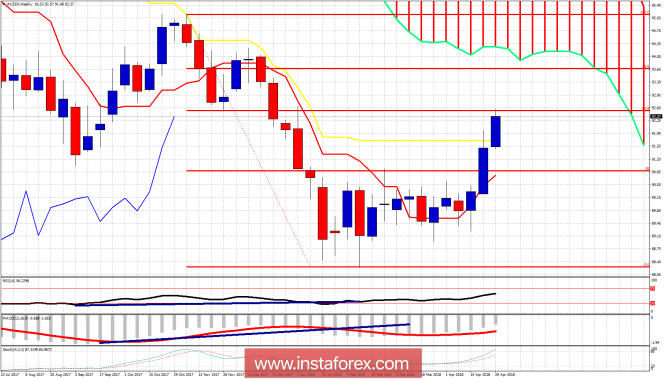

The Dollar index remains inside the bullish channel in an up trend. Price continues to make higher highs and higher lows above the cloud support levels and as long as we remain above 92 trend is short-term bullish. However looking at the weekly chart, we stopped the rise yesterday at the 61.8% Fibonacci retracement of the decline from 95.15 to 88.25 2018 lows.

Weekly trend remains bearish as price is below the Kumo (cloud). Price has broken above the weekly kijun-sen. This opens up the way for a bigger bounce towards at least the lower cloud boundary at 93.90. However the Fibonacci resistance we hit yesterday is very important. I would not rule out a rejection and full scale reversal from current levels taking into consideration the short-term bearish divergence signals we have.

The material has been provided by InstaForex Company - www.instaforex.com