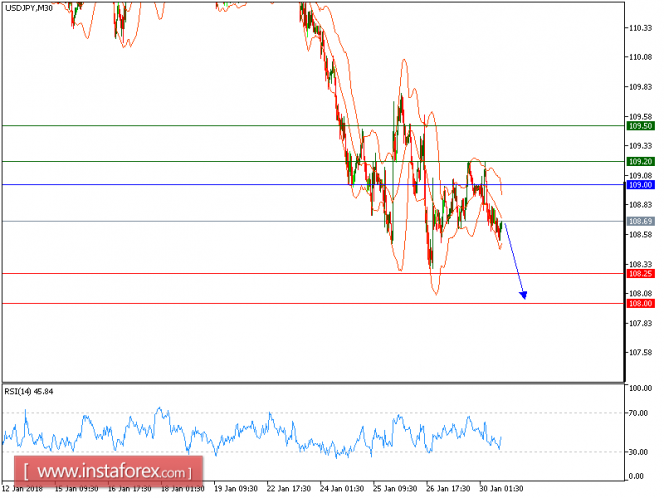

The pair remains under pressure below its major horizontal resistance at 109.00, and it is likely to post a new pullback. The 50-period moving average is heading downward, and it should continue to push the prices lower. In addition, the relative strength index lacks upward momentum.

The U.S. dollar rebounded against other major currencies, as investors took profits on dollar short positions in face of the rallying U.S. bond yields. At the same time, they are watching closely the Federal Reserve's monetary policy meeting and the January jobs report due later this week.

In which case, as long as 109.00 holds on the upside, look for further decline to 108.25 and 108.00 in extension.

Alternatively, if the price moves in the opposite direction, a LONG position is recommended to be above 109.00 with a target of 109.20.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels, and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, stop loss at 109.00, take profit at 108.25.

Resistance levels: 109.20, 109.50, and 110.15

Support levels: 108.25, 108.00, and 107.50.

The material has been provided by InstaForex Company - www.instaforex.com