USD/CAD has been stuck inside the corrective range between 1.28 to 1.2950 area from where no definite trend pressure is being observed. USD and CAD, both currencies have been struggling with the economic reports recently which lead certain indecision and volatility in the market persists currently. Recently CAD GDP report was published with an increase to 0.4% from the previous negative value of -0.1% which was expected to be at 0.3%. The positive GDP report did help CAD to regain its momentum against USD but was not sufficient to establish a definite trend in the market.

Ahead of the high impact economic reports to be published on the USD side this Friday, certain correction and volatility are quite expected but the mixed forecast of the economic reports are expected to confuse market sentiment along the way. Today there is no economic report or event on the CAD side to impact the market momentum but tomorrow CAD Trade Balance report is going to be published which is expected to increase to -2.3B from the previous negative figure of -2.7B.

On the other hand, today USD ADP Non-Farm Employment Change report is going to be published which is expected to decrease to 200k from the previous figure of 241k and Crude Oil Inventories report is also expected to decrease to 1.0M from the previous figure of 2.2M.

To sum up, USD economic reports to be published today are expected to have a certain impact on the upcoming price action and trend momentum in this pair whereas the definite trend is expected to be set after NFP, Average Hourly Earnings and Unemployment Rate report of USD is published before the weekly close this week. As of the current scenario, a break from this indecision and corrective structure is needed before the market sets a definite trend in the future whereas USD is expected to have an upper hand.

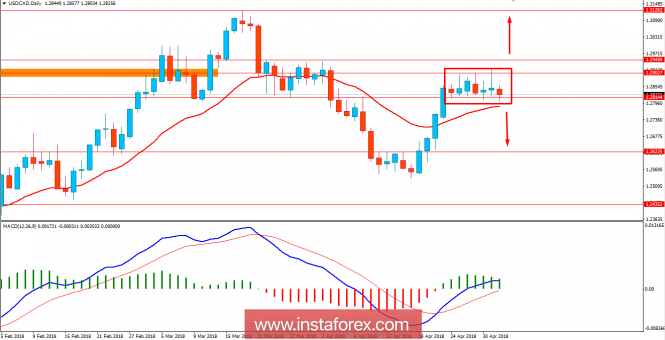

Now let us look at the technical view. The price is currently residing at the edge of the corrective structure support of 1.28 from where no definite trend pressure is being observed. There is no divergence being formed in the market for which we need to wait for the price to break above or below this range between 1.28 to 1.2950 area. As the price remains above 1.28 with a daily close, further bullish momentum is expected in this pair.