JPY is struggling amid the recent fluctuations in the Bank of Japan policies. USD has won favor with investors, thus having gained momentum.

According to economic adviser to Prime Minister Abe, the Bank of Japan can abandon its 2% inflation target or relax efforts to achieve it if the labor market revives because the population is more comfortable with falling prices rather than rising ones. As the inflation has currently stuck at 1%, the ultra-loose monetary policy creating jobs is expected to lead the economy to sustain the growth momentum. Today SPPI report was published unchanged as expected at 1.1% and tomorrow BOJ Core CPI report is expected to increase to 0.6% from the previous value of 0.4%. Retail Sales, Unemployment Rate, and Capital Spending reports are due later this week which are expected to have unchanged or neutral readings. If true, this may lead to further indecision for the upcoming JPY gains.

On the other hand, the US economy has been underperforming in certain sectors that pulled back the currency from further growth. Though there are certain elements which affected the overall economic growth, the government shutdown is still taken as the main reason. Recently the Federal Reserve stated in a report of economic scorecard that Trump's Administration undershot a little to ensure its 3% annual GDP target for 2018. As per verdict, the elements which affected economic growth are the impact of tax cuts and other policies warning, wider Federal Reserve's deficit, and trade protectionism. On the other hand, during this period the only thing which was in uptrend was employment growth. Ahead of FED Chairman Powell's Testimony this week, USD is expected to be trade with higher volatility and may lose certain momentum until any the US provides upbeat economic data.

Meanwhile, JPY is being still indecisive and neutral due to the downbeat expectations of the upcoming economic reports. USD could gain ground versus JPY if the events turn out to reveal positive results.

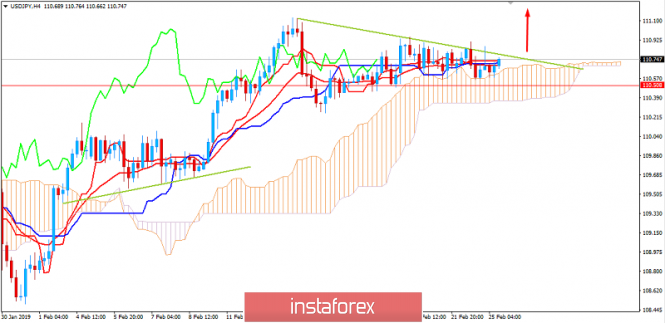

Now let us look at the technical view. The price is currently being held by the dynamic support area of Kumo cloud as support trading above 110.50 area in a corrective range. As the price remains above 110.50 with a daily close, further bullish pressure towards 112.00 area is expected in the coming days.