The Eurostat published the most important report during today's European session: the final data on consumer inflation in the Eurozone (CPI). In the case of data on a monthly basis, market forecasts increase, as was the case for year-on-year readings. As it turned out, expectations were a spot on.

In annual terms, inflation in May 2018 reached 1.9%, which in comparison to the April reading (1.3%) indicates its increase. In turn, the annualized CPI for the entire EU reached the level of 2.0% against 1.5% in April this year, while a year earlier the reading indicated 1.6%. Data on a monthly basis point to CPI inflation by 0.5%, thus they are in line with market expectations, but higher than the previous reading (0.3%).

The lowest increase in inflation was recorded in Ireland (0.7%) and Greece (0.8%). The highest in Romania, where the CPI is up 4.6%.

In conclusion, the Consumer Price Index data were in line with expectations, but there are still below the ECB target on a minimum 2.0%.

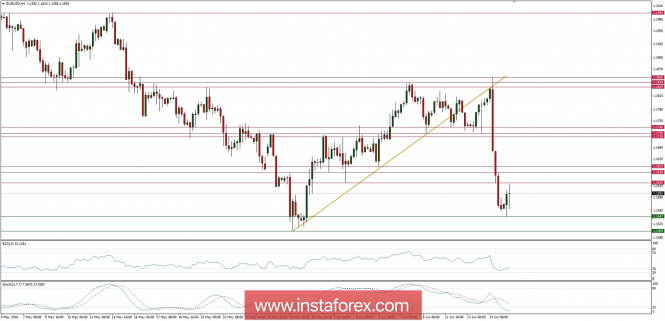

Let's now take a look at the EUR/USD technical picture at the H4 time frame. Quotations of the main currency pair are correcting the strong decline, which lasted until the end of yesterday's session. As can be seen in the 4-hour chart below, inflation data help to move the price above the level of 1.1600, but the nearest technical resistance at 1.1616 seems to be the line in the sand for now. The nearest technical support is seen at the level of 1.1542 and violation of this level would immediately lead to the test of the swing low at the level of 1.1509.