4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -197.5158

For the EUR/USD pair, the last trading day of the week begins with a continuing downward movement, which may very soon end. We believe that the euro currency is now simply correcting against the correction against the strongest fall between March 9 and 20. Thus, the entire current downward movement can end near the level of 1.0830, which is equal to 61.8% of the previous upward movement. Following the example of the pound, the euro can also go flat, since there are no new reasons for active trading among market participants at the moment. The volatility of the EUR/USD pair has decreased to about 120-130 points per day,which is still quite high. However, this is less than it was a couple of weeks ago. Thus, we still believe that when trading, we should first take into account technical factors that are still in favor of continuing the downward movement. Around the level of 1.0830, we recommend considering the option of turning the price up. However, if the Heiken Ashi indicator does not turn up or there is no eloquent rebound from any Murray level, then we do not recommend shorting short positions ahead of time. Yesterday showed that market participants do not pay any attention to macroeconomic statistics. It is clear that this will not always be the case. The time will come when trading on the currency market will be fully adjusted and will return to its usual course. But now we do not expect this until the markets have completely calmed down, volatility will fall to normal values of about 60 points per day, and the pair may spend some time in a narrow side channel. Only after that, when the situation on the currency market stabilizes, we can expect that macroeconomic reports will again play at least some significance for traders. However, this scenario also implies that there will be no new shocks to the US stock market in the near future, that the "coronavirus" epidemic will be overcome, if not overcome, then at least stop the growth rate of its spread, and oil prices will begin to rise. The situation with the pandemic is now a key negative factor for the global economy. The more cases there are around the world, the longer the quarantine lasts, the more the economy of each state will suffer, and the longer each economy will recover...

Meanwhile, today, Ursula von der Leyen, the President of the European Commission, announced a proposal to attract 100 billion euros in the second package of stimulus measures for the EU economy. It is expected that 100 billion euros will be used to help businesses and save jobs. This money will be issued as loans to EU member states, which, in turn, will send it to pay employees for the hours they could not work due to the "coronavirus" pandemic. There will also be support for both freelancers and private entrepreneurs. "During the "coronavirus" crisis, only strong measures can help. We must use all available means. Every euro available in the EU budget will be used to solve the crisis, and every rule will be simplified to ensure quick and efficient financing. We are mobilizing 100 billion euros to save people their jobs. We join forces with the alliance's member states to save lives and protect livelihoods. This is European solidarity," von der Leyen said on Thursday, April 2. In addition to helping businesses and employees, the European Commission is going to raise an additional 3 billion euros from the current EU budget and use this money to purchase personal protective equipment and finance mobile field hospitals.

At the same time, members of the European Parliament agreed to hold an extraordinary plenary session to discuss actions aimed at combating the spread of the "coronavirus". The meeting will be attended by representatives of the European Council and the European Commission, and a vote will be held on all proposed measures to counter the epidemic.

US Treasury Secretary Steven Mnuchin commented on the latest reports on applications for unemployment benefits in the US, one of which was published yesterday. According to Mnuchin, these reports are not indicative, since they reflect the state of things in the US economy, which was before the 2-trillion stimulus package was agreed. Mnuchin said that the package of assistance to the American economy will "work" only for three weeks and then, companies that were previously forced to reduce their staff due to the epidemic will re-hire employees.

A large number of macroeconomic publications are planned for the last trading day of the week. In the European Union, as well as separately in Germany, Spain, Italy, France and Britain, data on business activity, services and composite indices will be published. Forecasts for this area look terrifying. If the manufacturing sector of all EU countries remained afloat with the arrival of the epidemic, the service sector has almost completely stopped due to quarantine measures. Business activity in the EU services sector is expected to be at 28.4, while Germany's is expected to be at 34.3. Over the past 12 years, neither in the European Union nor in Germany, business activity indicators for the service sector have decreased so low. The European Union will also publish data on retail sales in February. The forecast is +1.7% in annual terms and +0.1% in monthly terms. However, we consider these data to be absolutely insignificant for the market. Most likely, both this report and reports on business activity, despite their "anti-record", will be completely ignored by traders. Also today, many interesting reports will be published in the US, which will be analyzed in detail in the article on GBP/USD.

From a technical point of view, while the downward movement continues. And there are no signals for its completion. The fact that the panic has subsided slightly in recent days should not mislead market participants. It is quite possible that there will be not only a "second wave" of the epidemic, but also a "second wave" of panic in the markets. In the European Union, a total of more than 400 thousand citizens are infected. Quarantine measures are being extended and tightened. The total number of cases worldwide is approaching one million. And this is only official data. In one way or another, the government of every country in the world admits that the real number of cases is much higher, and the peak of the epidemic has not yet passed.

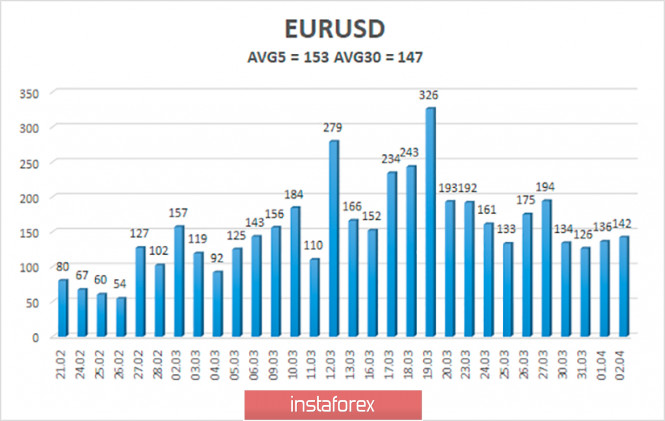

The volatility of the euro/dollar currency pair remains at fairly high values. As of April 3, the value of the indicator is 153 points and in the last ten days, the volatility does not exceed 200 points per day. We believe that the markets continue to return to normal and this is a very good sign for traders. Today, we expect a further decrease in volatility and price movement between the levels of 1.0673 and 1.0979. Turning the Heiken Ashi indicator upward will signal a round of upward correction.

Nearest support levels:

S1 - 1.0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0986

R3 - 1.1108

Trading recommendations:

The EUR/USD pair continues its downward movement. Thus, traders are now recommended to stay in the sales of the euro with the targets of 1.0742 and 1.0673, until the Heiken Ashi turns up. It is recommended to buy the euro only after the reverse consolidation of traders above the moving average line with the first target of the Murray level of "3/8"-1.1108. Increased caution is still recommended when opening any positions, as volatility is still high.

The material has been provided by InstaForex Company - www.instaforex.com