The report for the US labor market, despite being positive, again left more questions than answers.

Meanwhile, the apparently extended weak trend of the average wage growth was also noted.

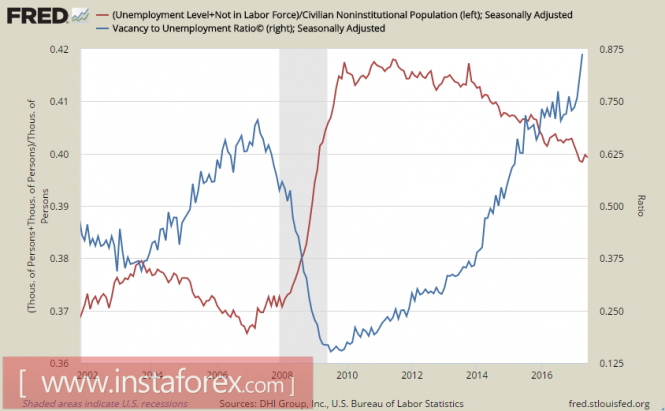

An in-depth analysis of the labor market shows that this assessment is fairly objective.

Thus, the employment report, in general, is positive, if we assume that the Fed's view will verify itself and inflation will rise by the end of the year.

While the dollar received a positive signal, it is clearly not enough to expect a change in sentiment.

Thus, the dollar continues to be under pressure until the appearance of signals that indicate the achievement of agreements on the future of reforms and the budget financing.

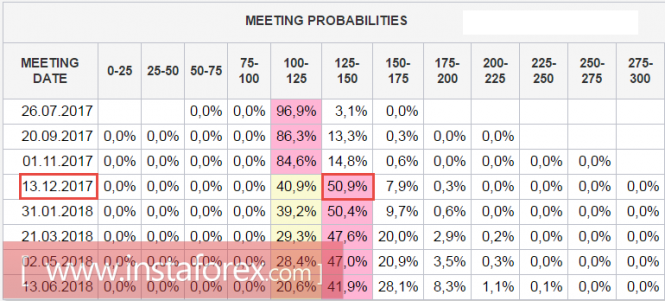

Expectations for the Fed's position are also becoming clearer. It is unlikely that the Fed will decide to hike the rate at the September meeting, the market is more convinced that the decision on this matter will be postponed until December. At the same time, the emergence of the first details regarding the reduction of the Fed's balance sheet increases the chance that policymakers will announce the start of the program at the September meeting.

It is evident that in the remaining two months, the issue of both the state level and the tax reform will be resolved, and the beginning of this process will mean a trend reversal in favor of the dollar bulls.

In order to gain extra points for the confrontation in Congress, Trump needs to resolve a number of foreign policy issues. The long-awaited meeting between Trump and Putin on the sidelines of the G20 summit is the first step in this direction. While analysts cautiously evaluate the outcome of the first talks that lasted more than two hours instead of the planned 35 minutes, but if our estimates are correct, then soon we will see the first real results- reducing tensions and boosting positive sentiment in the financial markets.

Nevertheless, all of these factors apply not only to the near-term but also to the future. This week, the dollar will continue to lose ground against the majority of its competitors. A pause in raising interest rates and domestic political tension will not allow the dollar to regain its initiative.

The material has been provided by InstaForex Company - www.instaforex.com