Trading plan for 07/04/2017:

The night session was primarily the talk of Donald Trump, the president of the United States, and Xi Jinping, chairman of the People's Republic of China. According to reports from Reuters, relations in the Washington-Beijing line have been warming up. Both sides are looking to expand their partnership - also on the commercial background. Exchange rate volatility has significantly increased after the US missile attacks on the Syrian government. In the first reaction, Gold prices shot up around $1,270 and Crude Oil prices shot up to the level of $52.50.

On Friday 7th of April, the main event of the day will be the Non-Farm Payrolls report from the US, but the market participant will pay attention to Industrial Production data from the UK, the Unemployment Rate data from Canada and Baker Hughes US Rig Count data.

EUR/USD analysis for 07/04/2017:

The Non-Farm Payrolls data are scheduled for release at 12:30 pm GMT and the market participants expect a significant decrease in jobs, from 235k last month to 174k this month. The Unemployment Rate is expected to remain unchanged at the level of 4.7% and Average Hourly Earnings are also expected to remain unchanged at 2.8%. Nevertheless, after a big beat from ADP earlier this week, there is a chance that the expected number of 174k jobs will be beaten as the market might deliver better than expected number. In that case as least temporary appreciation of US Dollar should occur again.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market is still consolidating around 61%Fibo at the level of 1.0651 and technical support at the level of 1.0634 looks to have been tested many times already. If the Non-Farm Payrolls data will be better than expected, then a further spike down should happen and the next technical support at the level of 1.0599 should be tested or even violated. On the other hand, if the Non-Farm Payrolls data will not deliver, then there are high chances that the market will spike up towards the technical resistance at the level of 1.0705.

GBP/USD analysis for 07/04/2017:

The Industrial and Manufacturing Production data from the UK are scheduled for release at 08:30 am GMT. The market participants are expecting another good set of data from the UK economy. The Industrial Production is expected to increase 0.2% after last month 0.9% decline and on yearly basis, another increase from the level of 3.2% to the level of 3.7% is expected. No surprise here that the market participants are expecting another set of good data from the UK and only an unexpected drop in this sector of the UK economy would start some pressure on the British Pound.

Let's now take a look at the GBP/USD technical picture at the H4 time frame. The consolidation zone is now a little wilder and currently is set between the levels of 1.2418 - 1.2508. Still, no important breakout occurred, so this sideway price action might last for some more time. The important technical support is seen at the level of 1.2377 and important technical resistance is seen at the level of 1.2560.

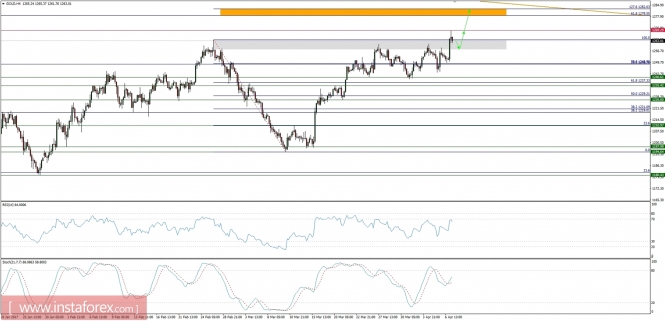

Market snapshot - Gold spikes up after US bombs Syrian military base

Gold tested the resistance at $1,260/63, but the supply side quickly took control of the market and led to partial erosion. In the near future, you can expect an adjustment for which $1,250 (local low from April 6) will be an important support. Ultimately, Gold should continue to grow. A clear cut of $1,263 will open the way to $1,280, where we will find the Fibonacci 61% retracement and 127.2% expansion levels.