USD/JPY has been making higher lows recently despite the volatile structure of the market. After breaching above 110.50 area recently, the price has pushed lower below 110.50 again impulsively that is more likely to inject certain bearish pressure in the market.

After the recent Federal Funds Rate hike from 1.75% to 2.00%, USD did not gain much momentum over JPY as expected. USD is still struggling for gains over JPY ahead of Fed Chair Powell's speech. He is going to speak about the short-term interest rates and future monetary policy at the conference in Portugal on Wednesday. After the recent rate hike by the US Fed, his remarks are expected to provide the required push for USD to encourage further gains in the coming days.

On the other hand, JPY has not been quite impressive amid the recent economic reports but still manages to sustain the momentum against USD for a while. Despite the Bank of Japan's decision to keep the key interest rate at -0.10% last week, JPY managed to keep the USD pressure low in the market. Today, Japan's Trade Balance report was published with a decrease to -0.30T from the previous figure of 0.45T which was expected to be at 0.14T, which did not quite affect JPY strength at all. Moreover, this week BOJ Governor Kuroda is going to speak about the policy plans and measures to be taken to improve the economic conditions in the future.

As for the current scenario, this week the pair is expected to be quite volatile as two market-moving events are going to be held both in the US and Japan. Though USD has greater probabilities to dominate further over JPY, it is not going to be a straight and easy route to take. Certain correction and higher volatility are expected along the way, though the odds are that JPY will keep momentum.

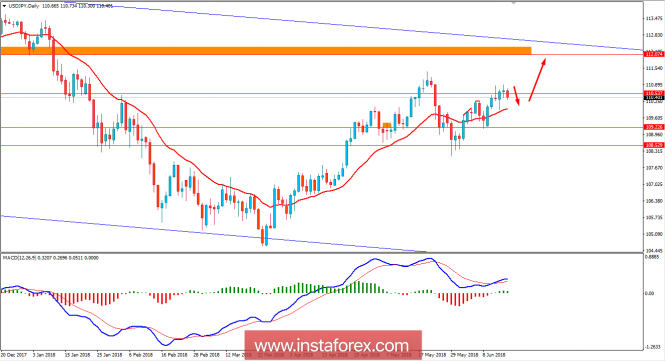

Now let us look at the technical view. The pair is trading in a bearish bias, aiming to trade below 110.50 in the process. Though the price structure is still quite corrective, holding above the dynamic level of 20 EMA indicates the bullish momentum in the pair. As the price remains above 108.50 area with a daily close despite having certain pullbacks, the bullish bias is expected to continue further.