The risk aversion slowed after the World Health Organization refused to declare a global emergency due to the new coronavirus. The markets considered this a good sign, and on Friday morning, the first signs of decline in tension were noted - oil is correcting after a three-day decline, the Japanese Nikkei225 and the Australian S & P / ASX 200 are trying to gain a foothold in the green zone, and the decline in government bond yields has slowed.

In general, the situation is characterized by a high level of uncertainty; there is no data to predict a drop in tension or, on the contrary, a new wave of sales. Under these conditions, the dollar receives additional support.

USD/CAD

The Canadian dollar has received several sensitive shocks that are forcing a review of its long-term prospects.

The Bank of Canada changed the text of the accompanying statement following the meeting on Wednesday, and now, monetary policy is not considered consistent with earlier forecasts. The probability of a rate cut at the next meeting in March increased, the spread between the US and Canada rates decreased, while the USD/CAD rate will move towards growth to equalize yields.

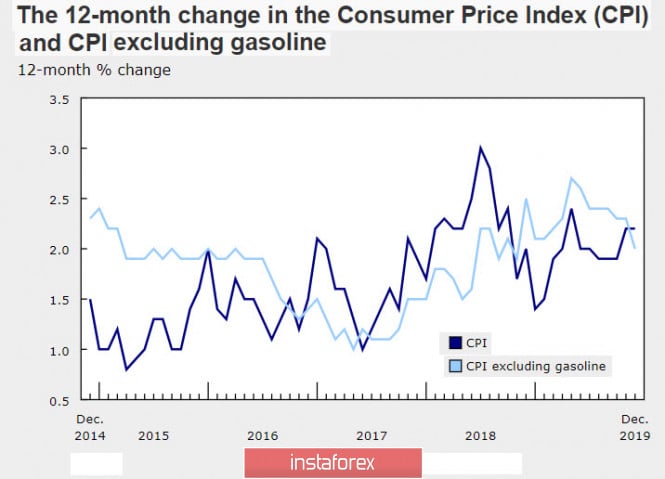

At the same time, core inflation growth slowed in December from 1.9% to 1.7% y / y, which was an unpleasant surprise for the markets.

The volume of wholesale sales declined again, while zero growth was projected. On the other hand, the volume of sales in the manufacturing industry was worse than forecasted.

All these factors are unpleasant, but have limited pressure on the Canadian currency, as a number of Fed measures led to an increase in the dollar supply and evens out the negative from the results of the BoC meeting. The situation is aggravated by the increase in panic, therefore, an additional factor is the decline in oil and the growth in demand for protective assets, hence the probability of a USD/CAD reversal now looks ghostly.

The Canadian will try to return to resistance 1.3170 / 90, but the chances of further growth to 1.3220 / 30 are still unclear. In terms of a combination of factors, the situation should be considered neutral. The key support is 1.3030 / 35, the movement to it will resume only in the event of a decrease in panic.

USD/JPY

The Bank of Japan left the monetary policy unchanged on Tuesday, but adjusted its GDP forecasts. BoJ believes that the economy will continue to grow in the coming years, and even with acceleration, this forecast is based primarily on positive expectations from government stimulus measures.

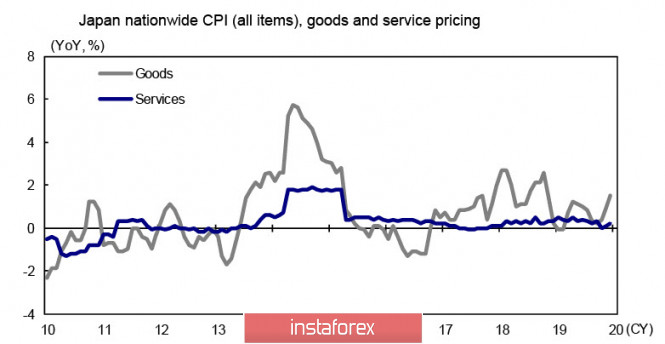

At the same time, the forecast for inflation is reduced by 0.1% in each subsequent year. The Bank of Japan has almost no options for further incentives, and the chances of reaching an inflation target of 2% are considered illusive. In December, core inflation rose by only 0.7% YoY, the increase was mainly due to higher prices for goods, which is largely a result of the weakening yen and, as a result, higher prices for imports, price increases in the services sector are barely kept above zero.

Nevertheless, the financial authorities of Japan do not want to admit that all measures taken since 2013 have not yet produced a sustainable result. Prime Minister Shinzo Abe made a speech in the Sejm on the afternoon of January 20, and he ignored the topic of deflation for the first time since 2013. The struggle against which has been going on with varying success for several decades.

As a result, inflationary pressures in Japan are noticeably weaker than in the United States or Europe, and therefore, it is becoming more and more difficult for the monetary authorities to deal with the strong yen. Thus far, the situation has been restrained by the strange faith of the markets in the upcoming recovery, which is reflected in a decrease in the demand for protective assets, so USD/JPY made an attempt to go up after a protracted trading in the range, breaking the resistance at 109.70. Meanwhile, pullback to 109.23 occurred against the backdrop of an increase in panic relative to the Coronavirus, but does not reflect long-term trends, that is, as soon as the panic wave subsides, the growth will resume. On the other hand, new year's celebrations began in China, and so, exchanges stop trading but the negativity will not receive domestic support, which gives grounds for a return to range trading within 109.25 - 110.25 with possibilities of movement to the upper border of the range and the subsequent attempt to break up.

The material has been provided by InstaForex Company - www.instaforex.com