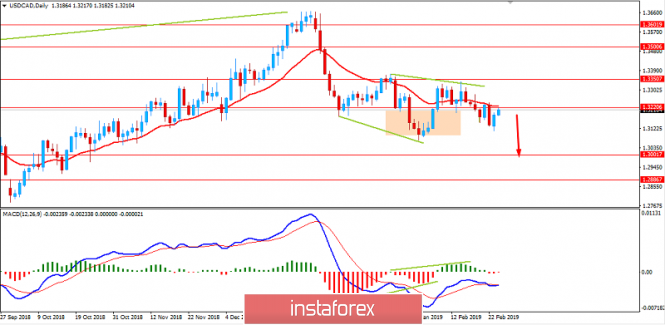

USD/CAD has been quite volatile and indecisive at the edge of 1.3200 area from where the pair is likely to extend bearish momentum.

Ahead of a CPI report this week, CAD has been quite weak against USD, so the pair is trading under bullish pressure along the way. On Wednesday, Canada's CPI report is going to be published. Consumer prices are expected to increase to 0.2% from the previous value of -0.1%. Moreover, Common CPI is expected to be unchanged at 1.9%, Median CPI is expected to be unchanged as well at 1.8%, and Trimmed CPI is also expected to be unchanged at 1.9%. A slump of oil prices accounts for CAD weakness as the Canadian economy has a direct link to this commodity.

Canada stocks were higher after the close yesterday that indicates optimistic sentiment in Canada's financial markets. The rising stocks outpaced the declining ones which seemed to attract more investors to CAD when investors made trading decisions.

On the USD side, the US economy has been operating at full employment with the FED having reached the 2% inflation target. Most of the FED officials are quite positive about growth rates of the domestic economy and want the funds rate to be held unchanged and sustain the growth further. However, the US economic growth has been dented by headwinds like the government shutdown and the trade protectionism. According to FED's Kaplan, the US central bank is currently looking forward to boost employment further. The unemployment rate at 4% is quite favorable and better than what the policymakers expected.

At present, the missing element to boost economic growth is solid economic reports from the US. If upbeat data comes true, this will encourage impulsive gains on the USD side in the coming days. Today FED Chairman Powell is going to deliver a semi-annual testimony. His speech is expected to contain optimistic notes. CB Consumer Confidence report is expected to increase to 124.8 from the previous figure of 120.2. Ahead of NFP next week, any positive economic report is expected to reinforce USD as employment increase influences the NFP reports directly.

Meanwhile, CAD is expected to regain certain momentum until it resides below 1.3200-1.3350 resistance area if the upcoming economic reports from Canada come in better than expected. Otherwise, any positive outcome in the US economic reports and events may lead to a strong counter-trend with an impulsive bullish move breaking above 1.3350 with a daily close above it for further upward pressure. According to Hidden Divergence method as it is spotted in this pair, the bearish pressure is expected to continue further.