The slowdown of the US economy in the third quarter, as well as the expectation of negative dynamics in the stock market, and possibly, the slowdown in global economic growth have returned to the market. The Fed might raise interest rates in December by 0.25%. It will be decided if at the beginning of 2019, there might be a pause in the process of following the course of normalization of monetary policy.

As previously mentioned, the impetus for this was an interview with P. Harker, the President of Federal Reserve Bank of Philadelphia on WSJ on Friday. He said that he doubted the need to continue actively raising interest rates. Market responded with increased optimism following the beginning of decline in US dollar. And the yield of government bonds of US Treasury began to decline sharply.

However, it seems to us that the weakening of the dollar and its rise by the middle of this week occurred not only against the background of Harker's comment, but also the resumption of the fall of the American stock market. First in all its technology sector, it remains under pressure from fears that the lack of agreement between the US and China on trade duties will cause serious damage to companies placing orders and having their production in the so-called "heaven".

The course of American currency is currently influenced by two forces. On one hand, this is a downward pressure due to the rising expectations that the Fed will decide not to understand interest rates early next year. And on the other hand, it is supported by the demand for a dollar if the investors sell their share in companies and cash out. Even so, the markets are still confident that the Fed's action to raise rates will be discussed at the December meeting. According to the dynamics of futures on federal fund rates, this probability is estimated at 75.8%.

Evaluating the emerging picture in the market, we believe that since the likelihood of absence of agreement between Washington and Beijing on trade duties will play a huge role, the dollar will consolidate against major currencies. This will likely to happen before the G20 summit which will be held in Brazil the other day. This will also have an undoubtedly noticeable impact on financial markets.

Today is Thanksgiving day in the States. The local market will be closed; therefore, the activity of the investors will be low.

Forecast of the day:

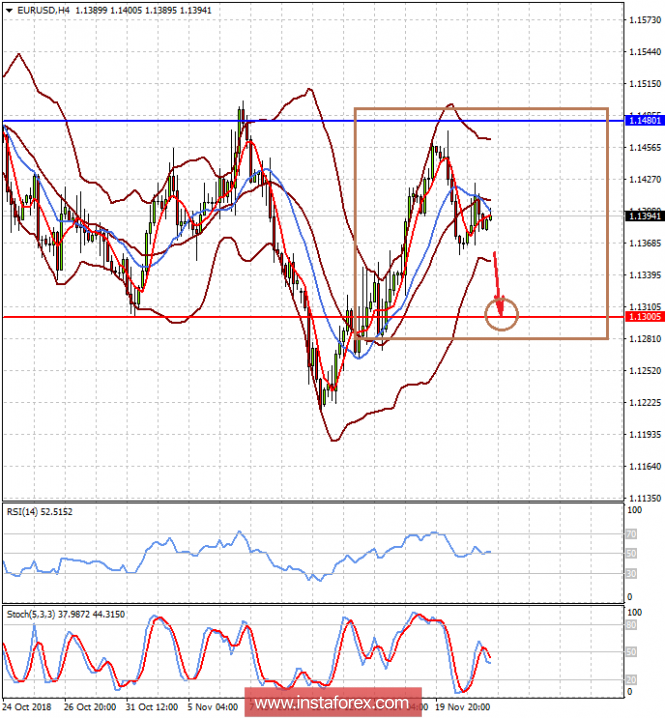

EURUSD pair is consolidating in a narrow range with the budget of Italy for next year, which does not suit the European Commission. Probably, the pair will remain within the range of 1.1300-1.1480 until the G20 summit and the posting of news regarding the Italian budget. It is therefore believed that there will be a local price reduction to the lower limit of the range.

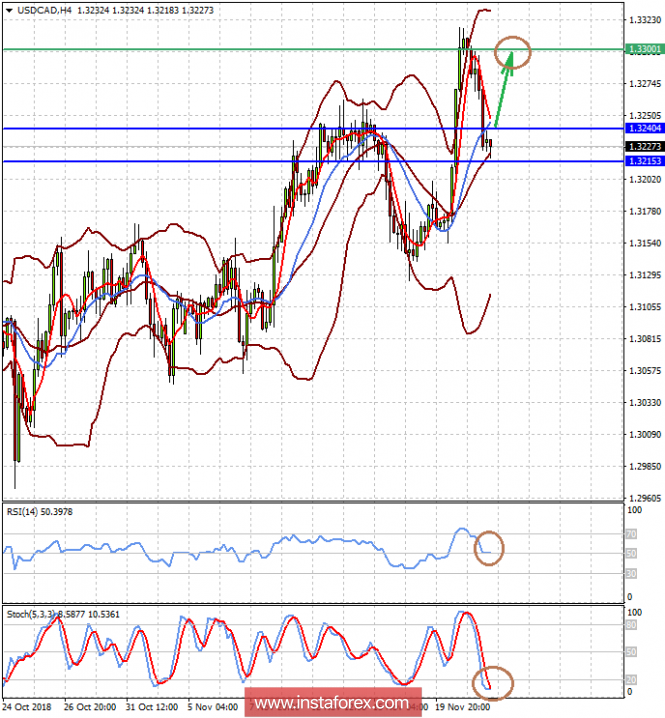

The pair USDCAD is trading above 1.3215. It can resume growth against the backdrop of continued decline in crude oil prices. If the price crosses the 1.3240 mark, a probability of its growth will be at 1.3300.