USD/JPY has been quite impulsive with bullish gains recently which led the price to proceed higher above 109.20 without a retracement along the way. Ahead of the upcoming high impact economic reports from the US this week, including NFP and Unemployment Rate reports, certain gains on the USD side indicate further momentum in the coming days. Today, US ADP Non-Farm Employment Change report is going to be published which is expected to decrease to 200k from the previous figure of 241k and Crude Oil Inventories report is also expected to decrease to 1.0M from the previous figure of 2.2M.

On the other hand, JPY Monetary Base report was published today with a decrease to 7.8% from the previous value of 9.1% which is expected to increase to 9.2% and Consumer Confidence report was also published with a decrease to 43.6 from the previous figure of 44.3 which was expected to increase to 44.6.

As for the current scenario, JPY has failed to provide positive economic reports results today to gain some momentum over the USD impulsive pressure. US economic reports are also expected to have negative readings. If the US presents better economic report today, USD is likely to extend its gains in the coming days, whereas JPY may still struggle to stop the impulsive bullish pressure along the way.

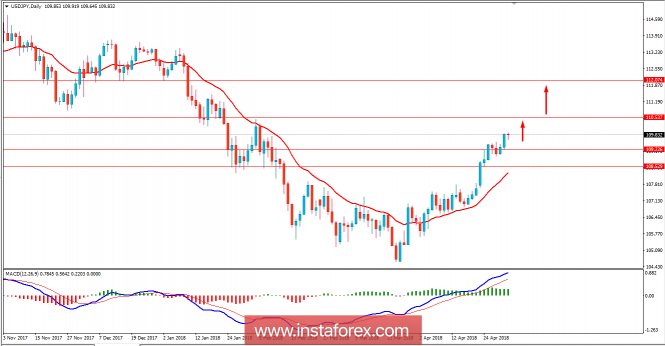

Now let us look at the technical view. The price has been quite impulsive with the gains yesterday having a retest off the 109.20 support level. The price has been trying to push hard lower today but currently the bears are being rejected along the way whereas bulls are trying to maintain their momentum. As for the current structure, the price is expected to push towards 110.00 in the coming days whereas breaking above 110.00 with a daily close will lead to further impulsive bullish pressure with a target towards 112.00 resistance area in the future. As the price remains above 108.50 area, the bullish bias is expected to continue further.