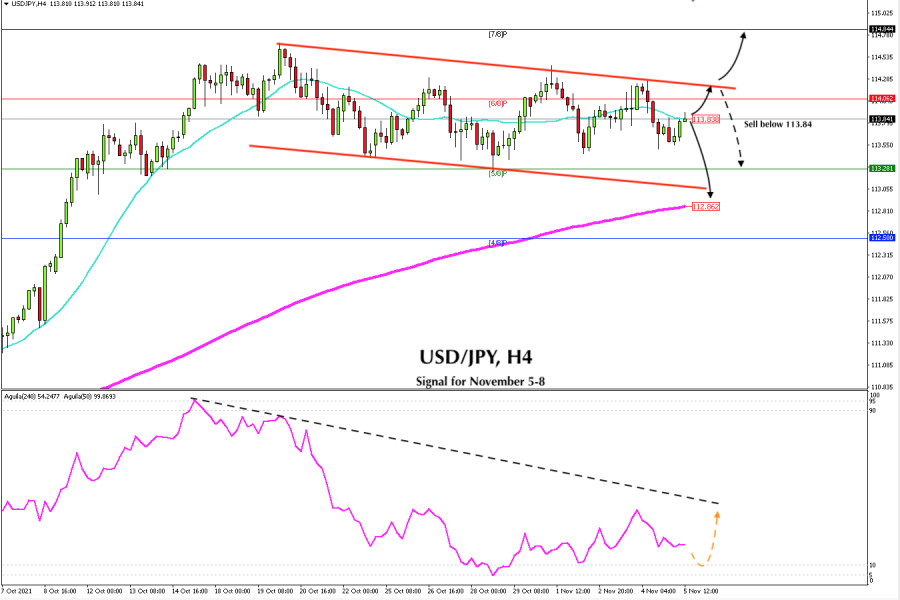

Since October 18, USD/JPY has been oscillating within a downtrend channel. In the early hours of the American session before the publication of payroll (NFP), the pair is trading around 113.84 just at the same level of the SMA of 21. If the employment data in the United States is upbeat for the US dollar, USD/JPY is expected to decline to the support at 113.28 and to the 200 EMA around 112.86.

The USD/JPY pair is consolidating within a range from 113.30 to 114.25. The swing movement is expected to continue for the next several days until it finds support at the 200 EMA, and then resumes its uptrend.

According to the daily chart and the 4-hour chart, the Japanese yen has a strong upward trend. So, there is a good point to buy USD/JPY if it manages to make a correction in the area of 112.86. There is the EMA of 200 or 4 Murray / 8 around 112.50. This zone will be the key point for a new bullish wave targeting 114.06 and the price could rise to the psychological level of 115.00.

The eagle indicator is approaching oversold levels. The pair is moving below a downtrend channel. We believe that if it hits the 10 to 5-point level, it could give the yen further bullish momentum. Meanwhile, it is now consolidating and showing a neutral signal. USD / JPY is likely to continue trading within the range levels between 114.25 and 13.28.

Market sentiment report for today shows that there are 66.53% of operators who are buying the yen. This is a positive sign and it is likely that in the next few days we will see a drop to the level of 112.35 (EMA 200). On the contrary, if this figure decreases, we could see a rise in USD / JPY and the pair could reach the level of 114.84 (7/8).

Our trading idea is to sell below the SMA of 21 located at 113.84, with targets at 113.45 and up to 113.28 (5/8). If a pullback occurs towards the top of the downtrend channel, it will also be an opportunity to sell.

Support and Resistance Levels for November 05 - 08, 2021

Resistance (3) 114.52

Resistance (2) 114.06

Resistance (1) 113.88

----------------------------

Support (1) 113.46

Support (2) 113.28

Support (3) 113.07

***********************************************************

A trading tip for USD/JPY for November 05 - 08, 2021

Sell below 113.84 (SMA 21) with take profit at 113.46 and 113.28 (5/8), stop loss above 114.25.

The material has been provided by InstaForex Company - www.instaforex.com