At yesterday's trading, the main currency pair of the Forex market continued its downward dynamics, which turned out to be quite decent in its strength. It is quite possible that additional pressure on the single European currency was exerted by the first speech of the President of the European Central Bank, Christine Lagarde, this week. The head of the ECB spoke in the European Parliament on Monday. However, her speech was very faceless. In other words, nothing new and (or) significant was heard from Lagarde. Following the leaders of the US Federal Reserve System (FRS), the head of the European Central Bank repeatedly repeats the reasons that cause such a rapid increase in inflation. Let me remind you once again that, according to the ECB leadership, the spikes in inflation are due to failures in supply mechanisms and significantly increased energy prices. At the same time, according to Christine Lagarde, it may take an indefinite amount of time to resolve these problems - absolutely no specifics. The only thing that can be considered positive, and then with a big stretch, is Lagarde's hopes that next year the growth of inflation will begin to slow down.

To be honest, I am not surprised by such rhetoric of the head of the ECB, as time shows – this is absolutely in her style. A minimum of specifics and a maximum of vagueness in his speeches, which, unlike the previous ECB head Mario Draghi, significantly reduces the degree of influence of Christine Lagarde's speeches for international financial markets. Today there will be another speech by the ECB chairman, however, in my personal opinion, there is nothing new to expect from Lagarde's next speech. Since we have already touched on today's events, it is worth noting the speeches of some members of the Open Market Committee (FOMC) The US Federal Reserve, as well as revised eurozone GDP data for the third quarter. In addition, reports on retail sales and industrial production will be received from the United States of America. Perhaps it's time to put an end to this and move on to considering the price charts of the euro/dollar currency pair.

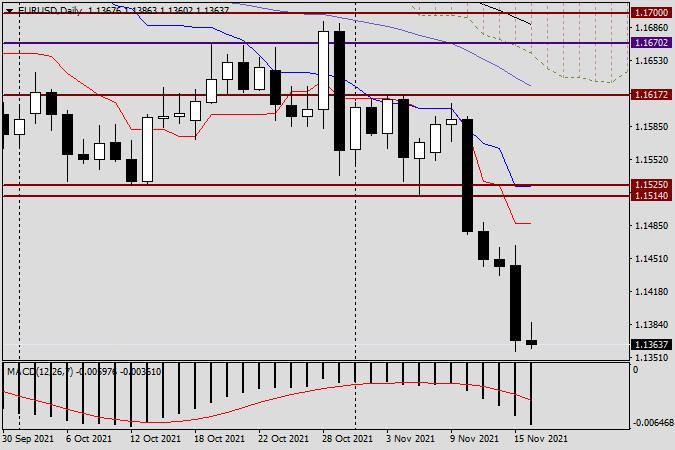

Daily

Everything is visible here, and you can do without any special comments. It looks like EUR/USD is flying into the abyss. An impressive drop and a large bearish candle with a closing price at 1.1367 perfectly emphasize the superiority of sellers over their opponents. A strong technical level of 1.1400 can most likely be considered broken, and a pullback to the price zone of 1.1400-1.1420 can be used to open deals for sale. The confirmation signal of this recommendation will be the appearance of reversal patterns of candlestick analysis in the selected zone at this or smaller time intervals. By the way, as promised the day before, let's see what kind of picture for potential positioning is observed on smaller timeframes.

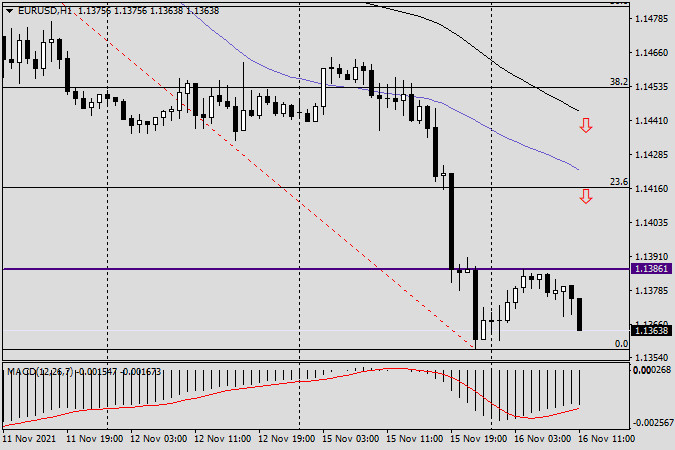

H1

The hourly chart clearly shows that after falling to 1.1357 today during the Asian session, the pair rebounded to 1.1386, after which it shows intentions to turn around to continue the downward dynamics. I think few people have doubts that the downward scenario, and hence the sale of EUR/USD, should be considered the main trading idea. Of course, you always want to sell at higher prices and buy at lower prices. But in this case, the correction to the designated zone may not happen. With such a course of trading, I recommend trying to open short positions based on yesterday's minimum values (1.1357) with small targets near 1.1330-1.1320. To open purchases, you need to wait for confirmation signals in the form of the formation of bullish patterns of Japanese candlesticks on the daily or smaller charts.

The material has been provided by InstaForex Company - www.instaforex.com