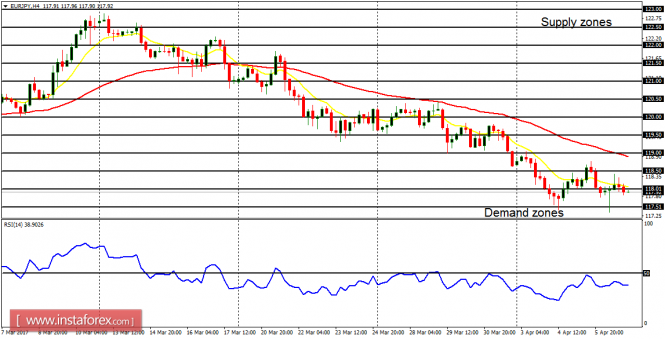

EUR/USD: The EUR/USD pair has been moving only sideways this week, but a breakout is imminent, which may happen any moment from today to next week. When the breakout occurs, it would most probably be in favor of the bears, for the outlook on the market is bearish. The current consolidation may be a temporary pause in the context of a short-term downtrend.

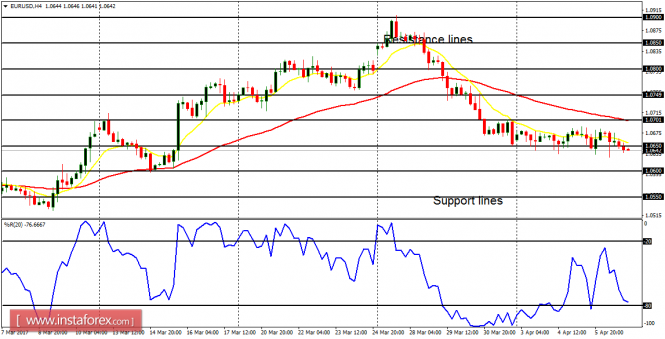

USD/CHF: Just like EUR/USD, USD/CHF is moving sideways – though in a context of an uptrend. There would soon be a rise in momentum, which would most probably be in favor of the bulls. When that happens, the price could go towards the resistance levels at 1.0100 and 1.0150. The resistance level at 1.0200 could be tested before the market retraces backwards.

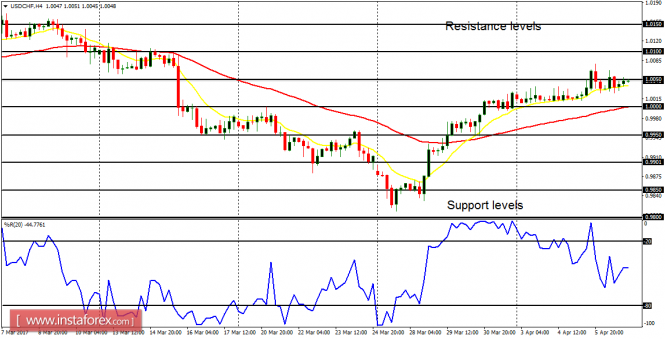

GBP/USD: This currency trading instrument has been moving only sideways this week. The price has moved between the distribution territory at 1.2550 and the accumulation territory at 1.2400. A movement above the distribution territory at 1.2550 is more likely than a movement below the accumulation territory at 1.2400.

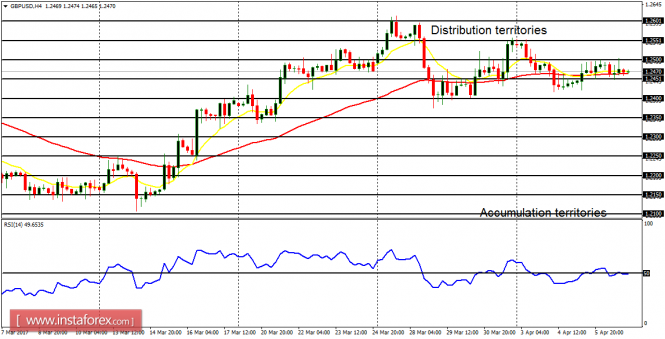

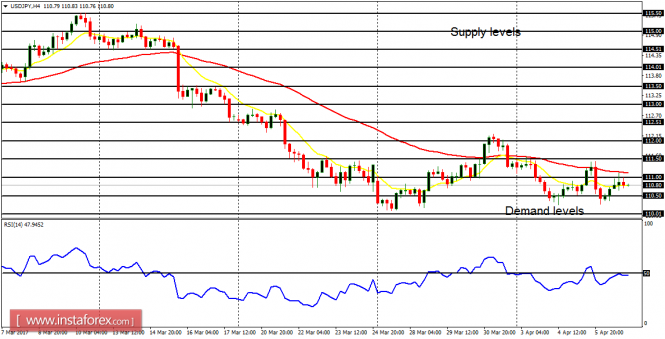

USD/JPY: Nothing significant happened in the market on Thursday, and the current equilibrium phase is in the context of a downtrend. When momentum rises in the market, it is expected that the demand levels at 110.50, 110.00 and 109.50, would be tested. It should be remembered that there is a bearish outlook on JPY pairs.

EUR/JPY: There is a Bearish Confirmation Pattern on EUR/JPY. The EMA 11 is below the EMA 56 and the RSI period 14 is below the level 50. While there may be occasional rallies in the market – which would be transitory – it is generally expected that the price would continue its bearish movement.