The approval of the Bitcoin ETF, as expected, has ushered in a record flow of institutional money into investment products based on the main cryptocurrency. The total value of bitcoin assets has reached $53 billion.

Billion-dollar investment inflow into the crypto market - the result of Uptober

Over the last week of October, institutional inflows into Bitcoin totaled $269 million. In general, during this period, the volume of investments in crypto products reached $288 million. And if we take into account the entire time of the bullish period, including before the appearance of funds, then the investments of institutions are measured in billions of dollars.

Of all cryptocurrencies, investors choose bitcoin

A recent report from CoinShares on Digital Asset Fund Flows highlights that Bitcoin remains the preferred choice for large institutional investments. In the first 10 months of 2021, BTC investment products received $6.3 billion. It should be noted that this is already 30% higher than in 2020.

In terms of market capitalization, Bitcoin retains its dominant position and remains the preferred crypto asset for large market participants. And the total value of global crypto assets under management exceeded $78.7 billion last week. Bitcoin accounts for almost 70% of this volume.

CoinShares Altcoin Demand Statistics

Data from CoinShares shows that investors are choosing a single-line exposure strategy and are very interested in Bitcoin. In addition to BTC, other digital assets have been popular among institutional investors over the past week: Solana, Cardano, and Polkadot.

The CoinShares report noted that the inflows of Solana, Cardano, and Polkadot amounted to $15 million, $5 million, and $6.2 million, respectively. And for investment products with several assets, the outflow of funds amounted to a record $23 million. Now we are talking about the third week of the outflow from altcoins.

How to Interpret Institutional Inflow Data

As expected, it can be seen that bitcoin is in demand among large investors. On the one hand, the reason is inflation, which makes the assets of the traditional sector unprofitable.

On the other hand, it is an indicator of prospects - institutions expect the main cryptocurrency to continue to rise.

And if you look at it from a different angle, the demand from large organizations suggests that the market is maturing. This means that volatility is likely to decrease slightly. Institutional will not panic to sell coins with minimal price fluctuations, and in the event of rollbacks, they will most likely buy more at cheaper prices.

Deep correction: canceled or not?

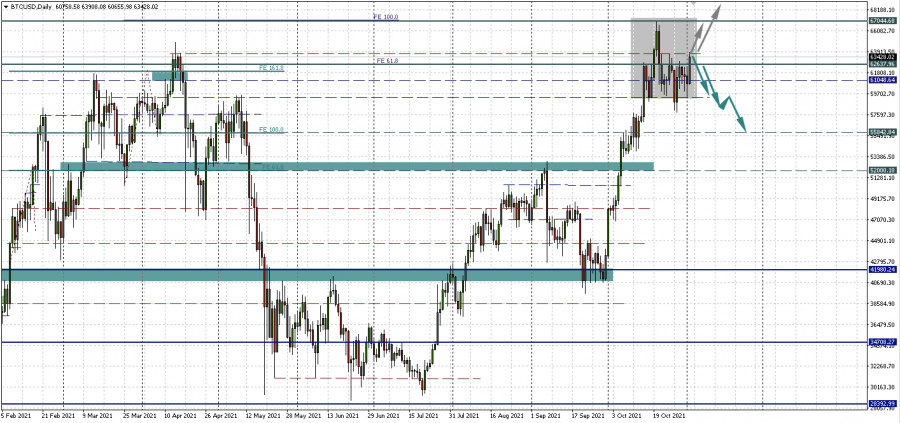

Today, the consolidation of bitcoin in the range of 59,000 and 62,500 continues. BTCUSD is trading under the resistance at 62,637.96. Does this mean that the head and shoulders pattern has lost its relevance?

It is hard to say. If the price breaks the level of 62,637.96 from the bottom up and even consolidates above it, it will be possible to say that the reversal is canceled and wait for growth to $67,000 and above.

But if now the price turns sideways again, then, most likely, it will go to the support at 59,383.67, near which we will probably again talk about a possible deepening of the correction.