AUD/JPY has been quite impulsive in the bearish bias after bouncing off the 84.00 area with a daily close recently. Amid the recent mixed employment report from Australia, JPY has gained impulsive momentum which is expected to encourage a further downward move in the coming days.

Today, RBA Assistant Governor Ellis spoke about the nation's key interest rate and future monetary policies which had a neutral impact on the market. RBA is currently in the process to develop plans for GDP growth with not much change in the policies which will be inveiled in the coming days.

On the other hand, today Japan's Policy Rate report was published with the same record low key policy rate at -0.10% in line with expectations, whereas BOJ Press Conference was quite indecisive, having a neutral impact on further economic developments.

As for the current scenario, certain correction and indecision is expected in this pair in the short run. JPY is expected to have an upper hand over AUD in the process, as AUD is found struggling for gains amid the fresh employment reports.

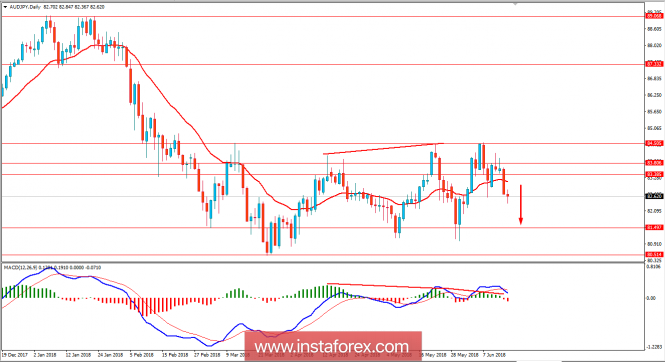

Now let us look at the technical view. The price is currently residing below 83.50-84.00 resistance area after the recent rejection off the level with a daily close. The price is being held by the dynamic level of 20 EMA in the process along with Bearish Divergence as well, which is expected to push the price much lower towards 80.50-81.50 support area in the coming days. As the price remains below 84.50 area with a daily close, the bearish bias is expected to continue further.