A contradictory report on employment in the US economy, published on Friday, did not allow the dollar to continue its rise.

The number of new jobs in November rose more than expected, recording an increase of 228, 000, which exceeded the average forecast of 195, 000. Also, the average working week increased from 34.4 to 34.5 hours, reaching a five-month high, which was also a surprise for analysts, who did not expect change. The share of the able-bodied population in the labor force remained unchanged at 62.7%, unemployment stood at 4.1%, and at its lowest level in more than 17 years.

These rather positive for the dollar data were overshadowed by the weaker than expected average wage growth. Growth relative to October was 0.2% with a forecast of 0.3%, as year-on-year growth was 2.47%, which is better relative to November's 2.3%, but worse than the forecast of 2.7%.

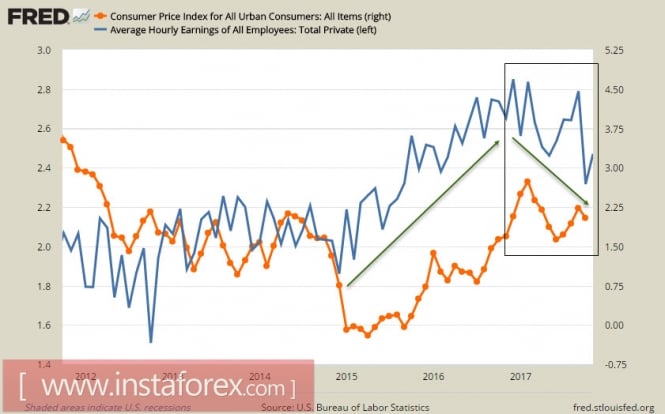

The weak growth of average wages casts doubt on the Fed's view that the labor market recovery will lead to an increase in inflation due to the growth of household incomes. Indeed, for the period of 2015- 2016. and it was, as is clearly seen in the graph below, but after the growth in wages in December 2016 reached 2.87% maximum since January 2009, the growth rate began to slow down, which immediately affected the fact that after this inflation began to slow down.

On this, the troubles for the dollar did not end. The Atlanta Fed was forced to lower the US GDP growth rate estimate in the fourth quarter from 3.2% to 2.9%, and thus two of the three key indicators that the Fed is targeting in monetary policy-inflation, unemployment and GDP growth, were at stake.

Of course, these factors will not prevent the Fed from raising the rate at the next meeting on Wednesday, December 13, but may serve as a reason for fixing profits and pulling back the dollar from the achieved levels. The rate hike has long been taken into account in prices and is unlikely to have a significant impact on markets, but the issue is the intention of the Fed to raise the rate three times in 2018.

However, despite the fears, the dollar still remains the favorite in the upcoming week, the reason for this is a noticeable drop in tension in the political life of the United States. First, Donald Trump managed to pass through the Congress a tax reform project without any significant losses, the changes were superficial, which indicates that the Democrats have no substantial objections. Secondly, the issue of impeachment, which only recently seriously worried the president's team, was removed from the day's story. Thirdly, Trump managed to defend in the Constitutional Court a law prohibiting the entry of Muslim migrants into the country. These factors have significantly strengthened the political position of Trump, and therefore one should expect that the policy will go to the background and investors will focus on the economy, which for the dollar will be clearly a positive driver.

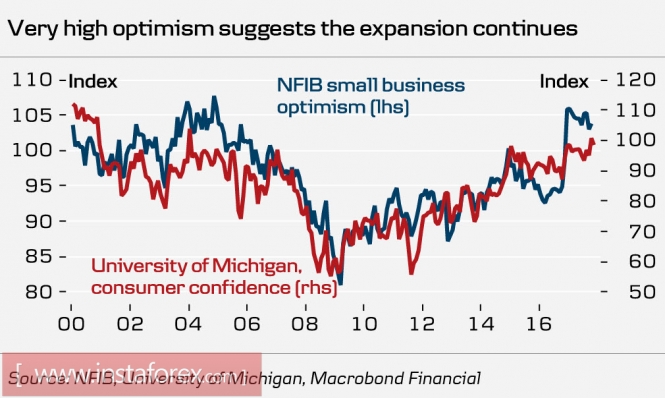

The level of optimism continues to be high, despite some slowdown. On Friday, the University of Michigan presented a preliminary result on consumer confidence in December, which showed a decline to 96.8p. against 98.5p a month earlier which was unexpected, but still much higher than before Trump's election as the president.

Banks advise selling the dollar before the FOMC meeting. Deutsche Bank forecasts EURUSD to rise to 1.21, Danske Bank expects that trade will remain in the range 1.17-1.20 with a growth trend, Scotiabank sees support at 1.18 and suggests that a break above 1.19 will pave the way for further growth. These forecasts are largely based on the fact that the eurozone, unlike the United States, looks much better for a number of key indicators, and therefore the ECB at its meeting next week will announce a move to stop the stimulus program.

Thus, there is no consensus on the fate of the dollar next week. The chances for continued growth look slightly more preferable, but we must proceed from the fact that central banks are entering the game, which can completely change the alignment of forces by the end of the week.

The material has been provided by InstaForex Company - www.instaforex.com