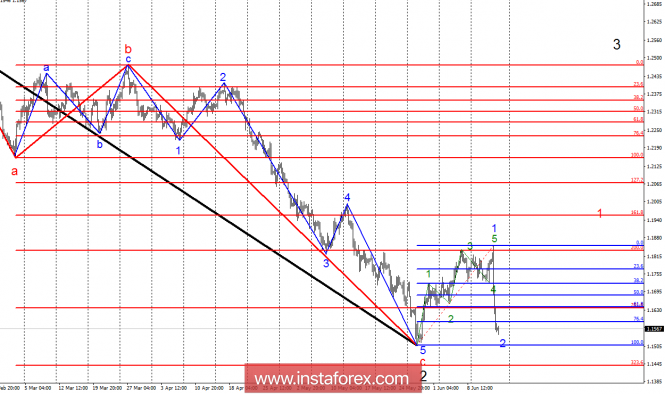

Analysis of wave counting:

As a result of the previous day, the EUR/USD pair lost almost 300 bp from the high of the day, after the ECB announced the extension of the program of buying up assets before the end of this year. The pair performed a point shot at the level of 1,1837, thus completing the construction of the supposed wave 5, at 1, at 1. The breakdown of the minimum of May 29 will lead to the need to refine the entire wave of markup and will mean a complication of the internal wave structure of the descending section of the trend originating still on March 27th. Small chances of resuming the construction of an upward trend segment are still available if the proposed wave 2 completes its construction in the next few hours.

Targets for selling:

1.1439 - 323.6% by Fibonacci of the highest order

1.1121 - 423.6% by Fibonacci of the highest order

Targets for buying:

1.1958 - 161.8% by Fibonacci of the highest order

1.2070 - 127.2% by Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR/USD currency pair has completed the construction of wave 5, at 1, at 1 and, probably, is close to the completion of corrective wave 2. If this is the case, then the increase in quotes will resume. At the same time, the breakdown of the mark of 1.1510 will lead to the complication of the downward trend section. Then it is recommended to resume selling the pair with targets near the estimated marks of 1.1439 and 1.1121, which corresponds to 323.6% and 423.6% of Fibonacci.

The material has been provided by InstaForex Company - www.instaforex.com