The euro returned to the lows of 1.1020. In fact, this area is where the pair was aiming at earlier this week. Meanwhile, the report showing a slight rise in the composite PMI indicates that the Eurozone economy will increase by only 0.2% in the 1st quarter of 2020, as compared to the 4th quarter of last year. At the same time, while the manufacturing sector showed the first signs of recovery, there was no encouraging growth in the index of the services sector for January.

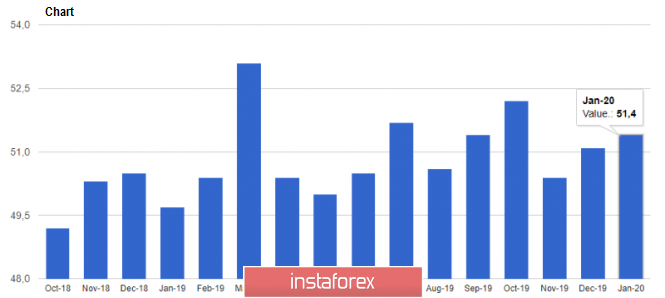

The index of France declined, while the index of Italy and Germany showed a slight increase. According to Markit data, the purchasing managers' index (PMI) for the Italian services sector rose to 51.4 points in January this year, as compared to 51.1 points in December. Economists had predicted that the index would be at 50.1 points.

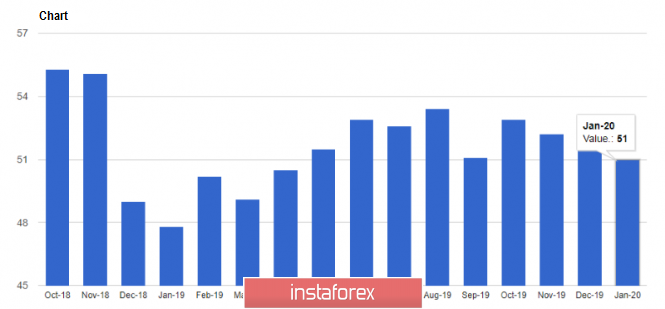

A similar index for the French services sector fell to 51.0 points in January, against 52.4 points in December. It was forecasted to be at 51.7 points.

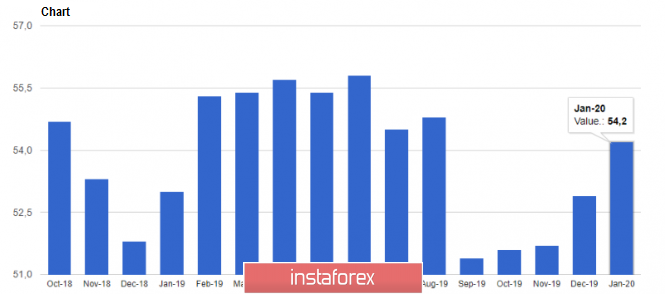

Meanwhile, geopolitical shocks continue to have a negative impact on the German economy. This was evidenced by the data on the manufacturing index. However, although Germany is particularly sensitive to geopolitical shocks in terms of industrial production, the stock market and services are the least affected. Today's report from Markit showed that the purchasing managers' index (PMI) for the German services sector rose to 54.2 points in January this year, while in December, it was at 52.9 points. This fully coincided with the forecasts of economists.

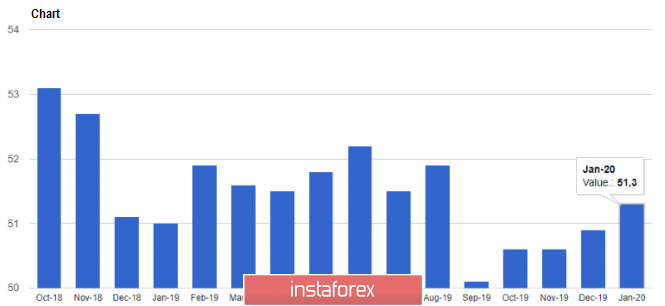

In the Eurozone, the purchasing managers' index (PMI) for services fell to 52.5 points in January, compared to 52.8 points in December. It had a forecast of a decline to 52.2 points. As for the composite index, which takes into account both the manufacturing sector and services, it recovered to 51.3 points in January, compared to its 50.9 points in December and the forecast of 50.9 points.

In the morning, a more serious pressure on the euro was provided by a report on a sharp decline on retail sales in the Euro area. This reflects the consumers' caution at the end of last year and the beginning of this year, which negatively affects the pace of economic growth in the Eurozone. According to the data, retail sales in December 2019 decreased immediately by 1.6% compared to November, where the figure was revised to 0.8%. Meanwhile, economists had forecasted a fall in sales of only 0.7%. However, compared to the same period in 2018, sales increased by 1.3%.

As for the technical picture of the EUR/USD pair, buyers of risky assets encounter more problems, as trading has moved to the support of 1.1020. If the bulls do not show themselves from this level in the near future, then the trading instrument will most likely push even lower to the area of the lows of 1.0990. However, an interesting scenario is for the buyers to return risky assets to the resistance of 1.1050, which will lead to an upward correction from the area of yesterday's high at 1.1065 to the level of 1.1095.

GBP/USD

The British pound managed to strengthen its position and return to the resistance area of 1.3065. This good growth of the pound was promoted by a report from IHS Markit, which showed that the final composite index, which takes into account the manufacturing sector and the service sector, rose to the level of 53.3 points in January against 52.4 points in December last year. The index level above 50 indicates an increase in activity compared to the previous month.

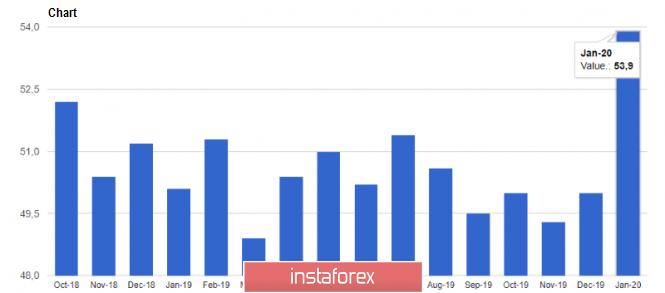

As for the services sector, which accounts for more than 70% of UK GDP, the January purchasing managers' index (PMI) was revised to 53.9 points, from a preliminary value of 52.9. Economists had expected this indicator to remain unchanged.

This data once again confirms the small progress in the growth of the UK economy after the general election at the end of last year. The reduction of uncertainty is clearly for the benefit of consumers, which stimulates the increase of spending, and leads to the increase of companies' investments.

As for the technical picture of the GBP/USD pair, the entire emphasis is placed on the level of 1.3065, where the market balance is gradually returning, and volatility is returning to normal. A break in this range will open a direct path to the highs of 1.3105 and 1.3165. However, when counting on a new wave of growth, we need to remember the support in the area of 1.3020, where a breakthrough of which can quickly cancel out all the plans of the bulls, pushing GBP/USD to the lows of 1.2980 and 1.2940.

The material has been provided by InstaForex Company - www.instaforex.com