EUR / USD

Over the weeks, there has been a rebound from the important resistance zone of this section 1.1146 (weekly Kijun) and 1.1185 - 1.1206 (monthly levels). In the coming days, we will close the month. It is important for the traders downside to form prerequisites for a rebound here. If the monthly candlestick has a slight upper shadow, then its bullish optimism will return the pair to the task of breaking through the encountered resistance with renewed force. On the other hand, the support and the bearish reference points now are the daily levels 1.1065 - 1.1030 - 1.0994, strengthened by the weekly short-term trend (1.1030). The attraction, in turn, is 1.1082 (weekly Fibo Kijun) and 1.1105 (upper border of the daily cloud + daily Tenkan).

The strength of the met support in the region of 1.1082 in the current situation forms a correctional rise. The significant stages in the development of the correction are now 1.1092 (central Pivot level) and 1.1125 (weekly long-term trend). Consolidating above will change the current balance of power in the lower halves and will allow us to consider the formation of rebound from the support of the higher halves. If correction is completed, the intra-day support will be performed by the classic pivot levels 1.1061 - 1.1042 - 1.1011.

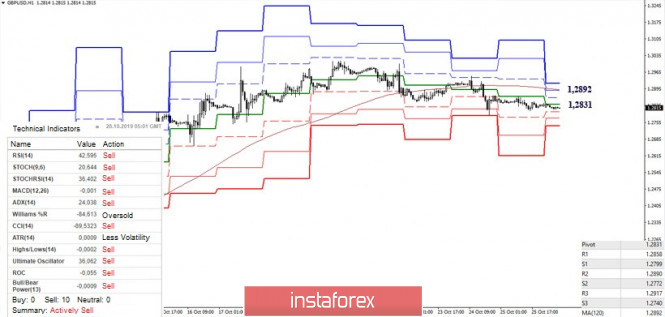

GBP / USD

The meeting with strong resistance (1.2882 monthly Fibo Kijun + 1.3014 lower border of the weekly cloud) led to the breaking and development of the daily downward correction. At the moment, the pair met with a daily short-term trend (1.2834), which is able to provide attraction and support. Meanwhile, the transition of the short-term trend to the side of the bears will lead to continued decline, with the closest bearish reference being 1.2669 - 1.2712 (weekly Fibo Kijun + monthly Tenkan + daily Fibo Kijun).

In the lower halves, the advantage belongs to the traders downside. If the minimum (1.2788) is updated, then the decline will continue, most likely, beyond the borders that were formed today by the classic pivot levels (1.2740 S3). Thus, we can observe the development of the upward correction after successive traders taking to increase the important resistance 1.2831 (central pivot level) and 1.2892 (weekly long-term trend). Consolidating above will allow you to consider options for exiting the daily correction zone (1.3012) and the continuation of rise to reference points of the higher halves.

Divergences of EUR / USD and GBP / USD (daily timeframe)

There are no new divergences.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com