The European currency continued its decline against the US dollar against the background of the Fed raising interest rates, as well as news that the Italian government raised the target level of the budget deficit, which was so feared by many experts.

Weak data on inflation in the euro area, which only at first glance reached the target level, also led to the formation of pressure on the euro.

The Government of Italy

As I noted above, today, it became known about the increase in the level of the Italian budget deficit for the next year. The new populist government of Italy went to such measures in order to fulfill all its election promises that were voiced during the campaign. This way of solving problems goes completely against the rules and policies of the authorities of the European Union, which will lead to even more confrontation and intensification of the political crisis in Italy.

According to the data, the budget deficit has been increased to 2.4% of GDP, which is three times the target level planned by the previous government.

The fundamental indicators of the eurozone

The eurozone inflation rate accelerated in September, exceeding the target value set by the ECB. However, one should remember about the indicator of core inflation, which has decreased, which will force the management of the European Central Bank to be wary of the completion of the incentive program.

According to the data, the preliminary CPI of the eurozone in September of this year, compared with the same period last year, increased by 2.1%. In August, the figure rose to 2.0%.

Not surprisingly, the growth is directly related to the increase in energy prices, which for the year rose by 9.5% after rising by 9.2% in August.

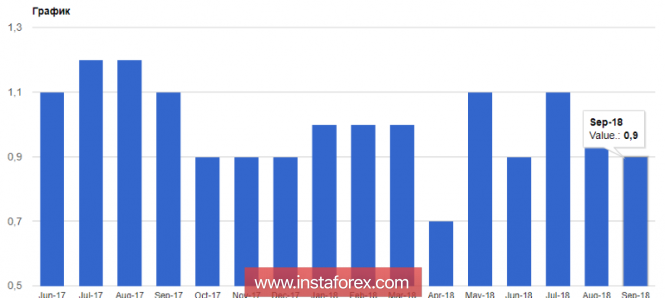

Core inflation, which does not take into account volatile categories, in September, on the contrary, slowed down to 0.9% from 1% in August and 1.1% in September of a gentle year.

As for the situation in the German labor market, everything is in order. According to today's report by the German Federal Employment Service, the number of applications for unemployment benefits fell by 23,000 in September this year compared with the previous month, while economists had expected a decline of 8,000. The unemployment rate in Germany fell to 5.1% in September.

The United Kingdom

The British pound ignored data on the growth of the UK economy and continued to decline gradually against the US dollar.

According to the report, in the first half of 2018 the growth of the UK economy was the weakest over the past 7 years. National Bureau of Statistics ONS revised its outlook for economic growth in the six months of this year to 0.5% from 0.6%. On an annualized basis, GDP grew by 1% in the first half of the year.

Today, a poll was published in which more than half of the respondents were in favor of maintaining British membership in the EU. Let me remind you that the Labor Party of Great Britain quite recently took the initiative to hold a second vote on the Brexit theme, as there are deep contradictions between London and Brussels on a number of problems.

The material has been provided by InstaForex Company - www.instaforex.com