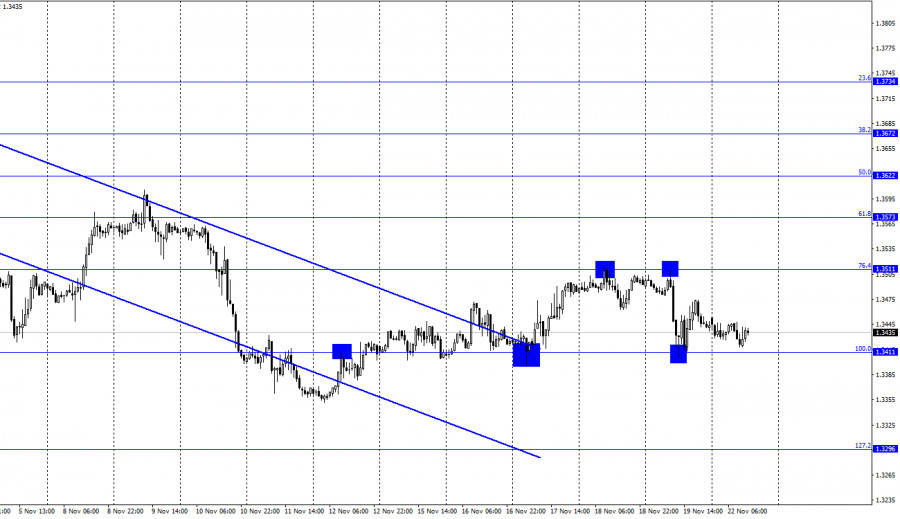

GBP/USD – 1H.

Hello dear traders! On the daily chart on Friday, GBP/USD dropped off 1.3511, i.e. 76.4% Fibonacci correction level and reversed downwards. Later, the currency pair fell to 1.3411 that is 100% Fibonacci level. The fact that the pair kicked off these levels makes us predict a moderate growth towards 1.3511. What actually happened on Monday, GBP/USD returned to 100.0% Fibonacci level. A new bounce would again revive hopes for some growth. If the pair closes above 100.0% Fibonacci level, there will be a higher chance that GBP/USD will continue a decline towards 1.3296, the next 127.2% Fibonacci level.

The information background on Friday was of little importance for GBP. The UK released the only report but traders took no notice of it. The UK retail sales rose 0.8% in October m/m, though the market had projected a slower rise. Anyway, the sterling was not able to continue its advance. In fact, analysts have no plausible reason why it began a slide an hour later. Perhaps it was just a downward move which is not somehow related to the information background. At present, the pound sterling might move in any direction.

The market conditions are uncertain for the British currency. The question is still open about the outcome of the talks between London and Brussels on the Northern Ireland border. Besides, investors are wondering what decision the Bank of England will take at the policy meeting in December. On top of that, traders have some expectations for the US currency and the Fed's agenda. Let me remind you that the Bank of England could venture into the first rate hike as early as in December. Moreover, the Federal Reserve might announce that it would accelerate the pace of tapering the QE program in December. All in all, I would not dare to predict a further dynamic of GBP/USD because the currency pair is largely dependent on the information background.

This week, don't miss two speeches by Bank of England Governor Andrew Bailey, the US GDP report, and the Fed's minutes. As you see, the economic calendar lacks any significant data this week.

In this context, any speech by a representative from a major central bank could give traders important clues or put them on edge. I mean that the information background this week could be very sparse.

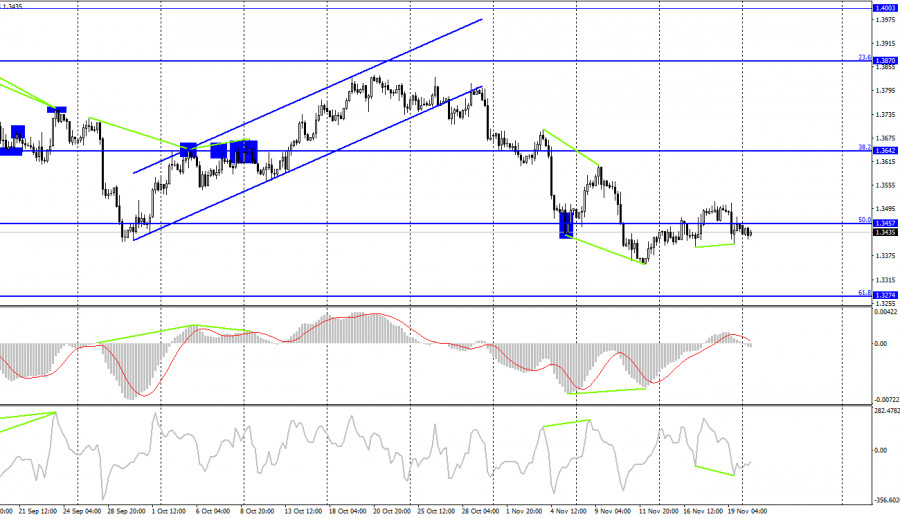

GBP/USD – 4H.

On the 4-hour chart, GBP/USD reversed downwards in favor of the US currency and closed at 1.3457, below 50.0% Fibonacci correction level. Thus, the pair might carry on with its decline towards 1.3274, the next Fibonacci level of 61.8%. Nevertheless, the bearish divergence of the CCI indicator allows traders to reckon a further growth towards 1.3642, 38.2% Fibonacci level. In case this outlook is cancelled, GBP/USD will continue its decline.

Economic calendar for US and UK

On Monday, the economic calendar is practically empty for the US and the UK. So, the information background has no catalyst for GBP/USD.

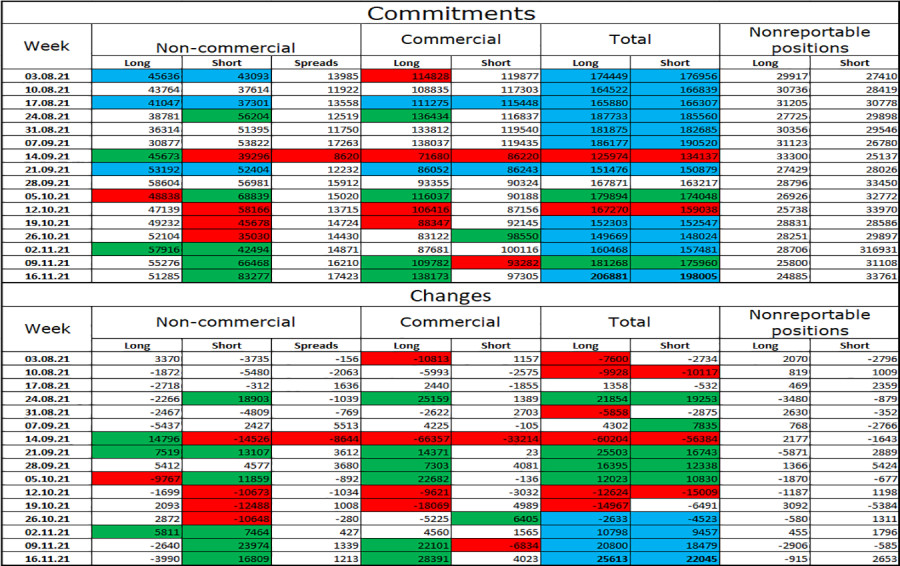

COT(Commitments of traders):

The recent COT report on GBP/USD from November 16 shows that large market players are turning more bearish. On the reported week, speculators closed 3,990 long contracts and opened 16,809 short contracts. Notably, the number of short contracts has been strongly increasing for the second week in a row. All in all, speculators opened almost 40,000 short contracts for two weeks. In other words, half of the newly opened contracts are short ones. A week ago, the number of long contracts was 17,000 more. Nevertheless, speculators are hesitant to express clear market sentiment. They increase buy positions and then suddenly increase sell contracts, but the total number of long and short contracts for all categories of traders remain roughly the same: 206K – 198K. Hence, after a few weeks of active selling GBP/USD, speculators may rush opening long positions.

Outlook for GBP/USD and trading tips

I would recommend selling GBP/USD if the pair closes below 1.3411 with the target at 1.3296. Alternatively, buy positions are recommended if the price rebounds again off 1,3211 at the daily chart with the target at 1.3511.

Terms

The Non-commercial category includes major market players: banks, hedge funds, investment funds, private, and large investors.

The Commercial category embraces commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

The category of Non-reportable positions means retail traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com