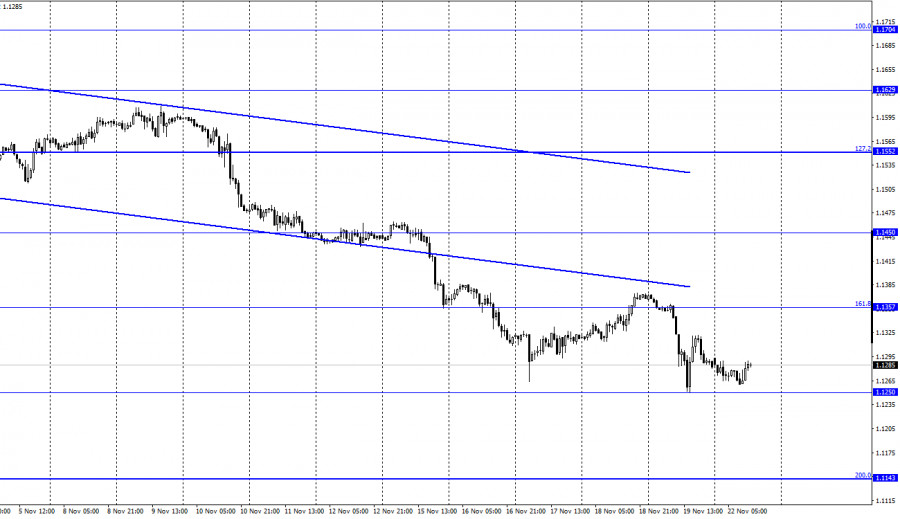

EUR/USD – 1H.

Hello, dear traders! On Friday, theEUR/USD pair made a reversal in favor of the US currency and fell to 1.1250. The rebound from this level provided support to the EU currency and contributed to some growth. However, today the fall of the euro resumed, and the pair quotes are actually within 20-30 pips from their annual lows. Thus, at the moment the situation is similar to a further downtrend. The descending trend corridor is still a sign of traders' bearish sentiment. The fixation of quotes under 1.1250 will increase the probability of further decline towards the next correctional level of 200.0% at 1.1143. I believe a further drop of the euro is most likely now. Despite the coronavirus epidemic not ending in Europe, in recent weeks some countries began to announce that they are going to or have already imposed a lockdown.

As from today, Austria is in lockdown and other EU countries may follow suit. Moreover, any lockdown is a potential drop in business and economic activity, a drop in retail sales, a drop in consumer spending. All these aspects could lead to a new slowdown or even reduction of the EU economy, which has not demonstrated any unprecedented growth in the last couple of quarters. Besides, before that time, it was shrinking rather than growing. Thus, the EU economy may suffer from another wave of COVID-19 pandemic. The situation in the US is more stable, and the economy is growing much better than in the EU. Moreover, traders do not consider that the ECB will tighten its monetary policy next year. It occurred after Christine Lagarde announced several times last week that her agency will not raise its key rate next year. Notably, now the deposit rate is -0.4% and the lending rate is 0.0% respectively. The US dollar is currently consolidating as the Fed is likely to raise interest rates at least twice next year, as well as completely wind down its stimulus program.

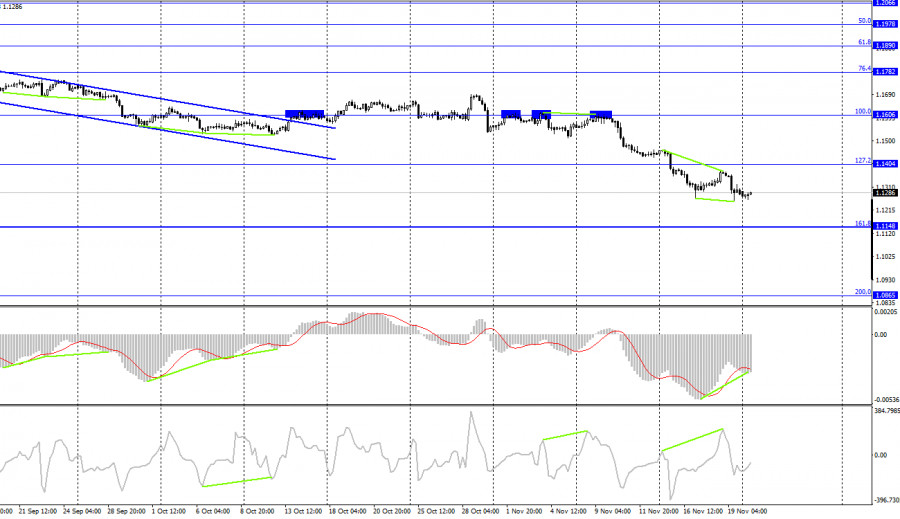

EUR/USD – 4H

On the 4-hour chart, the pair has settled below the 127.2% correctional level at 1.1404, counting on a further decline towards the next correctional level of 161.8% at 1.1148. A bearish divergence in the CCI indicator made it possible to resume the fall today. A new bullish divergence allows traders to expect some rise, which coincides with the forecasts on the hour chart, where there was a rebound from 1.1250.

US and EU news calendar:

On November 22, the EU economic calendar has not a single significant event. The situation is the same in the US. Thus, there will be no information background today.

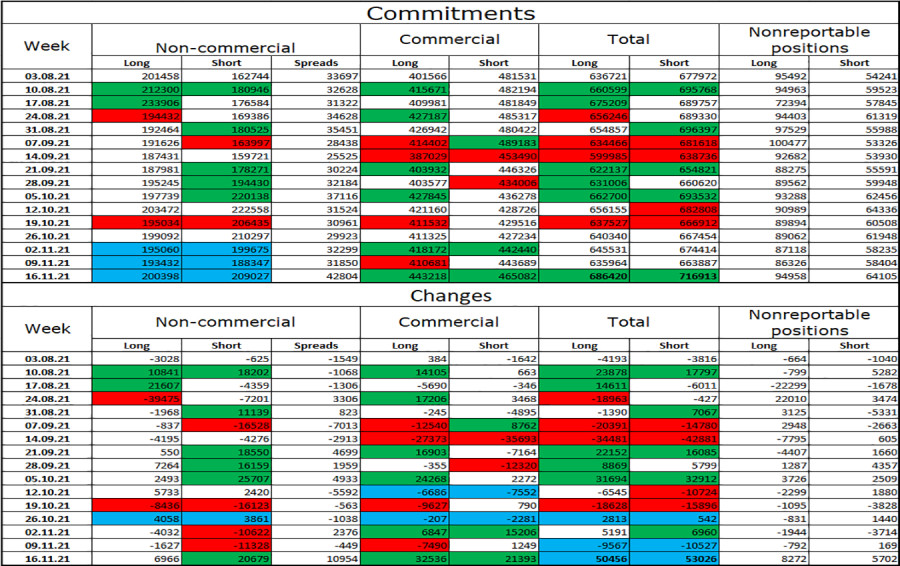

COT report (Commitments of traders):

The latest COT report showed that during the reporting week the sentiment of non-commercial traders became more bearish. Speculators opened 6,966 long euro contracts and 2,679 short contracts. Thus, the total number of long contracts held by speculators has grown to 200,000 and the total number of short contracts has risen to 209,000. These figures almost coincide for the third week in a row, indicating that speculators do not have a clear mood. However, in general, in recent months there has been a tendency of strengthening bearish sentiment. Therefore, I conclude that traders' sentiment is now at a point where neither bulls nor bears have an advantage. However, at the same time the European currency continues falling, so the trend of strengthening the bearish sentiment among the major players is evident.

EUR/USD forecast and recommendations for traders:

I recommended selling the pair at closing under the level of 1.1357 on the hourly chart with the target of 1.1250. This level is worked out. I recommend new sales at closing under the level 1.1250 with the target 1.1143. I recommend buying at the rebound from the level of 1.1250 on the hourly chart with the target of 1.1357. These trades can be kept open now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.

The material has been provided by InstaForex Company - www.instaforex.com