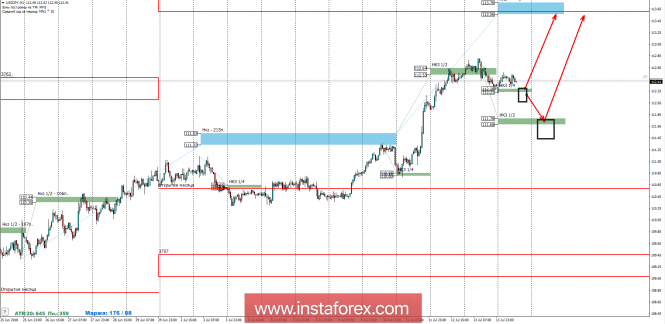

Last week, the pair reached the next target zone of the NCP 1/2 112.64-112.53, which resulted in the growth of supply. The first support zone for the NCP 1/4 is at 112.28-112.23.

Today, there was a test of the first support zone of the NCP 1/4 112.28-112.23. Holding prices above these marks will allow the pair to continue its growth, and the July buyout will be the goal of purchases. The second goal of the growth will be a weekly short-term fault 113.76-113.56, located within the monthly short-term fault of July. The upward movement remains impulsive, so the probability of updating the July high is more than 70%, which makes purchases from the support zones profitable at a distance.

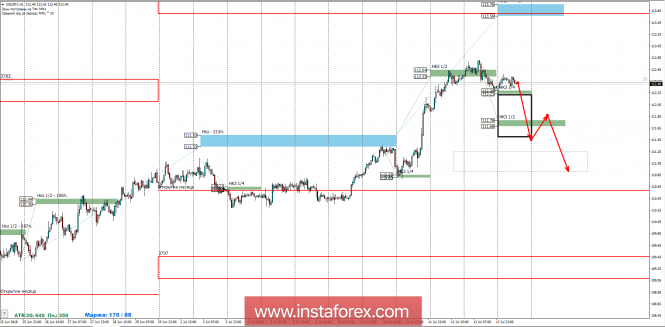

The most favorable prices for the purchase are located within the limits of the NCP 1/2 111.78-111.68. The test of this zone will be decisive for the whole upward momentum. If the pair can stay above this zone in US sessions, the upward movement will continue with a 70% probability.

To form an alternative downward model, a breakdown and anchoring below level 111.68 will be required. This will allow talking about the end of the current phase of the bullish trend and consider selling in the short term. This model has a probability of 30%, so short transactions today are not profitable to consider. Without confirmation of direction, even a high risk-to-profit ratio will not give a significant advantage in a series of transactions.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com