EUR/CAD is currently residing below 1.53 price area after being rejected off the 1.5350 price area with an impulsive bearish daily candle. EUR has been quite weak in comparison to CAD in the current market scenario, where the price is expected to push much lower in the coming days.

Despite the recent weak economic reports of CAD including a decrease in Employment Change to -7.5k from the previous figure of -1.1k, did have an impact on the growth of CAD in the process. Recently CAD NHPI report was published unchanged at 0.0% which was expected to increase to 0.2%.

On the other hand, EUR has been quite mixed with the recent economic reports whereas ECB had less to offer for the currency growth in the market. Today Final CPI report was published with an unchanged value as expected at 1.9%, Final Core CPI report was also published unchanged as expected at 1.1% and Trade Balance report was published with decrease to 18.1B from the previous figure of 19.8B which was expected to increase to 20.2B.

As of the current scenario, CAD is expected to gain further momentum over EUR in the coming days as of the recent EUR worse economic reports having impact on the economy growth. Though there are certain high impact economic events like ECB President Draghi's speech for a multiple time which is expected to inject volatility ahead of the CAD CPI and Retail Sales report to be published in the coming days.

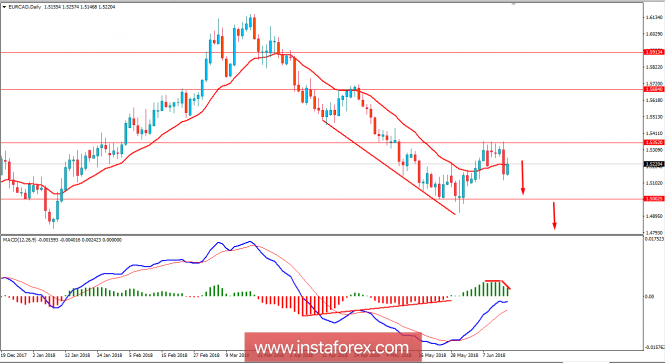

Now let us look at the technical view. The price is currently residing at the edge of breaking below the dynamic level of 20 EMA after being bounced off with a daily close from 1.5350 area. Currently the price is forming certain Continuous Bearish Divergence in the process, which is expected to push the price lower towards 1.50 in the coming days. As the price remains below 1.5350 area, the bearish bias is expected to continue further.