To open long positions for GBP / USD pair, you need:

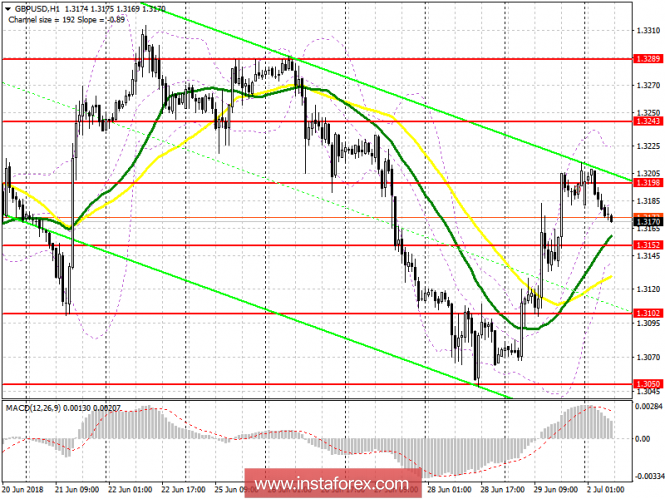

Buyers of the pound need to return to the resistance area of 1.3198, from which you can count on a new wave of growth in the area of resistance at 1.3243 and 1.3289, where fixing profits are recommended. In case of GBP / USD pair decline in the first half of the day, you can see the purchase after forming a false breakout in the support area of 1.3152 or open long positions on the rebound from 1.3102.

To open short positions for GBP / USD pair, you need:

An unsuccessful attempt to consolidate at the resistance level of 1.3198 will be a good signal for opening short positions in the pound with the main goal of breakdown and consolidation below the support of 1.3152, which will lead to a larger sellout of GBP / USD and a minimum update around 1.3102, where fixing profits are recommended. In the case of growth above 1.3198, the pound can be sold at a rebound of 1.3243.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20