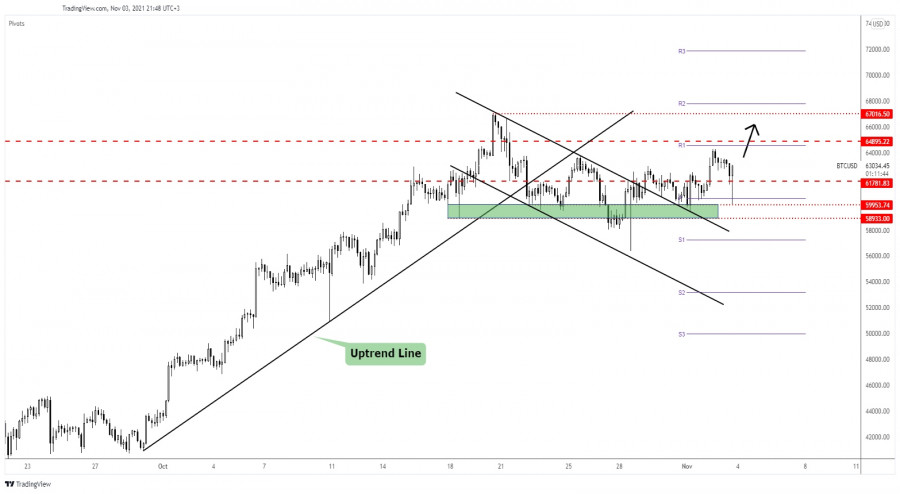

Bitcoin declined in the short term after reaching the 64,300 psychological level. The crypto dropped to as low as 60,018.46 level where it has found demand again. The upside scenario remains intact despite the most recent retreat.

In the short term, BTC/USD dropped by 6.66% from 64,300 yesterday's high to 60,018 today's low. At the moment of writing, it was at 63,308.44 level and it seemed determined to climb higher. Technically, the rate fell only to test and retest the immediate support levels before jumping higher.

Bitcoin false breakout with great separation

BTC/USD plunged but it could register only a false breakout with great separation below the weekly pivot of 60,487 which could signal strong bullish pressure. Its failure to reach the weekly R1 (64,584.23) signaled that the bulls are exhausted.

Technically, as long as it stays above 59,953.74 - 58,933 support zone and above the 60,000 psychological level, BTC/USD could resume its upside journey.

Bitcoin prediction

After escaping from the Flag pattern, the price of Bitcoin was expected to grow. The minor retreat could be only a temporary one. BTC/USD retested the buyers before climbing higher. A false breakout with great separation below the pivot point (60,487.91) followed by a bullish candle could announce more gains ahead.

An upside continuation could be invalidated only by a new lower low if the rate drops and closes below 60,018.46.

The material has been provided by InstaForex Company - www.instaforex.com