Price wars are common in the oil market. Over the past five years, such price wars have erupted between the United States and OPEC, Saudi Arabia and Russia, as well as between the members of the cartel. This time, there is a conflict between oil consumers and producers. Oil consumers argue that producers fail to ramp up production in a proper way, so they are ready to take active steps and start releasing strategic oil reserves. Meanwhile, exporting countries do not hurry to act as they are very well aware of how the growth of production may threaten their budgets. In any war, each side has its own truth.

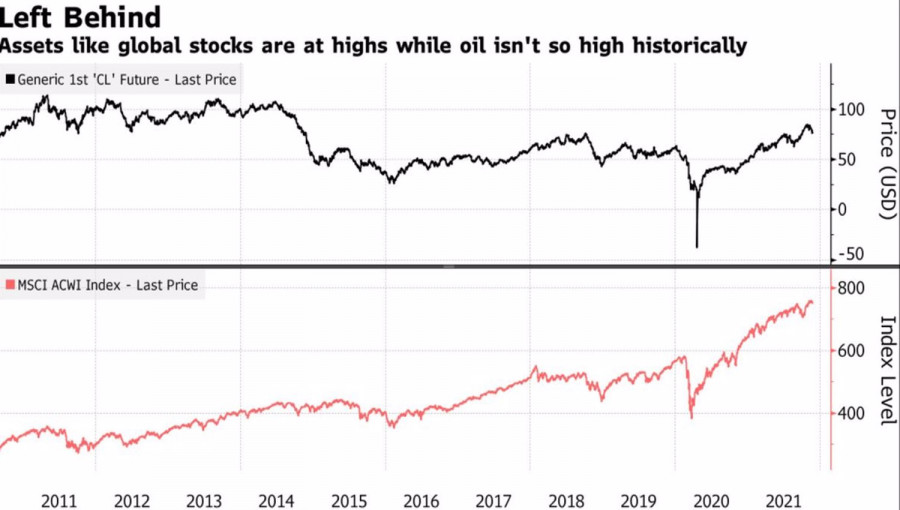

If you help someone once, they won't notice it; if you do it several times, they will take it for granted. According to JP Morgan, oil is highly undervalued compared to such assets as stocks, bonds, and other commodities. The American benchmark WTI should be trading around $115 a barrel while its actual price is $75-76. In fact, in this situation, oil producers (most often developing countries) subsidize importing countries (most often developed countries). It seems that the United States, who is unhappy with the allegedly slow output increase by OPEC+, does not appreciate this.

Dynamics of the global stock and oil market

Brent and WTI have been correcting from October highs on expectations that the United States, China, India, South Korea, and Japan will take coordinated steps and release oil stocks from strategic reserves. Besides, a new COVID-19 wave in Europe supports the correction in oil prices. The resumption of lockdowns in the EU slows down global demand and contributes to falling prices. Germany, the Netherlands, and other eurozone countries may follow the example of Austria, which reverted to large-scale restrictions. As for the US, according to Bloomberg, the White House intends to free up about 35 million barrels from strategic reserves, which is a very impressive amount and could put pressure on the commodity, at least in the short term.

In addition, Washington considers the possibility of returning the ban on US crude exports that was lifted a few years ago. At the moment, crude oil exports ate estimated at 3 million bpd. An increase in domestic supply may put pressure on prices.

At the same time, OPEC+ has also something to say. Saudi Arabia alone can easily resolve the issue of withdrawing 35 million bpd from the market. The cartel's announcement that it would adequately respond to the coordinated action to free up strategic reserves brought new buyers to the market. According to the UAE, there is no need for OPEC+ to deviate from the plan to increase production by 400 thousand bpd, no matter how much the US asks for a more aggressive increase in production. Such factors as unleashing of strategic reserves and COVID-19 resurgence in Europe were not part of the plan, so it can be adjusted at any moment.

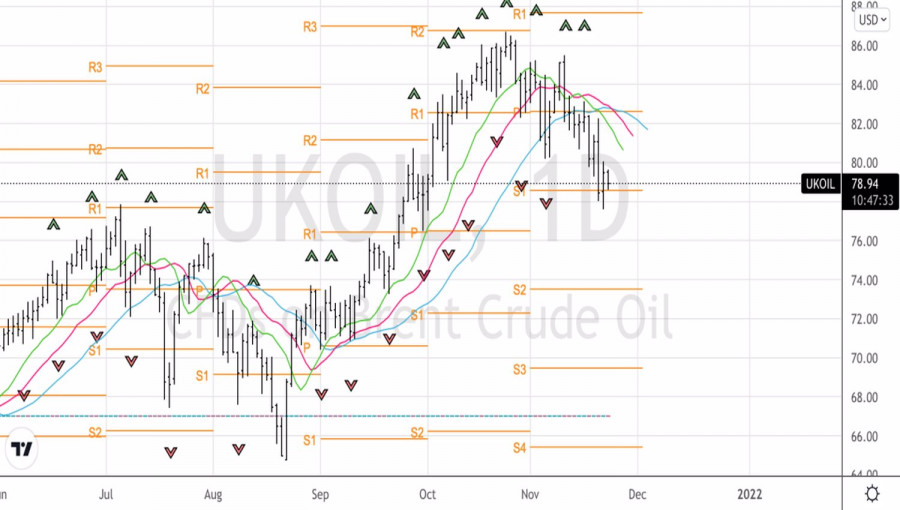

Technically, the correction of Brent continues, which allowed us to profit from selling the North Sea grade from the level of $81.1. Now we should look for entry points to go long, following the new principle "sell the rumors about the release of strategic reserves, buy the facts." A rise above $80 may serve as a buy signal.

Brent daily chart