To open long positions on GBPUSD, you need:

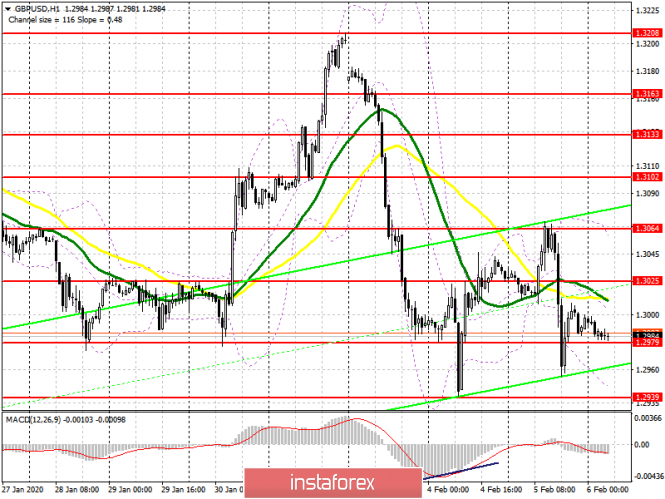

The British pound did not long enjoy a good report on the services sector, and after several unsuccessful attempts to break above the resistance of 1.3064, it returned to a powerful phase of decline. However, it is worth noting that it has not yet been possible to reach the minimum on February 4, which keeps the chance of continuing the upward correction due to the update of the last day's maximum. The first task of buyers will be to form a false breakdown in the support area of 1.2979 today, and a rebound from the lower border of the wide ascending channel (on the green chart), which will allow them to count on a return and update the resistance of 1.3025, just below which the moving averages also pass. If buyers miss 1.2979, then you can open long positions in GBP/USD only for a rebound from the minimum of 1.2939, and then, counting on a small correction of 15-20 points. More powerful support levels are seen in the areas of 1.2896 and 1.2845.

To open short positions on GBPUSD, you need:

Sellers only have to re-establish themselves below the support of 1.2979, as well as break below the lower border of the ascending channel, which will completely return the market to their control. In this case, the first goal will be a minimum of 1.2939, the breakdown of which will collapse the pound even lower, to the support area of 1.2896 and 1.2845, where I recommend fixing the profits. Given that no good fundamental statistics are expected for the UK today, the market is likely to remain on the side of the bears. In the scenario of an upward correction in the first half of the day, short positions can be viewed from the resistance of 1.3025, but you can sell immediately for a rebound from the maximum of 1.3064.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 moving averages, which indicates another predominance of the pound sellers in the market.

Bollinger Bands

If the pair declines, the lower border of the indicator around 1.2950 will provide support. Short positions can be viewed as a rebound from the resistance of 1.3050.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20