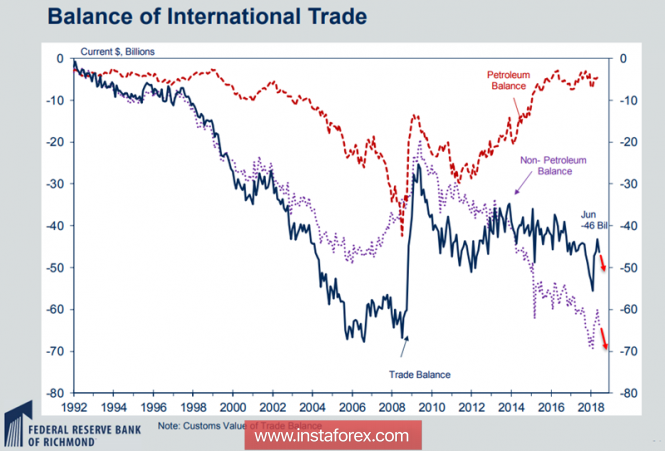

The US trade deficit grew by 9.5% in July to $ 50.1 billion, which is the maximum for 5 months, the deficit growth exceeded forecasts and indicates the difficulties with filling the budget, despite the trade war unleashed by Trump with most US trading partners.

As can be clearly seen from the chart compiled by the Federal Reserve Bank of Richmond, some stabilization of the deficit was achieved mainly through a reduction in oil and gas imports. Since 2009, oil production in the USA has been steadily growing, which has reduced imports and corrected the trade balance, but without taking into account the oil component, the trade balance continues to fall into the abyss.

Accordingly, the danger of a full-fledged budget crisis is growing at a high rate. Reduction of tax pressure has led to a decrease in budget revenues, but there is no evidence of an increase in budget revenues for other items.

In fact, the US is confidently moving towards another recession, as indicated by many indirect indicators, the main one being the approaching inversion of the yield curve, which characterizes long-term investor sentiment. Under normal circumstances, when the economy grows, long-term interest rates are higher than short-term ones, because in the long run, income generation is perceived as more risky, and the yield curve goes up. But if short-term debt becomes more risky for some reason, the yield curve turns down and at some point crosses the zero line, becoming inverse.

This behavior of the yield curve is typical for a year and a half before the start of another recession. Now the yield curve is confidently down, and there is confidence that the zero line will be crossed before the end of 2018. This means that the next recession may come by the end of 2019, just when the Fed plans to complete the cycle of normalizing interest rates.

The publication of the employment report on Friday is becoming increasingly important. Inflation stopped growth, and to justify the growth of rates fear of overheating the economy will not work. The GDP growth rate will slow down in the coming months, in 2019 the forecast from the Fed looks unconvincing. If tomorrow the labor market shows difficulties with growth, the dollar will start to be sold out massively, as negative moods will increase significantly, and the probability that the Fed will be able to withstand the announced rate of growth rates in 2019 will fall.

Also today, we need to pay attention to the ADP report on employment in the private sector, which can set the direction for the next day, as well as the ISM index for the services sector.

The currency pair EUR / USD today will continue to trade in the sideways range in anticipation of new data. Above, the range is limited by the resistance level of 1.1660, from below, by the trend line at the level of 1.1570.

The currency pair GBP / USD is unlikely to be able to update the range of the September 5 range, as no important macroeconomic news from the UK is expected during the day. The pound will be supported by 1.2850, from above growth is limited by resistance 1.2960.

Oil and ruble

Oil on Thursday is slightly corrected after the rapid growth the day before. The Gordon Storm in the Gulf of Mexico led to a 9.53% drop in oil production, and more signs that Iran, in an attempt to maintain the current production level, will face significant difficulties due to fears from its major buyers to fall under American pressure. At the same time, OPEC Secretary General Mohammed Barkindo said that oil consumption could reach a world level of 100 million barrels. a day much earlier than expected, thereby creating prerequisites for a deficit and further price increases.

The ruble is stable after the CBR meeting, at which the interest rate, as expected, remained unchanged. Comments of officials are neutral, Russia's economy feels confident, but growing political pressure limits growth.

Before the release of data from the US on the labor market, the ruble and oil will be traded in a narrow range near current levels.

The material has been provided by InstaForex Company - www.instaforex.com