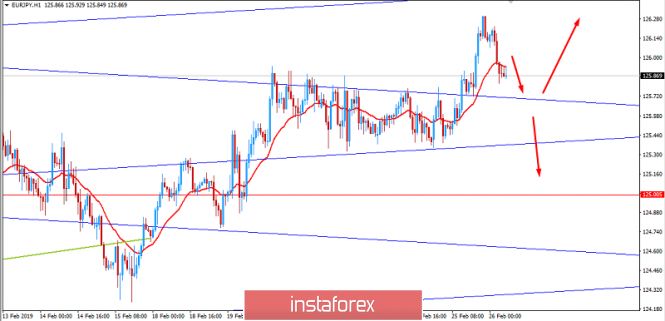

EUR gained impulsive momentum after breaking above the Gann Grid resistance at 125.60 area which is currently being recovered by JPY with an impulsive counter-momentum.

The eurozone's economy has been hurt by the looming BREXIT and an economic slowdown. Meanwhile, the eurozone's economy cannot regain the impulsive growth momentum it used to have earlier. The European Central Bank recently stated that it would allot 2.0 billion Euros at its three-month operation and 6.0 billion Euros at its weekly refinancing tender. Additionally, Germany's Finance Minister Mr. Olaf Scholz stated that Germany has a greater possibility to escape recession whereas the overall European economy also has such chances as well. The eurozone is facing grave risks such as trade conflicts and BREXIT. The recent data indicated a downturn in European markets. Importantly, it is not going to affect the upcoming growth in the long run. The hawkish statement drew market sentiment towards EUR but it not enough for EUR to regain strong momentum in a certain direction, while JPY has been gainign ground today.

On the other hand, today Bank of Japan's Governor Kuroda stated that he expects China's economic growth to pick up in the second half of the year despite the recent trade talks between the US and China. Japan has been looking forward to successful outcome of the trade talks as China is one Japan's important business partner. More import tariffs imposed by the US may lead to certain business complications for Japan's car industry as well. Core CPI report published today at 0.5% fell short of expectations for an increase to 0.6% from the previous value of 0.4%.

Meantime, despite downbeat economic reports from Japan, JPY managed to gain impulsive momentum over EUR that indicates weakness of EUR. JPY is winning favor with investors. Until the eurozone comes up with decent economic outcome, the pair is going to trade with higher volatility and bearish momentum.

Now let us look at the technical view. The price is heading lower towards the Gann Grid line support from where certain bullish pressure or intervention may lead to further upward pressure in the pair. Otherwise, an intra-day break below 125.50 is expected to lead the price lower towards 125.00 area.