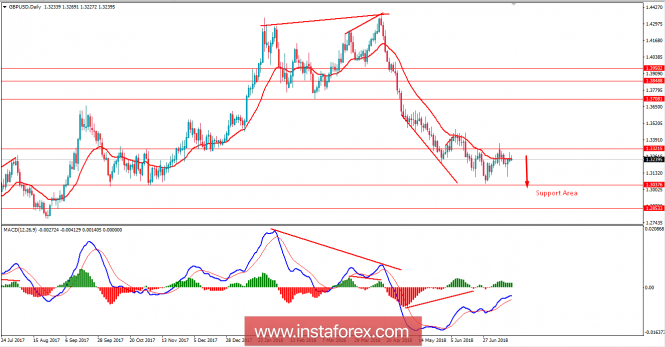

GBP/USD has been quite corrective and volatile, residing below the resistance area of around 1.3320. The price is expected to sink deeper towards 1.2850-1.3050 area in the coming days. GBP has been struggling politically and economically recently. GBP vulnerability is expected to lead to its further weakness against USD in the coming days.

Today, the UK Average Hourly Earnings Index report was published unchanged at 2.5% as expected which did not trigger any gains for the currency in the process. Moreover, Unemployment Rate was also unchanged at 4.2% but Claimant Count Change was increased by 7.8k in June from the previous figure of -3.0k which was expected to be at 2.3k. Additionally, BOE Governor Carney was quite dovish in his speech today, expanding on grave risks to the British economy. Thus, he does not signal readiness of the regulator to raise interest rates in the short term.

On the other hand, USD has been quite solid amid recent economic reports which helped the currency to sustain its gains over GBP. So, the pair is trading below 1.3320 with a daily close. Today, US Capacity Utilization Rate report is going to be published which is expected to increase to 78.4% from the previous value of 77.9%, Industrial Production is expected to increase to 0.5% from the previous value of -0.1%, and NAHB Housing Market Index report is also expected to increase to 69 from the previous figure of 68. Moreover, today Fed Chair Powell is going to testify on the central bank's agenda for further monetary tightening until the year end. Investors hope that the US regulator is ready for more agressive monetary policy.

At present, GBP is expected to struggle for further gains amid recent economic reports, whereas USD is performing better. Higher likelihood of two more rate hikes by the year end is certainly bullish for USD. As the economic calendar contains more macroeconomic reports from the UK this week, the pair is likely to trade with higher volatility but USD is expected to have an upper hand over GBP.

NEAR TERM RESISTANCE: 1.3320

NEAR TERM SUPPORT: 1.3050

BIAS: BEARISH

MOMENTUM: VOLATILE