The US dollar continues its triumphant march throughout the market. The October Nonfarm Payrolls report, which was published at the start of the American session on Friday, only fueled interest in the greenback. After a long exhausting siege, the EUR/USD bears finally broke through the resistance level of 1.1530 (the price minimum of the year, which coincided with the lower line of the Bollinger Bands indicator on the daily chart) and headed to the base of the 15th figure.

The last time the pair was at such lows was more than a year ago - in July 2020. Sellers of EUR/USD tried to change the price echelon in order to settle within the 14th price level, but the first blitzkrieg attempt failed. Now the bears need to keep the price below the level of 1.1530, which has been acting as a price citadel for almost two months. Otherwise, the pair will drift again in the range of 1.1530-1.1600.

It is noteworthy that the US dollar sharply strengthened its positions literally the day after the announcement of the results of the November Fed meeting, which turned out to be not as hawkish as expected. The Fed announced the tapering of QE (which was very predictable) and denied rumors that the regulator intends to start tightening monetary policy in the middle of next year. Federal Reserve Chairman Jerome Powell clearly hinted that the start of a QE tapering is not a signal that the Central Bank will raise the rate soon. Also, the head of the Fed once again repeated the message that the increase in inflation is temporary, and, therefore, the regulator does not need to stop this growth by tightening the parameters of monetary policy.

Against the background of such rhetoric, the EUR/USD pair demonstrated a corrective growth, which safely "stalled" as soon as the price crossed the 1.1600 mark. The very next day after the announcement of the results of the November meeting, the dollar began to actively gain momentum throughout the market.

What caused the dollar rally? There is no consensus among experts on this matter, but most of them are inclined to think that the market "did not believe" the Fed. First of all, I didn't believe that the regulator would be able to demonstrate patience next year, calmly observing the growth of inflation. Therefore, the markets are still pricing in at least one rate hike in 2022, while many currency strategists are confident that the Central Bank will return to this issue twice - next summer and in November-December.

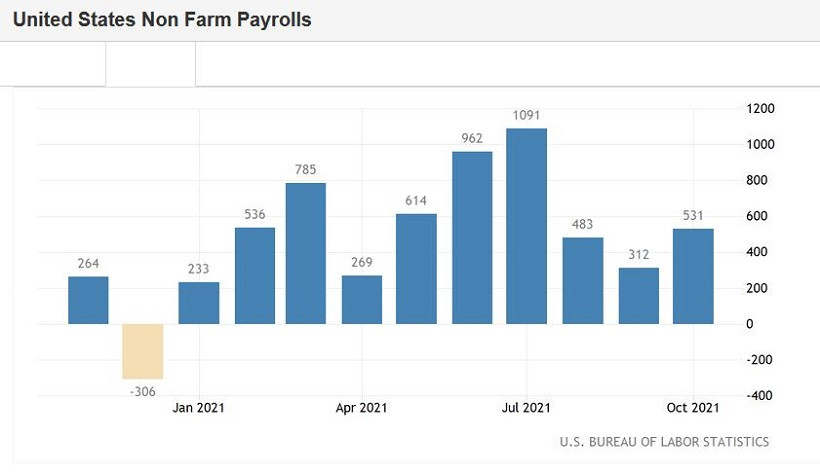

Agreeing with this thesis, I can only add that to some extent, dollar bulls were restrained by concerns about possible stagflation - the growth of inflationary indicators against the background of a slowdown in other macroeconomic indicators, primarily in the labor market. That is why weak data on US GDP growth undermined the position of the greenback and that is why the October Nonfarm Payrolls provided it with such support. The release laid the basis for further strengthening of the dollar, as it reduced the risks of a stagflationary scenario.

By and large, participants received a very categorical message on Friday which allowed us to draw a certain conclusion of an equally categorical nature. And this conclusion boils down to the fact that the time interval between the completion of the QE tapering (July 2022) and the first round of rate hikes will be quite short (if at all). And this interval will be reduced as the American labor market recovers and inflation continues to rise.

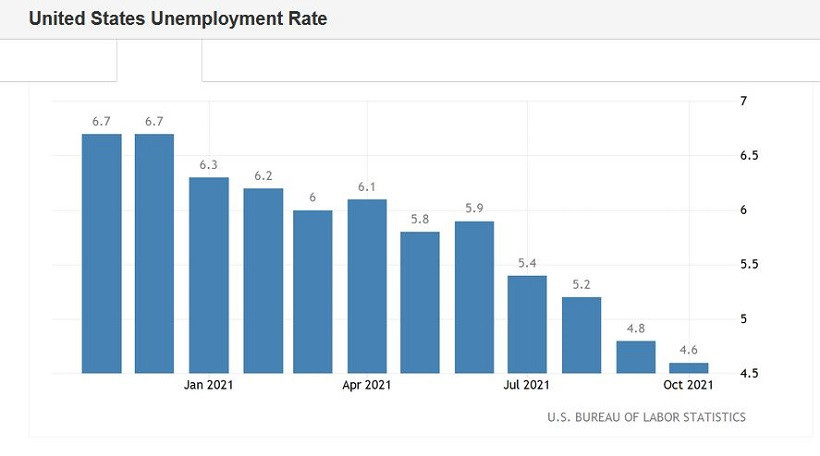

So, all the components of Friday's Nonfarm Payrolls report came out in the "green zone." The number of people employed in the non-agricultural sector increased by 531,000 – this is the strongest growth rate since July of this year. The unemployment rate dropped to 4.6% (the best result since April 2020). The growth rates of salaries did not disappoint either. Friday's figures (0.4% MoM and 4.9% YoY) complemented the good dynamics of the increase in the number of people employed in the non-agricultural sector. In the private sector of the economy, the indicator also showed strong dynamics – an increase of 604,000 with a growth forecast of 400,000. The number of people employed in the manufacturing sector of the economy immediately increased by 60,000 (the forecast was at the level of 22,000).

Note that following the results of the November meeting, the members of the Federal Reserve said that by the middle of next year, the requirement of full employment "can be fulfilled." The trends announced suggest that this scenario will be implemented ahead of schedule.

It is difficult for the European currency to oppose anything to the greenback. Following the results of the last meeting, the European Central Bank only intensified its "dovish" rhetoric, putting pressure on the euro. The timid assumptions of some analysts that the ECB may shift the expected timing of a rate hike at least to 2023 did not materialize. ECB President Christine Lagarde continues to "hold the line" - both regarding QE and the interest rate issue.

All this suggests that the EUR/USD pair will continue to be under background pressure. Corrective pullbacks are not excluded (including large-scale ones), but the euro will not be able to reverse the trend for the pair in the foreseeable future. Therefore, it is advisable to use any corrective bursts to open short positions.

For example, Friday's downside impulse has faded away when approaching the psychologically important key mark of 1.1500. Ahead of the weekend, traders began to fix profits en masse, thereby "deploying" the pair. At the same time, downside prospects remain a priority: when approaching the 1.1600 mark (the middle line of the Bollinger Bands indicator on the daily chart), you can consider selling the pair with a target of 1.1530 (the lower line of the Bollinger Bands on the same timeframe).

The material has been provided by InstaForex Company - www.instaforex.com