Forecast for October 28:

Analytical review of currency pairs on the scale of H1:

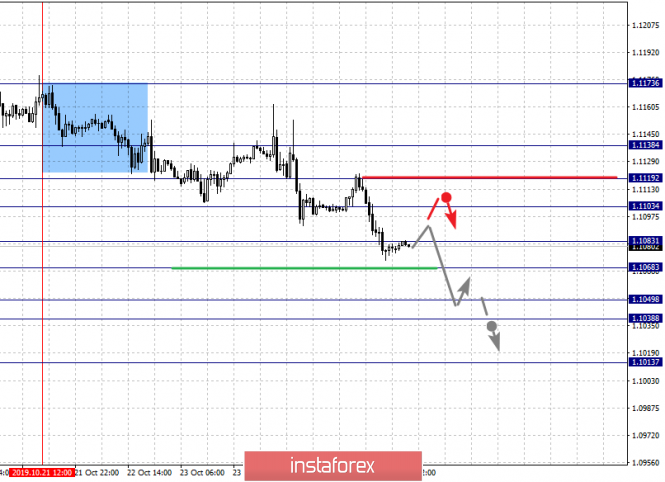

For the euro / dollar pair, the key levels on the H1 scale are: 1.1138, 1.1119, 1.1103, 1.1083, 1.1068, 1.1049, 1.1038 and 1.1013. Here, the continuation of the development of the downward cycle of October 21 is expected after the breakdown of the level of 1.1068. In this case, the goal is 1.1049. Price consolidation is in the range of 1.1049 - 1.1038 . For the potential value for the bottom, we consider the level of 1.1013. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is expected in the range 1.1103 - 1.1119. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1138. This level is a key support for the downward structure.

The main trend is the descending structure of October 21.

Trading recommendations:

Buy: 1.1104 Take profit: 1.1117

Buy: 1.1120 Take profit: 1.1137

Sell: 1.1068 Take profit: 1.1050

Sell: 1.1037 Take profit: 1.1014

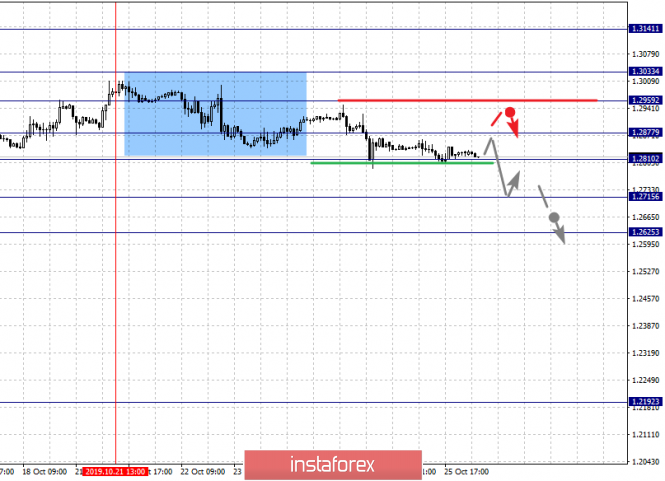

For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, we are following the development of the upward cycle of October 9. At the moment, the price has expressed a pronounced potential for the downward movement of October 21. The continuation of the movement to the top is expected after the breakdown of the level of 1.2959. In this case, the first target is 1.3035. The breakdown of the level of 1.3035 will lead to a pronounced upward movement. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215.

We expect consolidated movement in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the goal is 1.2625.

The main trend is the ascending structure of October 9, the formation of the descending structure of October 21.

Trading recommendations:

Buy: 1.2960 Take profit: 1.3031

Buy: 1.3035 Take profit: 1.3140

Sell: 1.2808 Take profit: 1.2717

Sell: 1.2713 Take profit: 1.2627

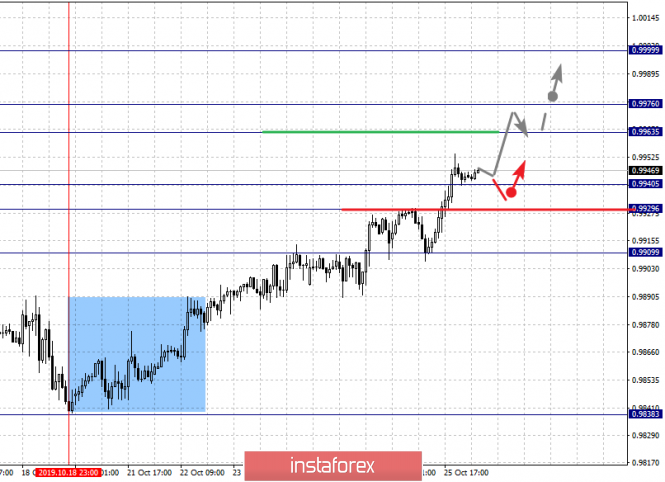

For the dollar / franc pair, the key levels on the H1 scale are: 0.9999, 0.9976, 0.9963, 0.9940, 0.9929 and 0.9909. Here, we are following the development of the ascending structure of October 18. Short-term upward movement, we expect in the range 0.9963 - 0.9976. The breakdown of the last value will lead to a pronounced movement. Here, the target is a potential target - 0.9999, when this value is reached, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9940 - 0.9929. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9909. This level is a key support for the upward structure.

The main trend is the upward structure of October 18.

Trading recommendations:

Buy : 0.9963 Take profit: 0.9974

Buy : 0.9978 Take profit: 0.9999

Sell: 0.9940 Take profit: 0.9931

Sell: 0.9927 Take profit: 0.9912

For the dollar / yen pair, the key levels on the scale are : 109.66, 109.33, 108.90, 108.72, 108.24, 108.02 and 107.67. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 108.72 - 108.90. The breakdown of the latter value will lead to a movement to the level of 109.33. Price consolidation is near this level. For the potential value for the top, we consider the level of 109.66. Upon reaching this level, we expect a consolidated movement, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 108.24 - 108.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.67. This level is a key support for the top.

Main trend: local structure for the top of October 23.

Trading recommendations:

Buy: 108.90 Take profit: 109.30

Buy : 109.34 Take profit: 109.65

Sell: 108.24 Take profit: 108.03

Sell: 108.00 Take profit: 107.70

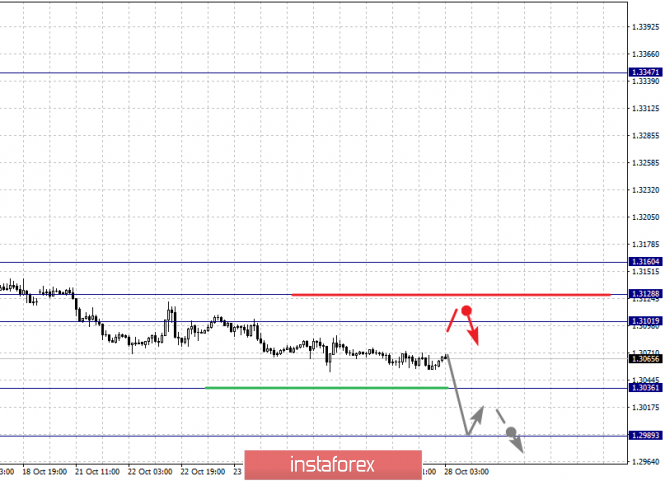

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3160, 1.3128, 1.3101, 1.3036 and 1.2989. Here, we are following the development of the downward trend of October 10. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3036. In this case, the target is the potential target 1.2989. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.3101 - 1.3128. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3160. This level is a key support for the downward structure.

The main trend is the downward cycle of October 10.

Trading recommendations:

Buy: 1.3101 Take profit: 1.3126

Buy : 1.3130 Take profit: 1.3160

Sell: Take profit:

Sell: 1.3034 Take profit: 1.3000

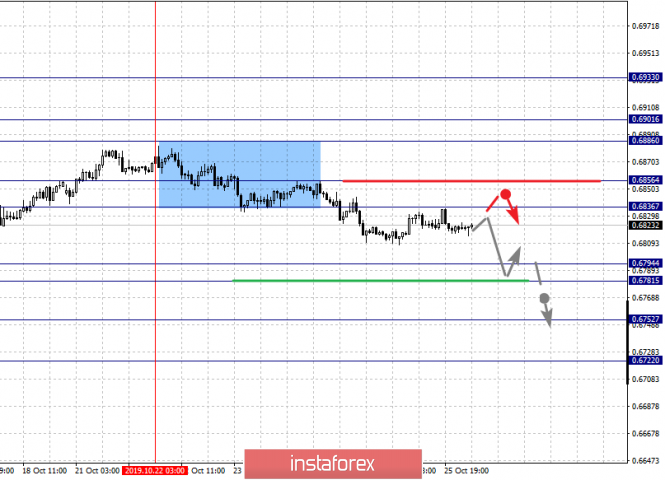

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6933, 0.6901, 0.6886, 0.6856, 0.6836, 0.6794, 0.6781, 0.6752 and 0.6722. Here, we are following the descending structure of October 22. At the moment, we expect to reach the level of 0.6794. Price consolidation is in the range of 0.6794 - 0.6781. The breakdown of the level of 0.6780 will lead to a pronounced movement. Here, the target is 0.6752. Price consolidation is near this level, and there is also a high probability of a rollback to the top. For the potential value for the bottom, we consider the level of 0.6722. Upon reaching which, we expect a departure in the correction.

Short-term upward movement is possibly in the range of 0.6836 - 0.6856. The breakdown of the latter value will favor the formation of an ascending structure. Here, the potential target is 0.6886.

The main trend is the descending structure of October 22.

Trading recommendations:

Buy: 0.6836 Take profit: 0.6854

Buy: 0.6858 Take profit: 0.6886

Sell : 0.6780 Take profit : 0.6752

Sell: 0.6750 Take profit: 0.6724

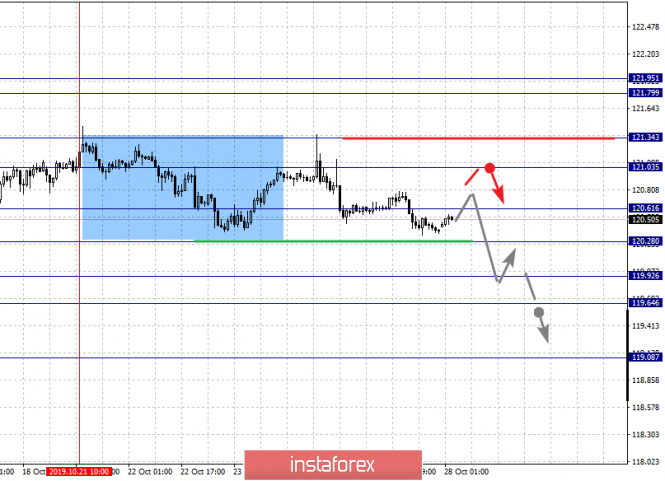

For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.79, 121.34, 121.03, 120.61, 120.28, 119.92 and 119.64. Here, the price has entered an equilibrium state and forms the potential for the downward movement of October 21. Short-term upward movement is expected in the range 121.03 - 121.34. The breakdown of the level of 121.35 should be accompanied by a pronounced upward movement. Here, the target is 121.79. Price consolidation is in the range of 121.79 - 121.95. From here, we expect a correction.

We expect consolidated movement in the range of 120.61 - 120.28. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.92. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the first goal is 119.64.

The main trend is the upward structure of October 15 and the formation of potential for the bottom of October 21.

Trading recommendations:

Buy: 121.05 Take profit: 121.34

Buy: 121.36 Take profit: 121.76

Sell: 120.25 Take profit: 119.94

Sell: 119.90 Take profit: 119.66

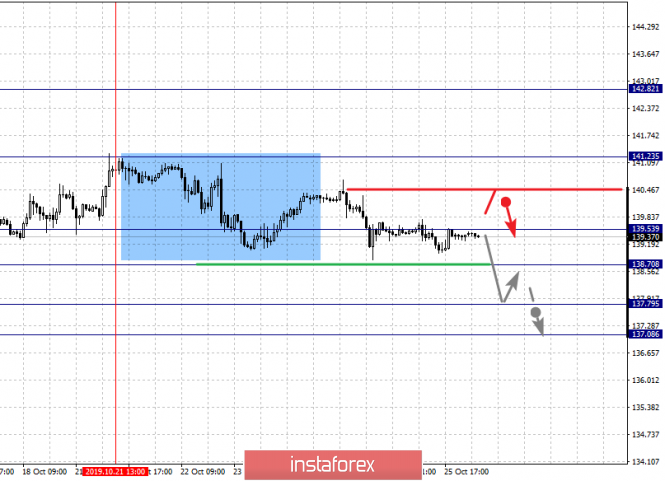

For the pound / yen pair, the key levels on the H1 scale are : 142.82, 141.23, 139.53, 138.70, 137.79 and 137.08. Here, the price has entered an equilibrium state and currently forms a potential for the bottom of October 21. The continuation of movement to the top is expected after the breakdown of the level of 141.23. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement, as well as consolidation, are possible in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top.

The main trend is the medium-term upward structure of October 8, the formation of potential for the downward movement of October 21.

Trading recommendations:

Buy: Take profit:

Buy: 141.25 Take profit: 142.80

Sell: 139.50 Take profit: 138.75

Sell: 138.65 Take profit: 137.80

The material has been provided by InstaForex Company - www.instaforex.com